Answered step by step

Verified Expert Solution

Question

1 Approved Answer

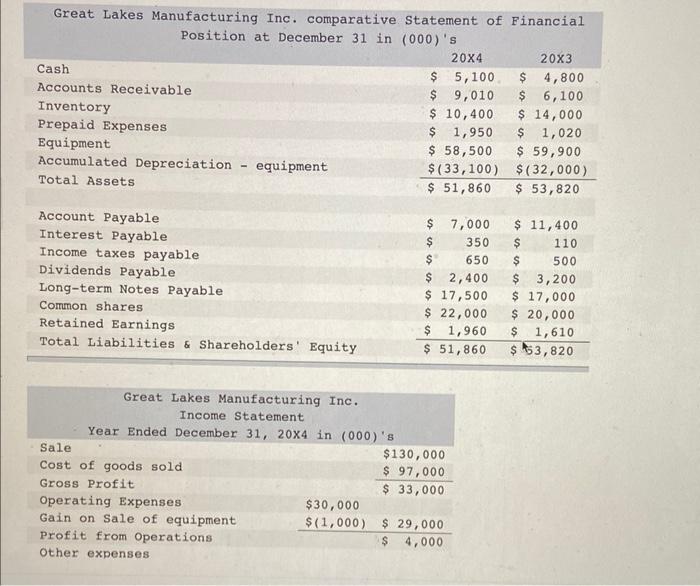

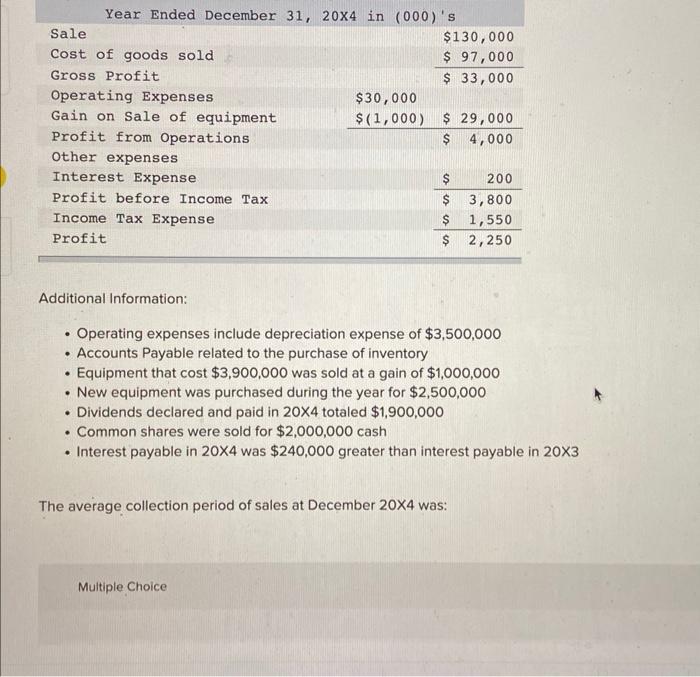

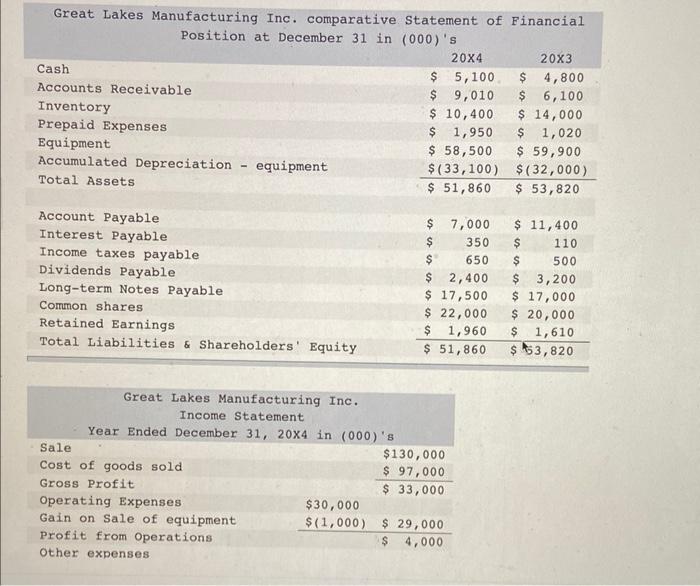

Great Lakes Manufacturing Inc. comparative Statement of Financial Position at December 31 in (000) 's Additional Information: - Operating expenses include depreciation expense of $3,500,000

