Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Good evening, Could you please help in finding the method and solution to the highlighted sections? Thank you in advance! Study Hard Ltd has share

Good evening,

Good evening,

Could you please help in finding the method and solution to the highlighted sections?

Thank you in advance!

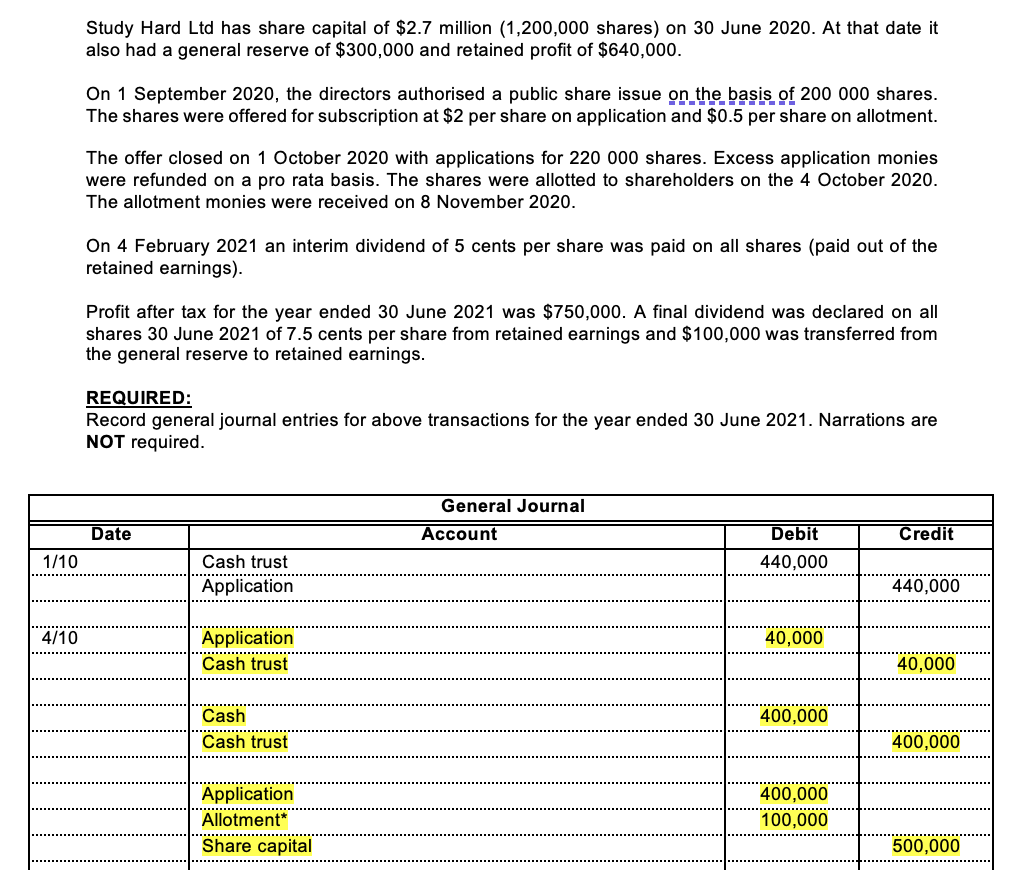

Study Hard Ltd has share capital of $2.7 million (1,200,000 shares) on 30 June 2020. At that date it also had a general reserve of $300,000 and retained profit of $640,000. On 1 September 2020, the directors authorised a public share issue on the basis of 200 000 shares. The shares were offered for subscription at $2 per share on application and $0.5 per share on allotment. The offer closed on 1 October 2020 with applications for 220 000 shares. Excess application monies were refunded on a pro rata basis. The shares were allotted to shareholders on the 4 October 2020. The allotment monies were received on 8 November 2020. On 4 February 2021 an interim dividend of 5 cents per share was paid on all shares (paid out of the retained earnings). Profit after tax for the year ended 30 June 2021 was $750,000. A final dividend was declared on all shares 30 June 2021 of 7.5 cents per share from retained earnings and $100,000 was transferred from the general reserve to retained earnings. REQUIRED: Record general journal entries for above transactions for the year ended 30 June 2021. Narrations are NOT required. General Journal Date Account Debit Credit 1/10 440,000 Cash trust Application 440,000 4/10 40,000 Application Cash trust 40,000 400,000 Cash Cash trust 400,000 Application Allotment* Share capital 400,000 100,000 500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started