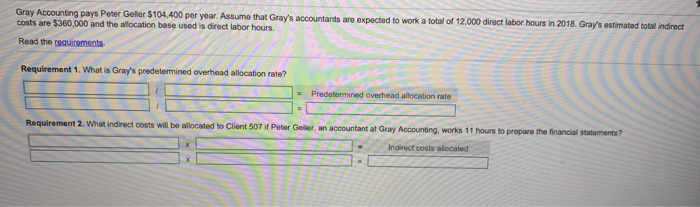

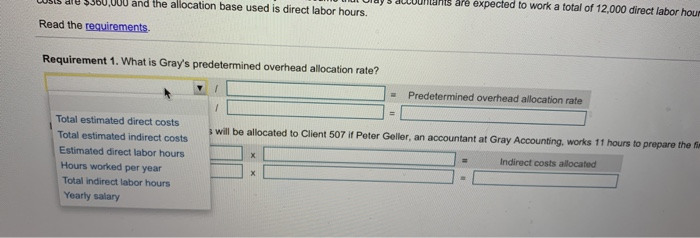

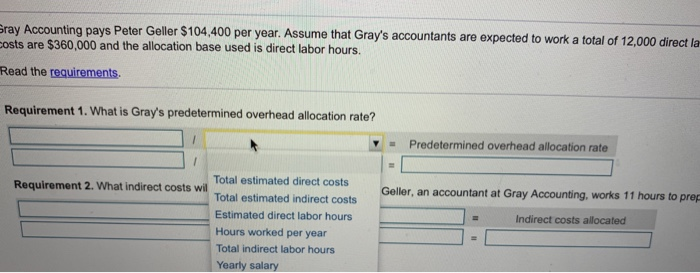

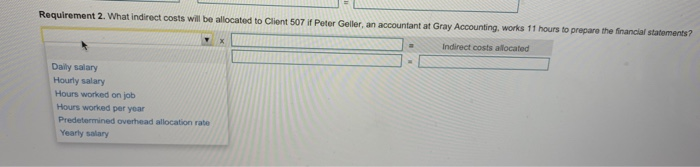

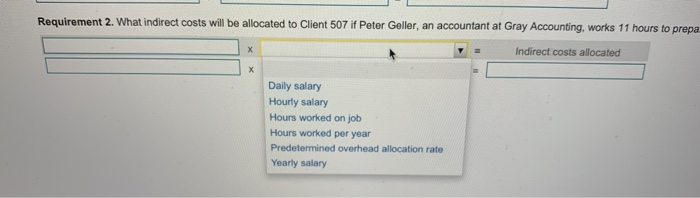

Gray Accounting pays Peter Geller $104,400 per year. Assume that Gray's accountants are expected to work a total of 12,000 direct labor hours in 2018. Gray's estimated total indirect costs are $360,000 and the allocation base used is direct labor hours Read the requirements Requirement 1. What is Gray's predetermined overhead allocation rate? Predetermined overhead allocation rater Requirement 2. What indirect costs will be allocated to Client 507 if Peter Geller, an ac at Gray Accounting, works 11 hours to prepare the financial statements? Indirect costs alocated ay s accountEns are expected to work a total of 12,000 direct labor hour ww CstS are S380,000 and the allocation base used is direct labor hours. Read the requirements. Requirement 1. What is Gray's predetermined overhead allocation rate? Predetermined overhead allocation rate Total estimated direct costs a will be allocated to Client 507 if Peter Geller, an accountant at Gray Accounting, works 11 hours to prepare the fir Total estimated indirect costs Indirect costs allocated Estimated direct labor hours Hours worked per year x Total indirect labor hours Yearly salary ray Accounting pays Peter Geller $104,400 per year. Assume that Gray's accountants are expected to work a total of 12,000 direct la $360,000 and the allocation base used is direct labor hours. costs are Read the requirements Requirement 1. What is Gray's predetermined overhead allocation rate? Predetermined overhead allocation rate Total estimated direct costs Geller, an accountant at Gray Accounting, works 11 hours to prep Requirement 2. What indirect costs will Total estimated indirect costs Estimated direct labor hours Indirect costs allocated Hours worked per year Total indirect labor hours Yearly salary Requirement 2. What indirect costs will be allocated to Client 507 if Peter Geller, an accountant at Gray Accounting, works 11 hours to prepare the financial statements? Indirect costs allocated Daily salary Hourly salary Hours worked on job Hours worked per year Predetermined overhead allocation rate Yearly salary Requirement 2. What indirect costs will be allocated to Client 507 if Peter Geller, an accountant at Gray Accounting, works 11 hours to prepa Indirect costs allocated X Daily salary Hourly salary Hours worked on job Hours worked per year Predetermined overhead allocation rate Yearly salary