GOVERNMENTAL ACCOUNTING

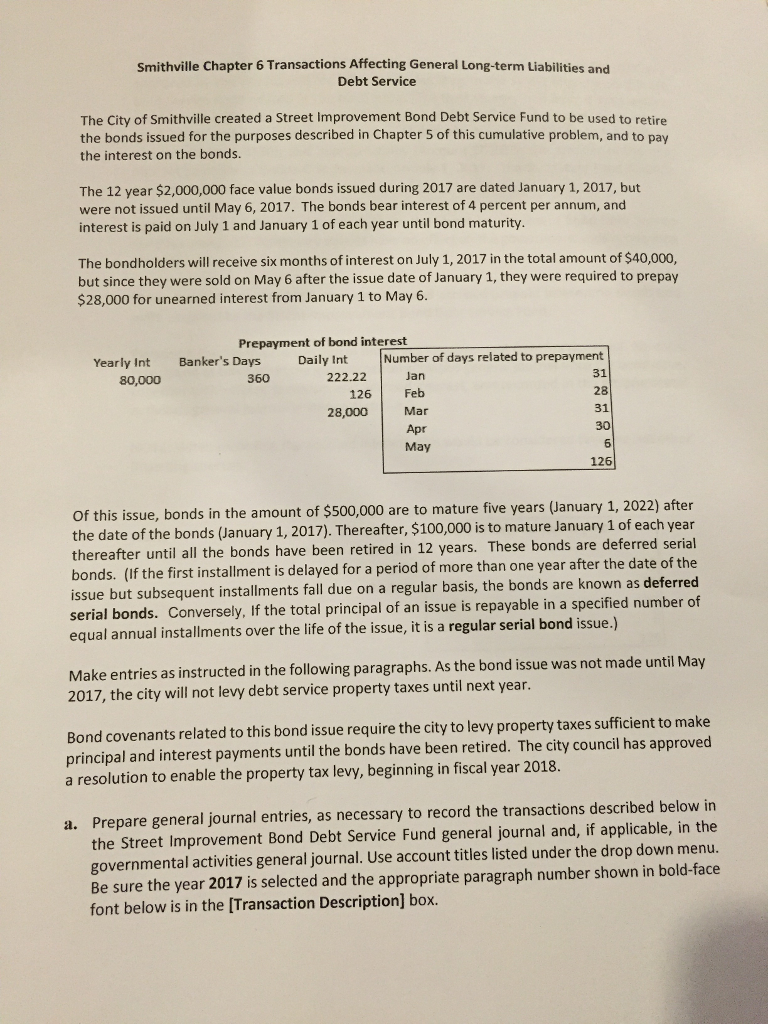

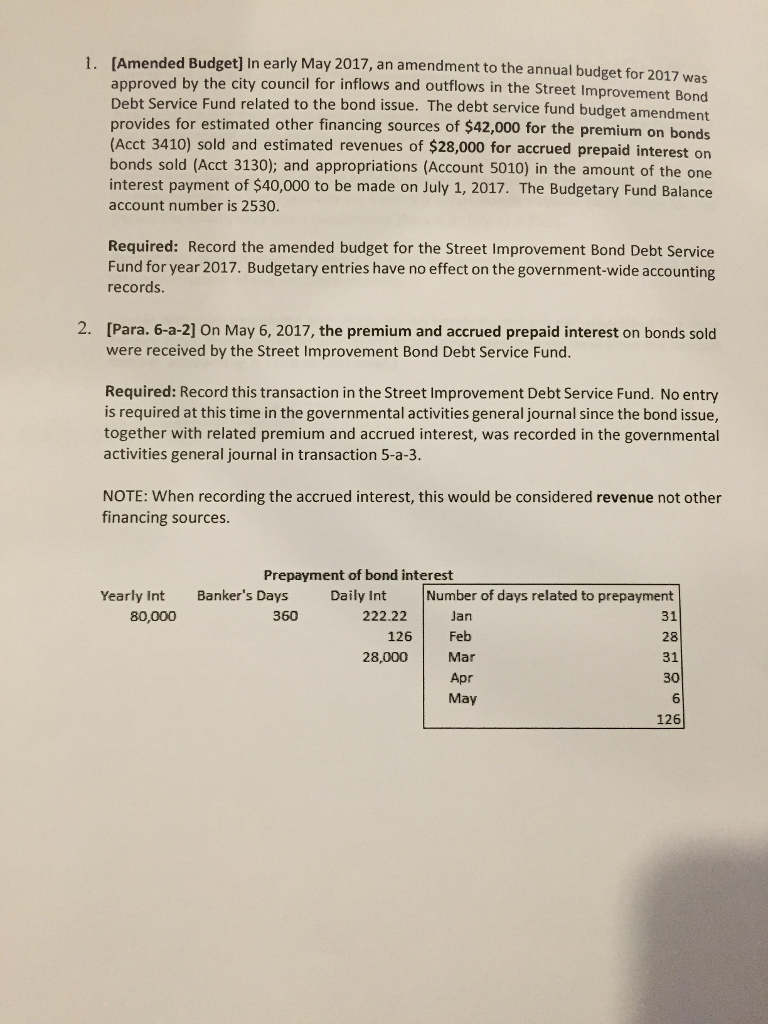

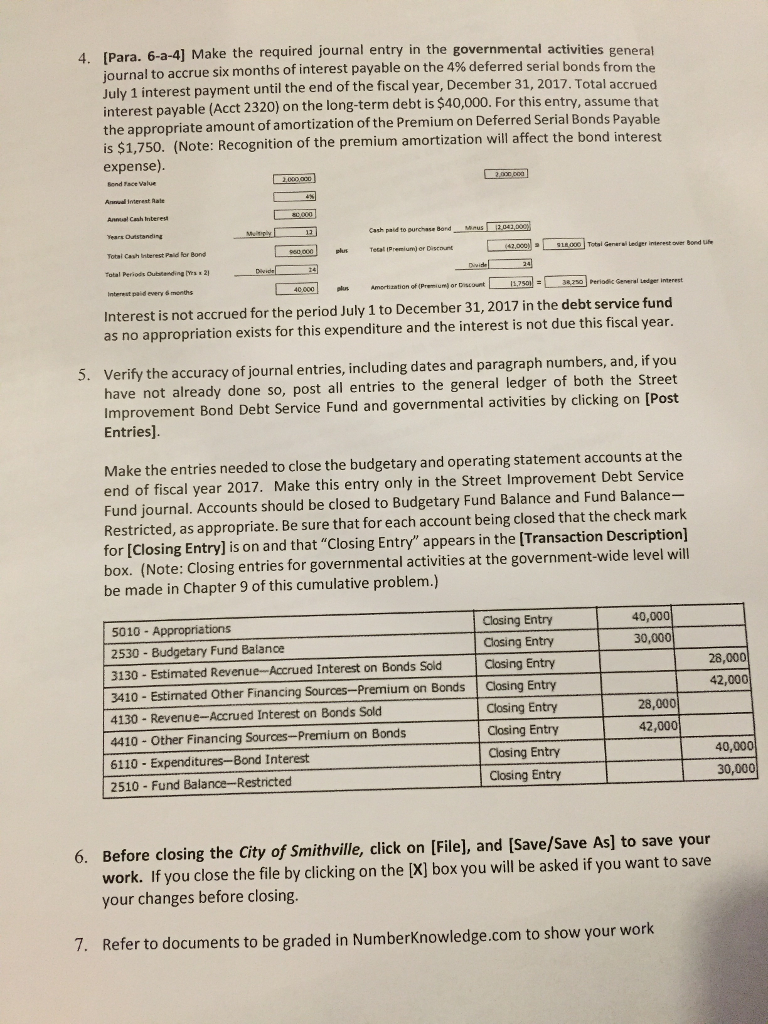

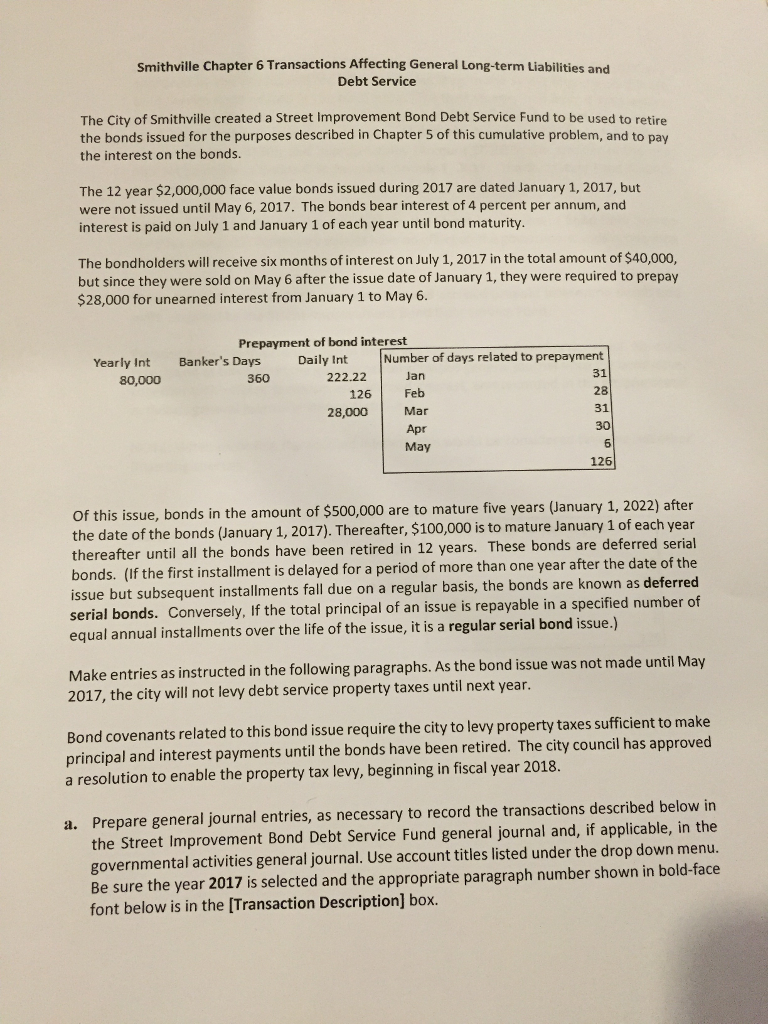

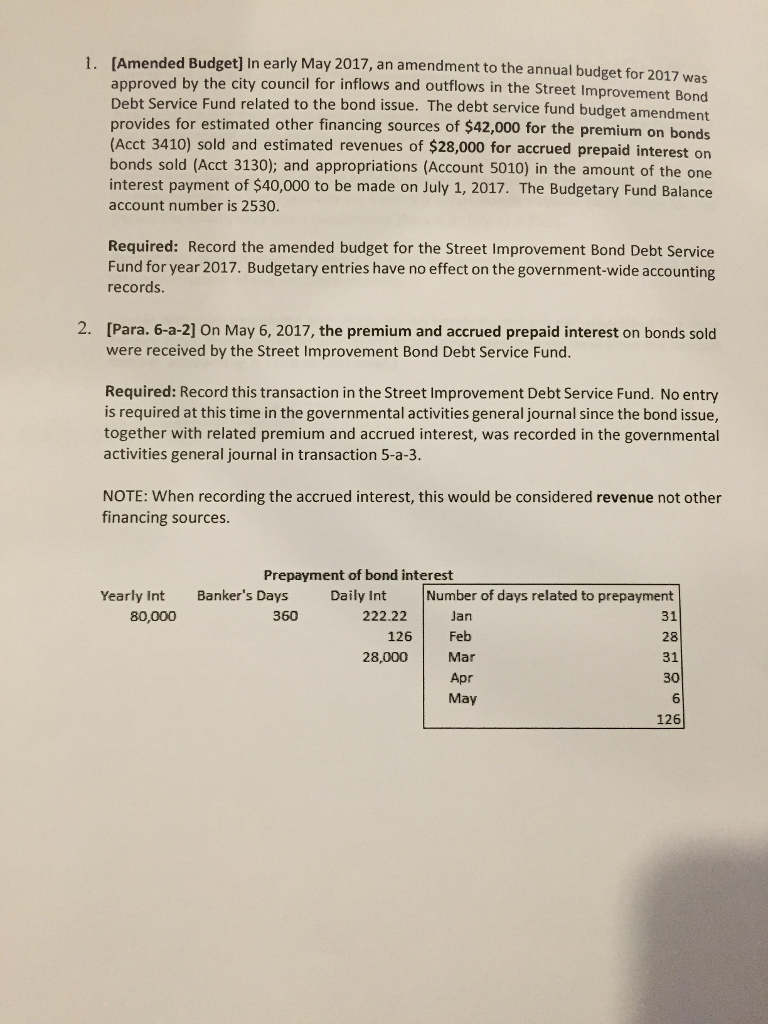

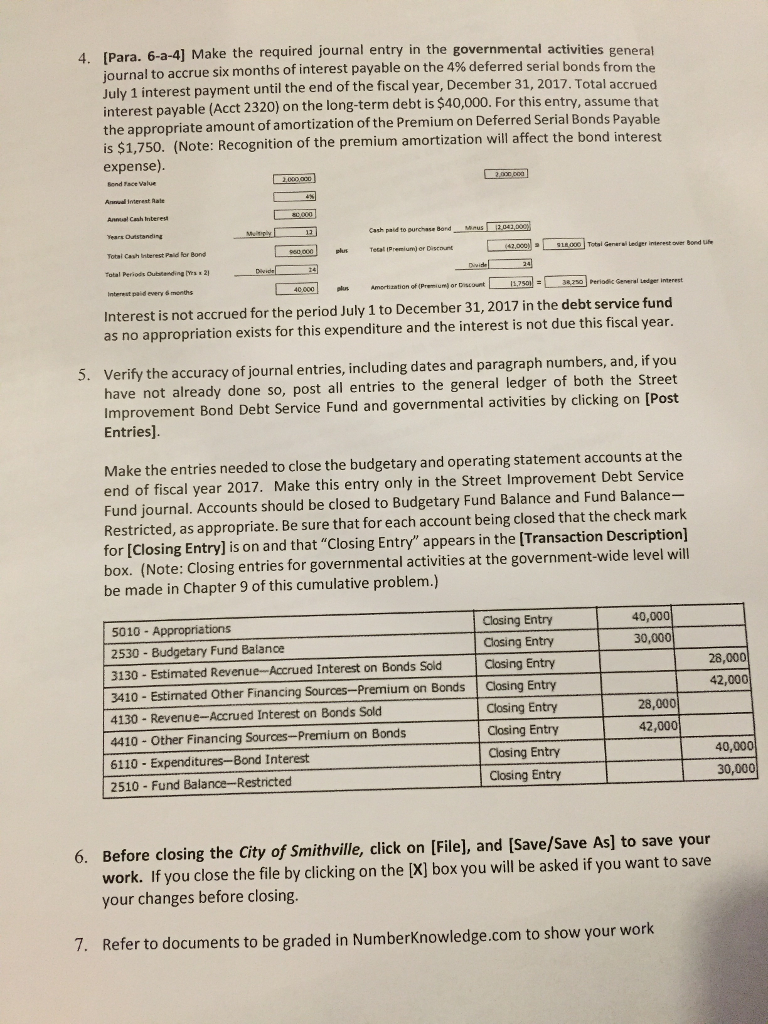

Smithville Chapter 6 Transactions Affecting General Long-term Liabilities and Debt Service The City of Smithville created a Street Improvement Bond Debt Service Fund to be used to retire the bonds issued for the purposes described in Chapter 5 of this cumulative problem, and to pay the interest on the bonds. The 12 year $2,000,000 face value bonds issued during 2017 are dated January 1, 2017, but were not issued until