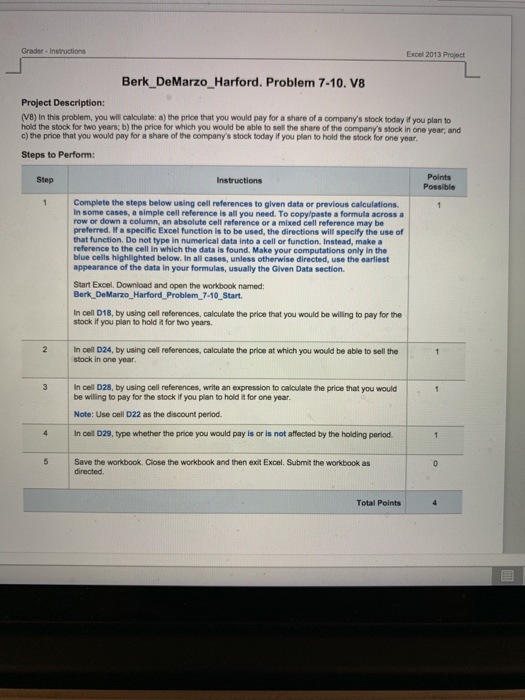

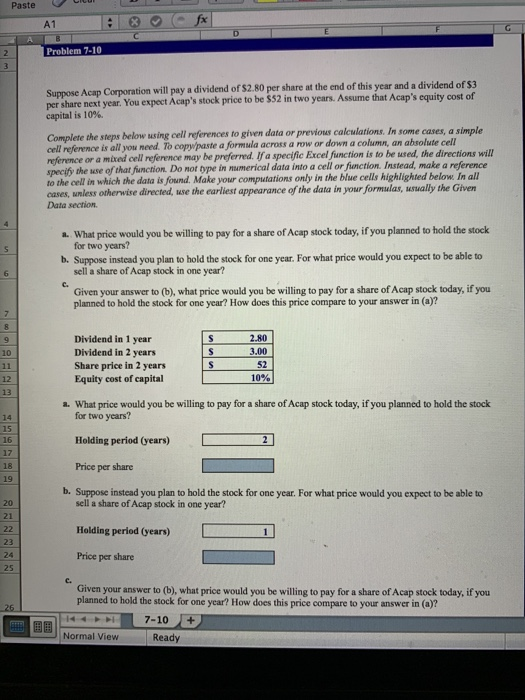

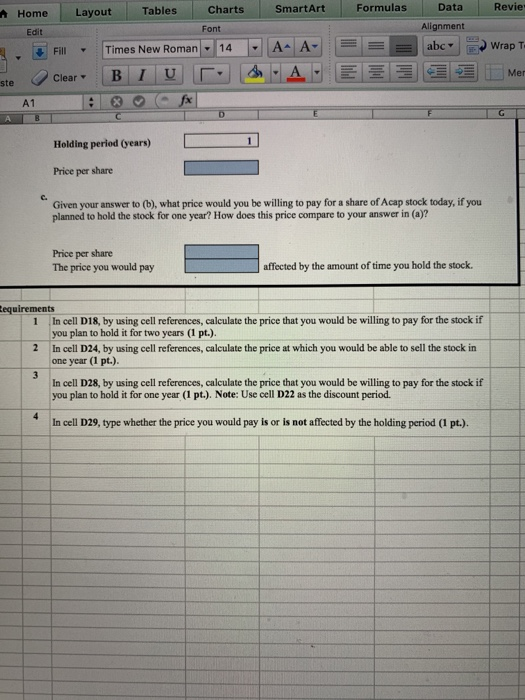

Grader Instructions Excel 2013 Project Berk DeMarzo Harford. Problem 7-10. V8 Project Description: (V8) In this problem, you will caloulate: a) the price that you would pay for a share of a company's stock today if you plan to hold the stock for two years; b) the price for which you would be able to sell the share of the company's stock in one year, and c) the price that you would pay for a share of the company's stock today if you plan to hold the stock for one year Steps to Perform: Points Possible Step Instructions Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copylpaste a formula acrossa row or down a column, an absolute cell reference or a mixed cell reference may be preferred. If a specific Excel function is to be used, the directions will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. Start Excel. Download and open the workbook named: Berk DeMarzo_Harford Problem 7-10 Start In cell D18, by using cel references, calculate the price that you would be willing to pay for the stock if you plan to hold it for two years. 2 In cell D24, by using cell references, calculate the price at which you would be able to sell the stock in one year 3 In cel D28, by using cell references, write an expression to calculate the price that you would be willing to pay for the stock if you plan to hold # for one year Note: Use cell D22 as the discount period 4 In cel D29, type whether the price you would pay is or is not affected by the holding period. 5 Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed Total Points Paste O A1 Problem 7-10 tion will pay a dividend of S2.80 per share at the end of this year and a dividend of S3 per share next year. You expect Acap's stock price to be $52 in two years. Assume that Acap's capital is 10%. Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell reference or a mixed cell reference may be specify the use of that function. Do not ope in mumerical data into a cell or function. Instead, make a reference to the cell in which the data is found. Make your computations only in the blue cells highlighted below In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas, usually the Given Data section. preferred. If a specific Excel function is to be used, the directions will a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? sell a share of Acap stock in one year? Given your answer to (b), what price would you be willing to pay for a share of Acap stock today, if you b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to planned to hold the stock for one year? How does this price compare to your answer in (a)? Dividend in 1 year Dividend in 2 years Share price in 2 years Equity cost of capital 2.80 3.00 52 10% 10 12 13 a. What price would you be willing to pay for a share of Acap stock today, if you planned to hold the stock for two years? Holding period (years) Price per share 14 15 16 17 18 19 2 b. Suppose instead you plan to hold the stock for one year. For what price would you expect to be able to sell a share of Acap stock in one year? Holding period (years) Price per share Given your answer to (b), what price would you be willing to pay for a share of Acap stock today, if you 20 21 23 24 25 c. stock for 7-10 Normal View Ready Formulas Data Revie SmartArt Layout Tables Alignment Font Edit | | | A^ A : | Times New Roman-14 4/ Fill Clear ste A1 Holding period (years) Price per share Given your answer to (b), what price would you be willing to pay for a share of Acap stock today, if you C. planned to hold the stock for one year? How does this price compare to your answer in (a)? Price per share The price you would pay affected by the amount of time you hold the stock. equirements 1 In cell D18, by using cell references, calculate the price that you would be willing to pay for the stock if you plan to hold it for two years (1 pt.) In cell D24, by using cell references, calculate the price at which you would be able to sell the stock in one year (1 pt.) In cell D28, by using cell references, calculate the price that you would be willing to pay for the stock if you plan to hold it for one year (1 pt.). Note: Use cell D22 as the discount period. 2 In cell D29, type whether the price you would pay is or is not affected by the holding period (1 pt.)