Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Got this resolved on Chegg and the answers were wrong (posted below for reference). Cantel Company produces cleaning compounds for both commercial and household customers.

Got this resolved on Chegg and the answers were wrong (posted below for reference).

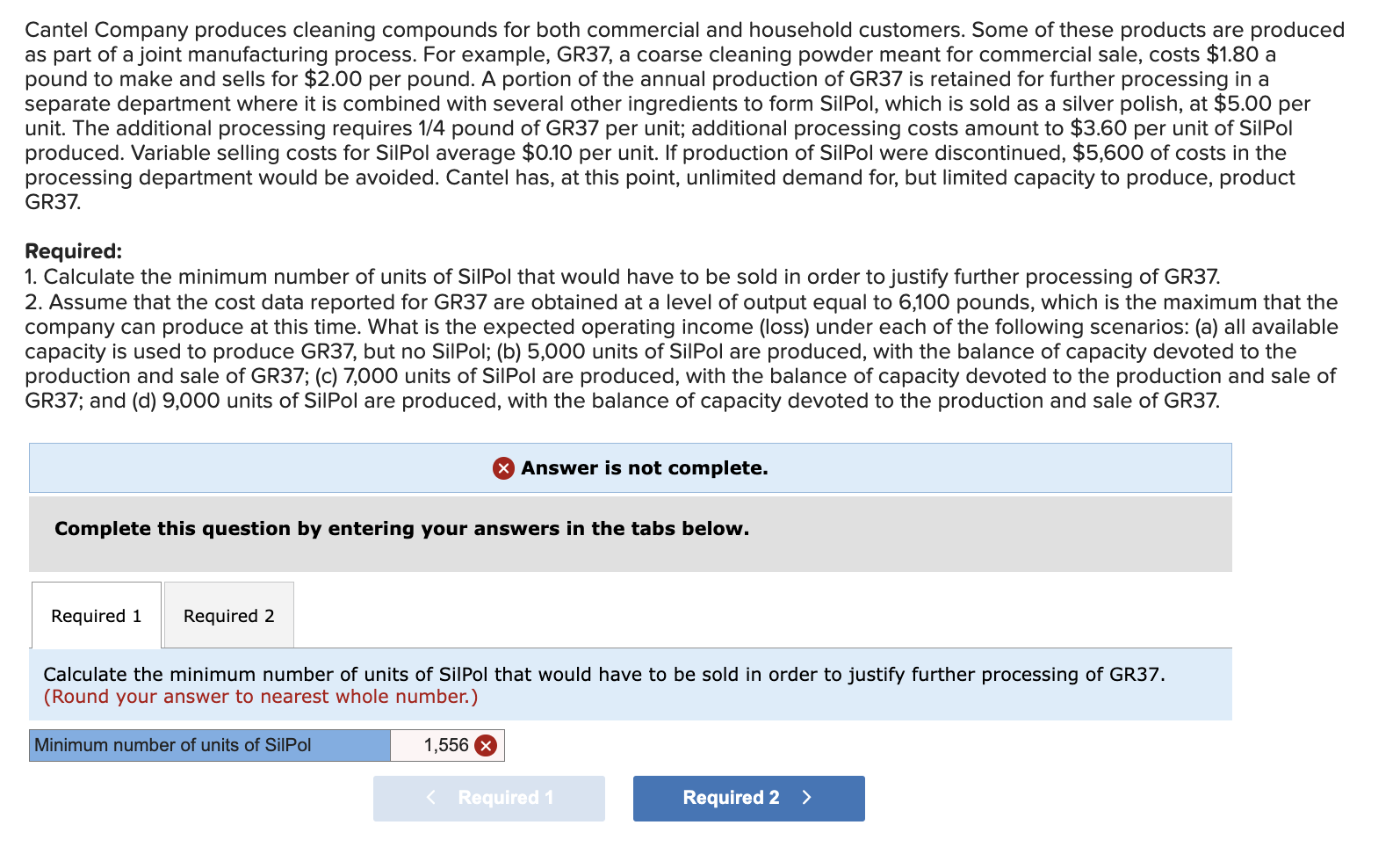

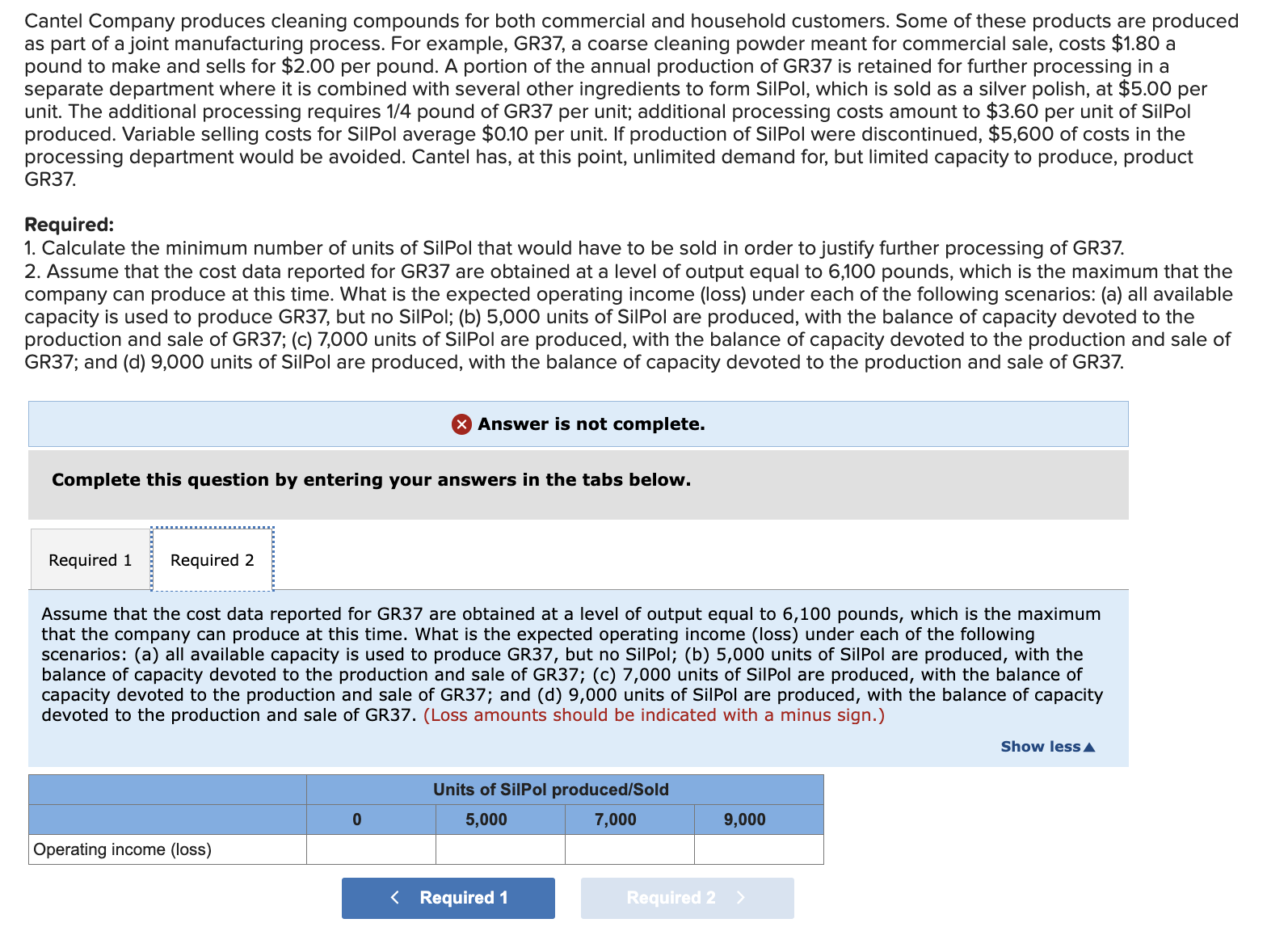

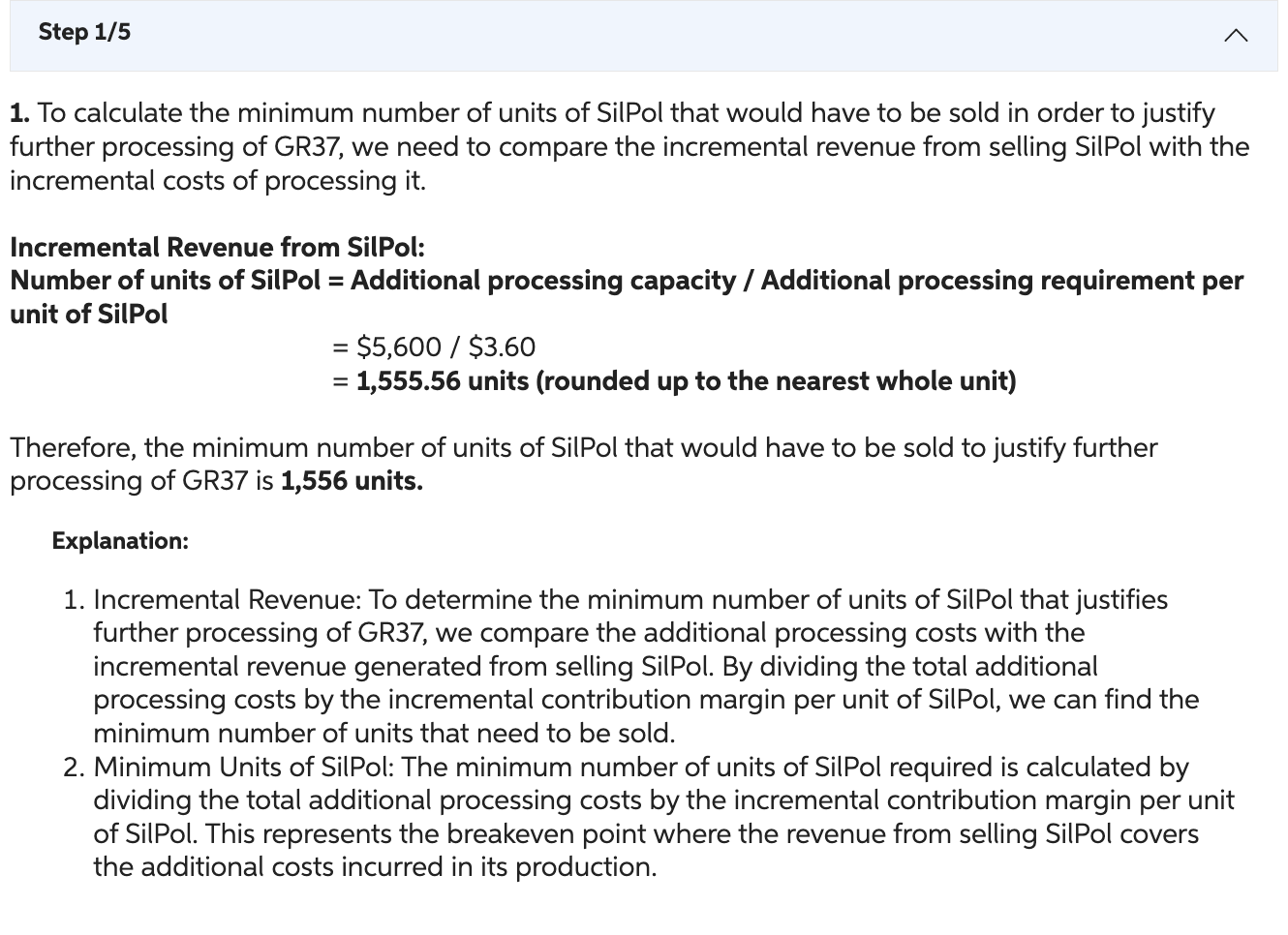

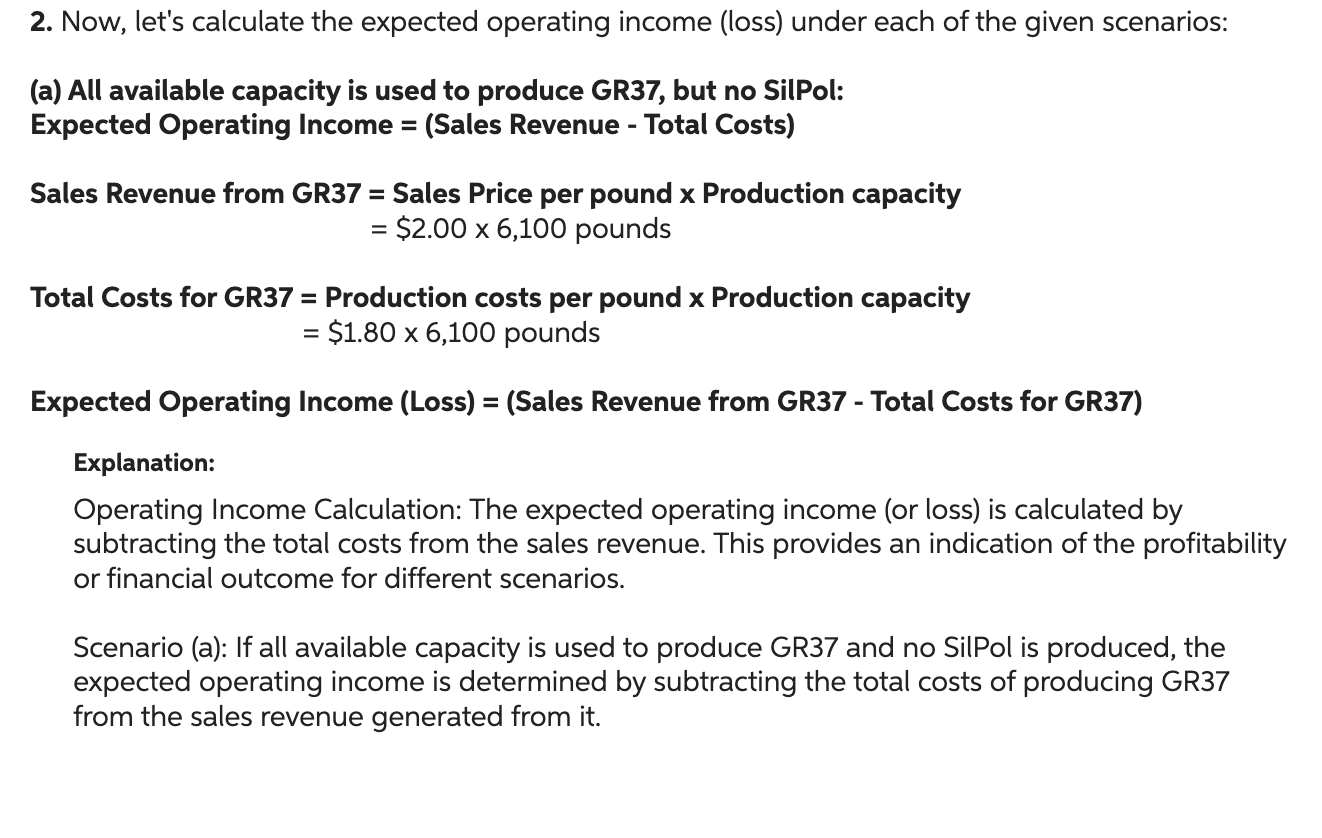

Cantel Company produces cleaning compounds for both commercial and household customers. Some of these products are produced as part of a joint manufacturing process. For example, GR37, a coarse cleaning powder meant for commercial sale, costs $1.80 a pound to make and sells for $2.00 per pound. A portion of the annual production of GR37 is retained for further processing in a separate department where it is combined with several other ingredients to form SilPol, which is sold as a silver polish, at $5.00 per unit. The additional processing requires 1/4 pound of GR37 per unit; additional processing costs amount to \$3.60 per unit of SilPol produced. Variable selling costs for SilPol average $0.10 per unit. If production of SilPol were discontinued, $5,600 of costs in the processing department would be avoided. Cantel has, at this point, unlimited demand for, but limited capacity to produce, product GR37. Required: 1. Calculate the minimum number of units of SilPol that would have to be sold in order to justify further processing of GR37. 2. Assume that the cost data reported for GR37 are obtained at a level of output equal to 6,100 pounds, which is the maximum that the company can produce at this time. What is the expected operating income (loss) under each of the following scenarios: (a) all available capacity is used to produce GR37, but no SilPol; (b) 