Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Got stuck on 1 and 2. You are considering the purchase of a small multi family building. In year 1, you expect to earn an

Got stuck on 1 and 2.

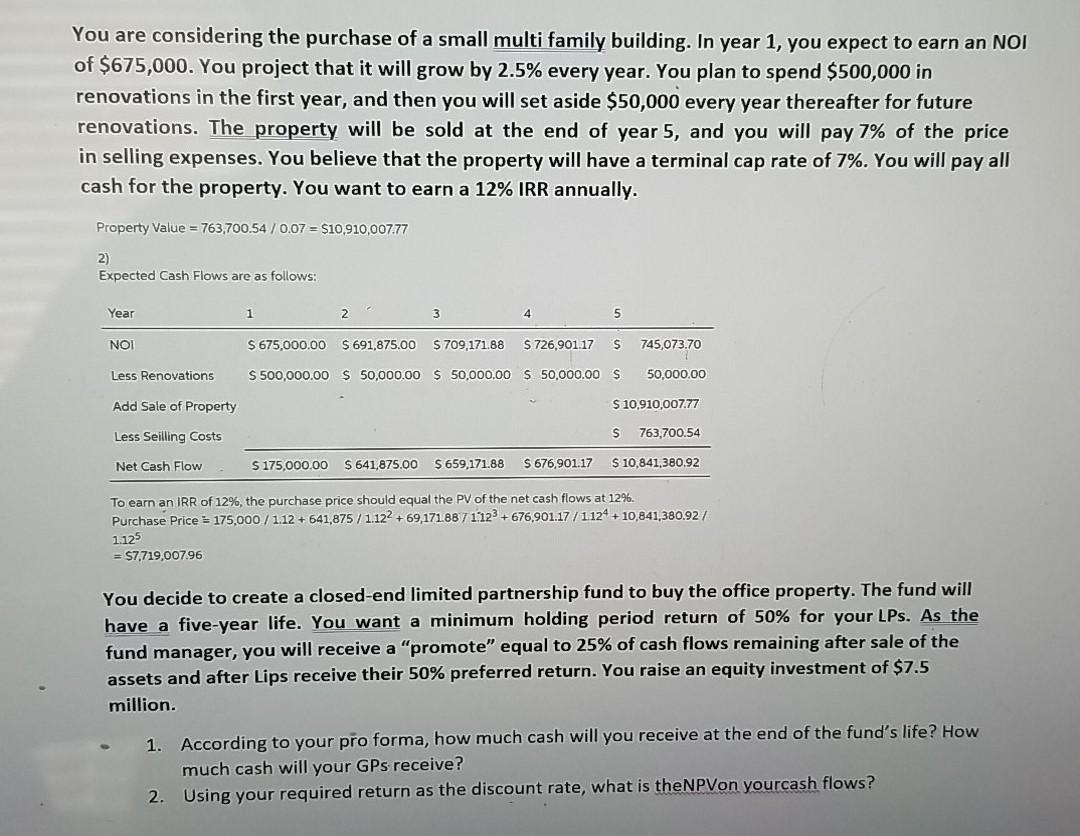

You are considering the purchase of a small multi family building. In year 1, you expect to earn an NOI of $675,000. You project that it will grow by 2.5% every year. You plan to spend $500,000 in renovations in the first year, and then you will set aside $50,000 every year thereafter for future renovations. The property will be sold at the end of year 5, and you will pay 7% of the price in selling expenses. You believe that the property will have a terminal cap rate of 7%. You will pay all cash for the property. You want to earn a 12% IRR annually. Property Value = 763,700.54 / 0.07 = $10,910,007.77 2) Expected Cash Flows are as follows: Year 1 3 4 5 NOI S 675,000.00 $ 691,875.00 S 709,171.88 $ 726,901.17 $ 745,073.70 Less Renovations S 500,000.00 $ 50,000.00 $ 50,000.00 $ 50,000.00 S 50,000.00 Add Sale of Property $ 10,910,007.77 Less Seilling Costs S 763,700.54 Net Cash Flow $ 175,000.00 $ 641,875.00 $ 659,171.88 $ 676,901.17 $ 10,841,380.92 To earn an IRR of 12%, the purchase price should equal the PV of the net cash flows at 12%. Purchase Price = 175,000 / 1.12 + 641,875 / 1.122 +69,171.8871123 +676,901.17 / 1124 + 10,841,380.92 / 1.125 = 57,719,007.96 You decide to create a closed-end limited partnership fund to buy the office property. The fund will have a five-year life. You want a minimum holding period return of 50% for your LPs. As the fund manager, you will receive a "promote" equal to 25% of cash flows remaining after sale of the assets and after Lips receive their 50% preferred return. You raise an equity investment of $7.5 million. 1. According to your pro forma, how much cash will you receive at the end of the fund's life? How much cash will your GPs receive? 2. Using your required return as the discount rate, what is theNPVon yourcash flowsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started