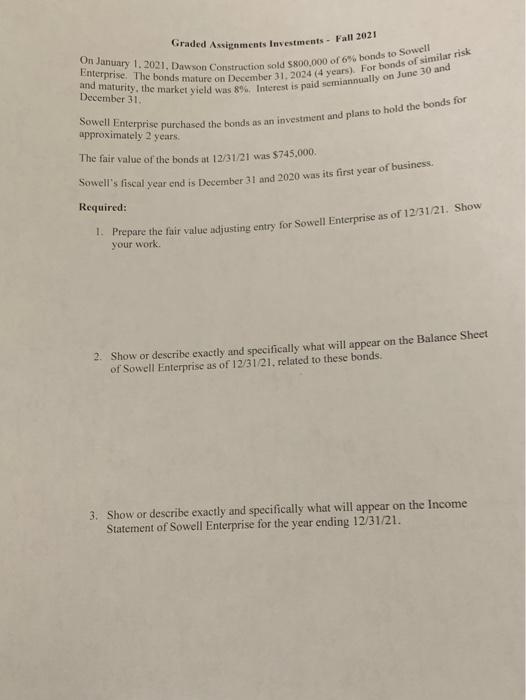

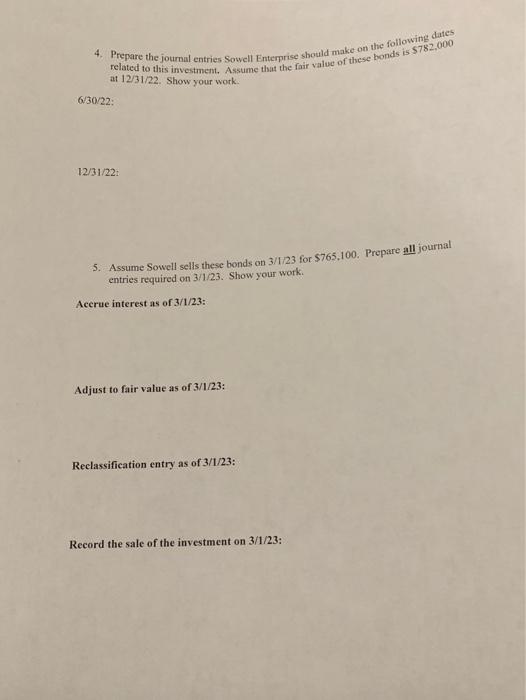

Graded Assignments Investments - Fall 2021 On January 1.2021. Dawson Construction sold 5800,000 of 6% bonds to Sowell and maturity, the market yield was 8%. Interest is paid semiannually on June 30 and Enterprise. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk December 31 approximately 2 years Sowell Enterprise purchased the bonds as an investment and plans to hold the bonds for The fair value of the bonds at 12/31/21 was $745,000 Sowell's fiscal year end is December 31 and 2020 was its first year of business. Required: 1. Prepare the fair value adjusting entry for Sowell Enterprise as of 12/31/21. Show your work 2. Show or describe exactly and specifically what will appear on the Balance Sheet of Sowell Enterprise as of 12/31/21. related to these bonds. 3. Show or describe exactly and specifically what will appear on the Income Statement of Sowell Enterprise for the year ending 12/31/21. 4. Prepare the journal entries Sowell Enterprise should make on the following dates related to this investment. Assume that the fair value of these bonds is $782.000 at 12/31/22. Show your work 6/30/22 12/31/22: 5. Assume Sowell sells these bonds on 3/1/23 for $765,100. Prepare all journal entries required on 3/1/23. Show your work Acerue interest as of 3/1/23: Adjust to fair value as of 3/1/23: Reclassification entry as of 3/1/23: Record the sale of the investment on 3/1/23: Graded Assignments Investments - Fall 2021 On January 1, 2021, Dawson Construction sold $800,000 of 6% bonds to Sowell Enterprise. The bonds mature on December 31, 2024 (4 years). For bonds of similar risk and maturity, the market yield was 8%. Interest is paid semiannually on June 30 and December 31. Sowell Enterprise purchased the bonds as an investment and plans to hold the bonds for approximately 2 years. The fair value of the bonds at 12/31/21 was $745,000. Sowell's fiscal year end is December 31 and 2020 was its first year of business. Required: 1. Prepare the fair value adjusting entry for Sowell Enterprise as of 12/31/21. Show your work. 2. Show or describe exactly and specifically what will appear on the Balance Sheet of Sowell Enterprise as of 12/31/21. related to these bonds. mondo orihe eyactly and specifically what will appear on the Income