5,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; (c) 7,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; and (d) 9,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37. Answer is not complete. Complete this question by entering your answers in the tabs below. Calculate the minimum number of units of SilPol that would have to be sold in order to justify further processing of GR37. (Round your answer to nearest whole number.) Cantel Company produces cleaning compounds for both commercial and household customers. Some of these products are produced as part of a joint manufacturing process. For example, GR37, a coarse cleaning powder meant for commercial sale, costs $1.80 a pound to make and sells for $2.00 per pound. A portion of the annual production of GR37 is retained for further processing in a separate department where it is combined with several other ingredients to form SilPol, which is sold as a silver polish, at $5.00 per unit. The additional processing requires 1/4 pound of GR37 per unit; additional processing costs amount to $3.60 per unit of SilPol produced. Variable selling costs for SilPol average $0.10 per unit. If production of SilPol were discontinued, $5,600 of costs in the processing department would be avoided. Cantel has, at this point, unlimited demand for, but limited capacity to produce, product GR37. Required: 1. Calculate the minimum number of units of SilPol that would have to be sold in order to justify further processing of GR37. 2. Assume that the cost data reported for GR37 are obtained at a level of output equal to 6,100 pounds, which is the maximum that the company can produce at this time. What is the expected operating income (loss) under each of the following scenarios: (a) all available capacity is used to produce GR37, but no SilPol; (b) 5,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; (c) 