Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Granite Works currently maintains a debt-equity ratio of 0.5 and has a tax rate of 40 percent. It has 300 perpetual bonds each with

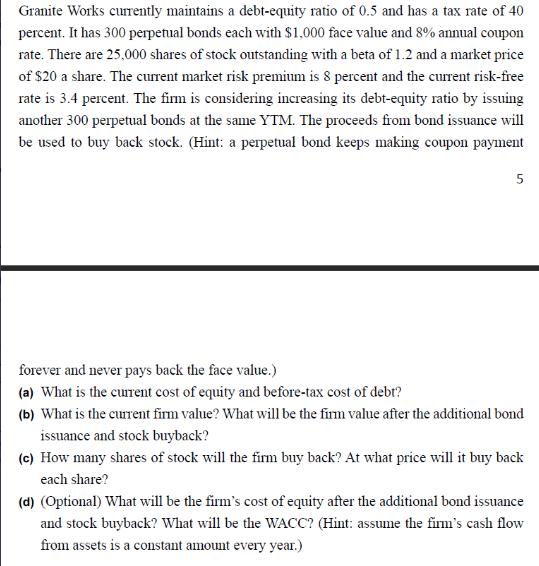

Granite Works currently maintains a debt-equity ratio of 0.5 and has a tax rate of 40 percent. It has 300 perpetual bonds each with $1,000 face value and 8% annual coupon rate. There are 25,000 shares of stock outstanding with a beta of 1.2 and a market price of $20 a share. The current market risk premium is 8 percent and the current risk-free rate is 3.4 percent. The firm is considering increasing its debt-equity ratio by issuing another 300 perpetual bonds at the same YTM. The proceeds from bond issuance will be used to buy back stock. (Hint: a perpetual bond keeps making coupon payment 5 forever and never pays back the face value.) (a) What is the current cost of equity and before-tax cost of debt? (b) What is the current firm value? What will be the firm value after the additional bond issuance and stock buyback? (c) How many shares of stock will the firm buy back? At what price will it buy back each share? (d) (Optional) What will be the firm's cost of equity after the additional bond issuance and stock buyback? What will be the WACC? (Hint: assume the firm's cash flow from assets is a constant amount every year.)

Step by Step Solution

★★★★★

3.55 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a The current cost of equity can be calculated using the Capital Asset Pricing Model CAPM Cost of equity Rf beta x Rm Rf where Rf is the riskfree rate beta is the stocks beta and Rm is the market risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started