Answered step by step

Verified Expert Solution

Question

1 Approved Answer

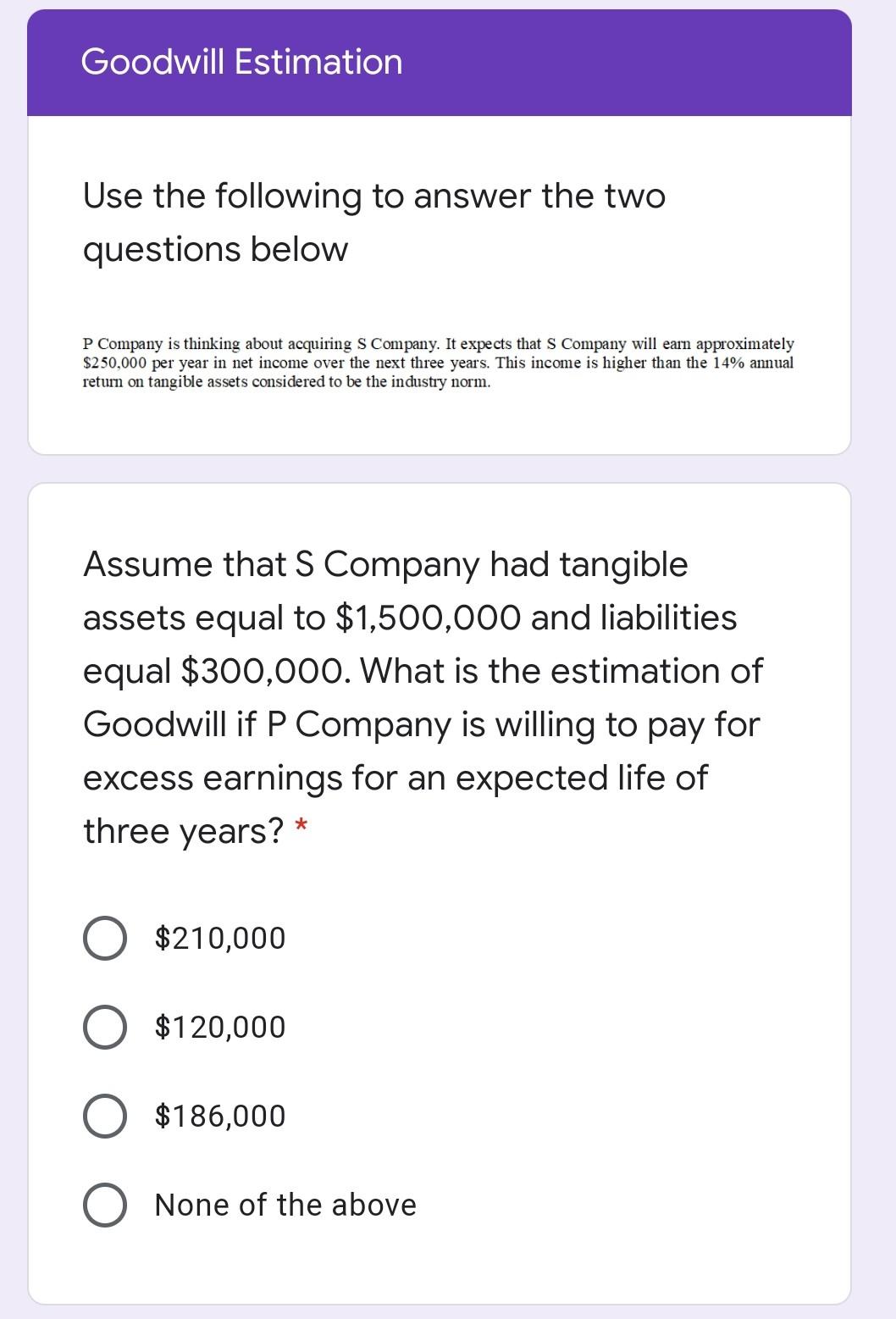

Goodwill Estimation Use the following to answer the two questions below P Company is thinking about acquiring S Company. It expects that S Company will