7,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; and (d) 9,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37. Answer is not complete. Complete this question by entering your answers in the tabs below. Assume that the cost data reported for GR37 are obtained at a level of output equal to 6,100 pounds, which is the maximum that the company can produce at this time. What is the expected operating income (loss) under each of the following scenarios: (a) all available capacity is used to produce GR37, but no SilPol; (b) 5,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; (c) 7,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37; and (d) 9,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37. (Loss amounts should be indicated with a minus sign.) 1. To calculate the minimum number of units of SilPol that would have to be sold in order to justify further processing of GR37, we need to compare the incremental revenue from selling SilPol with the incremental costs of processing it. Incremental Revenue from SilPol: Number of units of SilPol = Additional processing capacity / Additional processing requirement per unit of SilPol =$5,600/$3.60=1,555.56units(roundeduptothenearestwholeunit) Therefore, the minimum number of units of SilPol that would have to be sold to justify further processing of GR37 is 1,556 units. Explanation: 1. Incremental Revenue: To determine the minimum number of units of SilPol that justifies further processing of GR37, we compare the additional processing costs with the incremental revenue generated from selling SilPol. By dividing the total additional processing costs by the incremental contribution margin per unit of SilPol, we can find the minimum number of units that need to be sold. 2. Minimum Units of SilPol: The minimum number of units of SilPol required is calculated by dividing the total additional processing costs by the incremental contribution margin per unit of SilPol. This represents the breakeven point where the revenue from selling SilPol covers the additional costs incurred in its production. 