Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Gracle recelved an annual salary of R 389675 and a bonus of R 40000 from her employer, Peaks (Pty) Ltd. Her employer provided her with

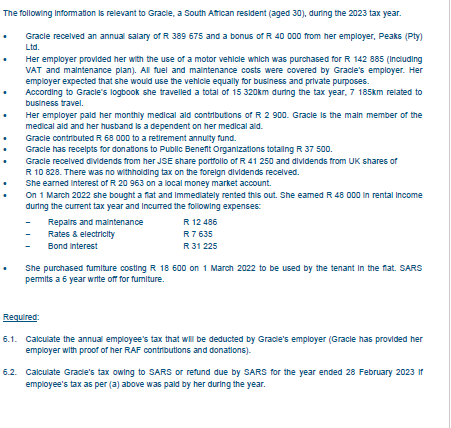

Gracle recelved an annual salary of R 389675 and a bonus of R 40000 from her employer, Peaks (Pty) Ltd. Her employer provided her with the use of a motor vehicle which was purchased for R 142885 (Including VAT and malntenance plan). All fuel and malntenance costs were covered by Gracle's employer. Her employer expected that she would use the vehicle equally for business and private purposes. Accordling to Gracle's logbook she travelled a total of 15320km during the tax year, 7185km related to business travel. Her employer pald her monthly medical ald contributions of R2900. Gracle is the maln member of the medical ald and her husband is a dependent on her medical ald. Gracle contributed R68000 to a retirement annulty fund. Gracle has recelpts for donations to Publlc Benent Organizations totaling R 37500. Gracle recelved dividends from her JSE share portfollo of R 41250 and dlvidends from UK shares of R 10 828. There was no withholding tax on the forelgn dlvidends recelved. She earned interest of R 20963 on a local money market account. On 1 March 2022 she bought a flat and Immedately rented this out. She eamed R48000 in rental Income during the current tax year and Incurred the following expenses: - Repairs and malntenance R 12486 - Rates 8 electricity R 7635 - Bond interest R 31225 She purchased fumlture costing R 18600 on 1 March 2022 to be used by the tenant In the flat. SARS permits a 6 year write ofl for fumlture. Requlred: 1. Calculate the annual employee's tax that will be deducted by Gracle's employer (Gracle has provided her employer with proof of her RAF contributions and donations). 2. Calculate Gracle's tax owing to SARS or refund due by SARS for the year ended 28 February 2023 If employee's tax as per (a) above was pald by her during the year

Gracle recelved an annual salary of R 389675 and a bonus of R 40000 from her employer, Peaks (Pty) Ltd. Her employer provided her with the use of a motor vehicle which was purchased for R 142885 (Including VAT and malntenance plan). All fuel and malntenance costs were covered by Gracle's employer. Her employer expected that she would use the vehicle equally for business and private purposes. Accordling to Gracle's logbook she travelled a total of 15320km during the tax year, 7185km related to business travel. Her employer pald her monthly medical ald contributions of R2900. Gracle is the maln member of the medical ald and her husband is a dependent on her medical ald. Gracle contributed R68000 to a retirement annulty fund. Gracle has recelpts for donations to Publlc Benent Organizations totaling R 37500. Gracle recelved dividends from her JSE share portfollo of R 41250 and dlvidends from UK shares of R 10 828. There was no withholding tax on the forelgn dlvidends recelved. She earned interest of R 20963 on a local money market account. On 1 March 2022 she bought a flat and Immedately rented this out. She eamed R48000 in rental Income during the current tax year and Incurred the following expenses: - Repairs and malntenance R 12486 - Rates 8 electricity R 7635 - Bond interest R 31225 She purchased fumlture costing R 18600 on 1 March 2022 to be used by the tenant In the flat. SARS permits a 6 year write ofl for fumlture. Requlred: 1. Calculate the annual employee's tax that will be deducted by Gracle's employer (Gracle has provided her employer with proof of her RAF contributions and donations). 2. Calculate Gracle's tax owing to SARS or refund due by SARS for the year ended 28 February 2023 If employee's tax as per (a) above was pald by her during the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started