May 6, 2017. The bonds bear interest of 4 percent per annum, and interest is paid on July 1 and January 1 of each year until bond maturity. The bondholders will receive six months of interest on July 1, 2017 in the total amount of $40,000 but since they were sold on May 6 after the issue date of January 1, they were required to prepay $28,000 for unearned interest from January 1 to May 6 Prepayment of bond interest Daily Int Number of days related to prepayment 31 28 31 30 6 126 Yearly Int Banker's Days Jan Feb Mar Apr May 80,000 360 222.22 126 28,000 Of this issue, bonds in the amount of $500,000 are to mature five years (January 1, 2022) after the date of the bonds (January 1, 2017). Thereafter, $100,000 is to mature January 1 of each year thereafter until all the bonds have been retired in 12 years. These bonds are deferred serial bonds. (If the first installment is delayed for a period of more than one year after the date of the issue but subsequent installments fall d serial bonds. Conversely, If the total principal of an issue is repayable in a specified number equal annual installments over the life of the issue, it is a regular serial bond issue.) ue on a regular basis, the bonds are known as deferred Make entries as instructed in the following paragraphs. As the bond issue wa 2017, the city will not levy debt service property taxes until next year s not made until May Bond covenants related to this bond issue require the city to levy property taxes sufficient to make principal and interest payments until the bonds have been retired. The city council has approved a resolution to enable the property tax levy, beginning in fiscal year 2018 Prepare general journal entries, as necessary to record the transactions described below in the Street Improvement Bond Debt Service Fund general journal and, if applicable, in the governmental activities general journal. Use account titles listed under the drop down menu Be sure the year 2017 is selected and the appropriate paragraph number shown in bold-face font below is in the [Transaction Description] box a