2. Now, let's calculate the expected operating income (loss) under each of the given scenarios: (a) All available capacity is used to produce GR37, but no SilPol: Expected Operating Income = (Sales Revenue - Total Costs) Sales Revenue from GR37 = Sales Price per pound x Production capacity =$2.006,100pounds Total Costs for GR37 = Production costs per pound x Production capacity =$1.806,100pounds Expected Operating Income (Loss) = (Sales Revenue from GR37 - Total Costs for GR37) Explanation: Operating Income Calculation: The expected operating income (or loss) is calculated by subtracting the total costs from the sales revenue. This provides an indication of the profitability or financial outcome for different scenarios. Scenario (a): If all available capacity is used to produce GR37 and no SilPol is produced, the expected operating income is determined by subtracting the total costs of producing GR37 from the sales revenue generated from it. (b) 5,000 units of SilPol are produced, with the balance of capacity devoted to the production and sale of GR37: Expected Operating Income = (Sales Revenue from GR37 + Sales Revenue from SilPol - Total Costs for GR37 - Total Costs for SilPol) Sales Revenue from SilPol = Number of units of SilPol x Selling price per unit =5,000 units x$5.00 Total Costs for SilPol = Number of units of SilPol x (Additional processing costs per unit + Variable selling costs per unit) =5,000units($3.60+$0.10) Explanation: If 5,000 units of SilPol are produced, with the remaining capacity used for GR37, the expected operating income can be calculated by considering