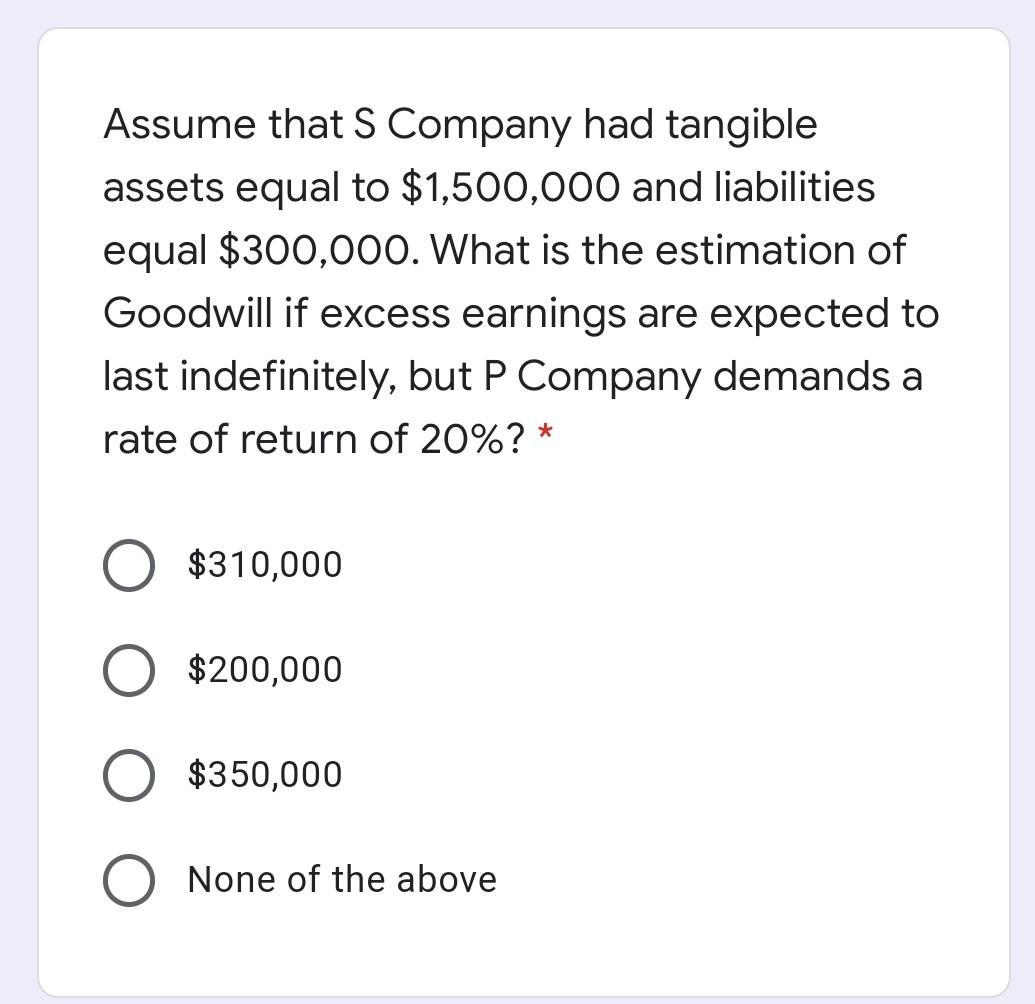

Goodwill Estimation Use the following to answer the two questions below P Company is thinking about acquiring S Company. It expects that S Company will earn approximately $250,000 per year in net income over the next three years. This income is higher than the 14% annual return on tangible assets considered to be the industry norm. Assume that S Company had tangible assets equal to $1,500,000 and liabilities equal $300,000. What is the estimation of Goodwill if P Company is willing to pay for excess earnings for an expected life of three years? * O $210,000 O $120,000 $186,000 O None of the above Assume that S Company had tangible assets equal to $1,500,000 and liabilities equal $300,000. What is the estimation of Goodwill if excess earnings are expected to last indefinitely, but P Company demands a rate of return of 20%? * $310,000 $200,000 $350,000 None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started