Great Ape Glassworks manufactures glass used for the screens on smartphones. It has two producing departments, P1 and P2, and only one service department,

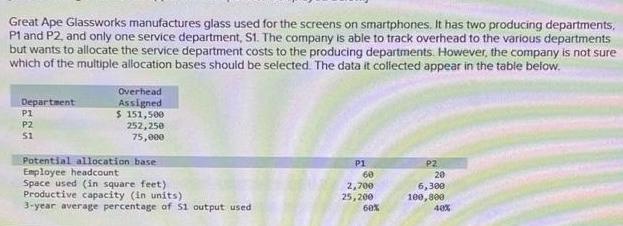

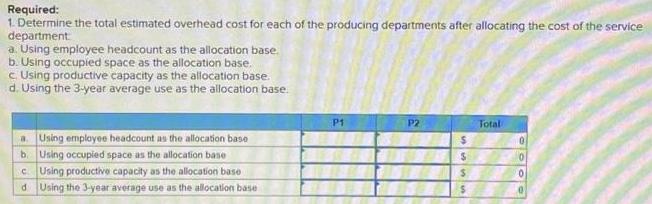

Great Ape Glassworks manufactures glass used for the screens on smartphones. It has two producing departments, P1 and P2, and only one service department, S1. The company is able to track overhead to the various departments but wants to allocate the service department costs to the producing departments. However, the company is not sure which of the multiple allocation bases should be selected. The data it collected appear in the table below. Overhead Assigned $ 151,500 252,250 75,000 Department P1 P2 Potential allocation base Employee headcount Space used (in square feet) Productive capacity (in units) 3-year average percentage of Si output used P2 20 P1 60 2,700 25,200 60% 6,300 100,800 40% Required: 1 Determine the total estimated overhead cost for each of the producing departments after allocating the cost of the service department a. Using employee headcount as the allocation base. b. Using occupied space as the allocation base. c Using productive capacity as the allocation base. d. Using the 3-year average use as the allocation base. P1 P2 Total a Using emplayee headcount as the allocation base b Using occupied space as the allocation bane c. Using productive capacity as the alocation base dUsing the 3-year average use as the allocation base

Step by Step Solution

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 Allocation of Service Department Cost is shown as follows Amounts in a Using employee headcount as ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started