the sales revenue and total costs for both products. (d) 9,000 units of SilPol are produces with the balance of capacity devoted to the production and sale of GR37: Expected Operating Income = (Sales Revenue from GR37 + Sales Revenue from SilPol - Total Costs for GR37 - Total Costs fro SilPol) Sales Revenue from SilPol = Number of units of SilPol x selling price per unit =9,000 units x$5.00 Total Costs for SilPol = Number of units of SilPol x (Additional processing costs per unit + Variable selling costs per unit) =9,000 units ($3.60+$0.10) Please note that the specific values for production capacity, costs, and prices were not provided in the question, so the calculations above are based on the given information and assumptions. Explanation: - Scenario (b), (c), and (d): These scenarios involve producing varying quantities of SilPol alongside G37. The expected operating income is calculated by combining the sales revenue from GR37 and SilPol and subtracting the total costs incurred for both products. This analysis allows for a comparison of profitability under different production and sales strategies. These calculations and scenarios provide insights into the profitability and decision-making process related to the production and sale of GR37 and SilPol, helping Cantel Company assess its options and make informed business decisions. 1. Minimum units of SilPol to justify processing: 1,556 units. 2. Scenarios: (a) GR37 only: Calculate operating income based on GR37 sales and costs. (b) 5,000 SilPol units: Calculate operating income considering GR37 and SilPol sales and costs. (c) 7,000 SilPol units: Calculate operating income considering GR37 and SilPol sales and costs. (d) 9,000 SilPol units: Calculate operating income considering GR37 and SilPol sales and costs

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started