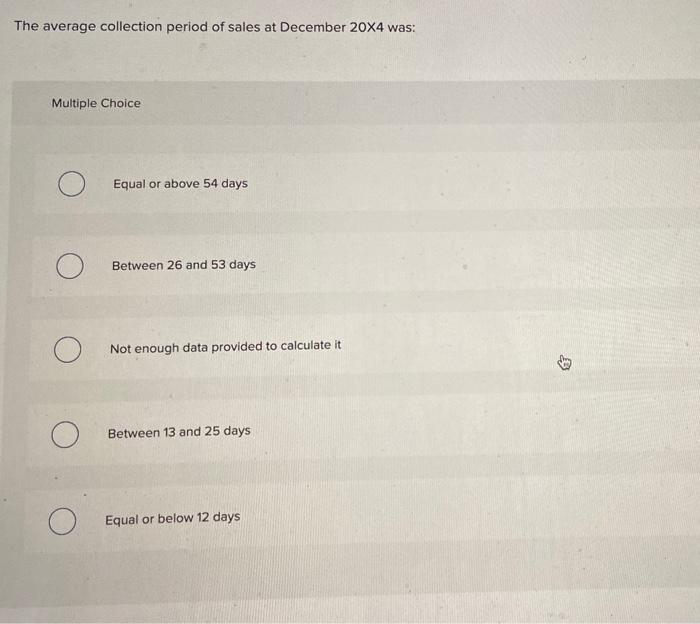

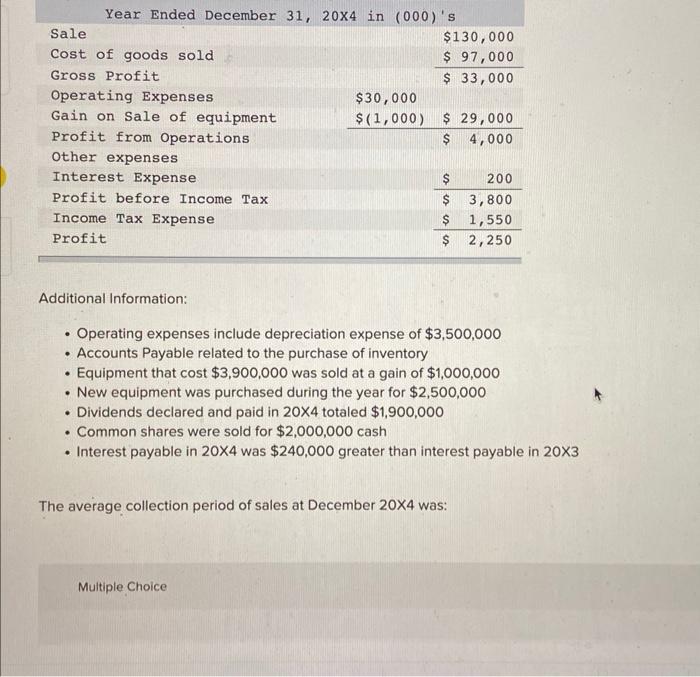

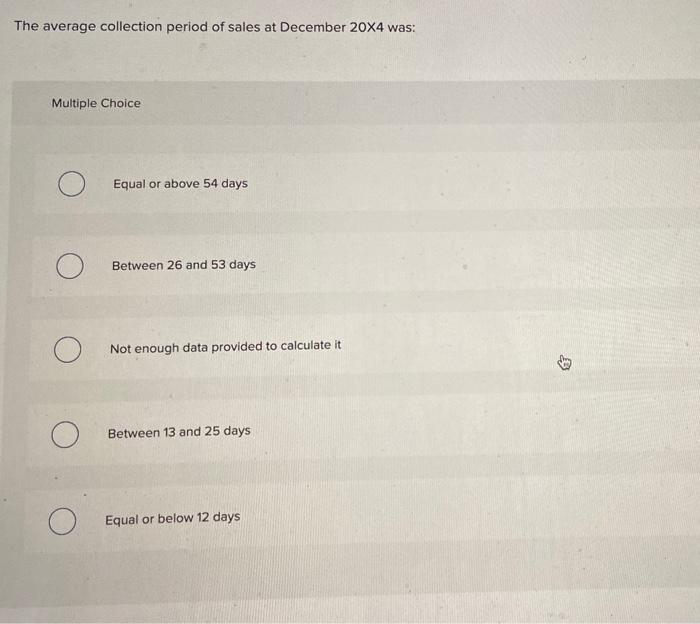

Great Lakes Manufacturing Inc. comparative Statement of Financial Position at December 31 in (000) 's Additional Information: - Operating expenses include depreciation expense of $3,500,000 - Accounts Payable related to the purchase of inventory - Equipment that cost $3,900,000 was sold at a gain of $1,000,000 - New equipment was purchased during the year for $2,500,000 - Dividends declared and paid in 204 totaled $1,900,000 - Common shares were sold for $2,000,000 cash - Interest payable in 204 was $240,000 greater than interest payable in 20X The average collection period of sales at December 204 was: The average collection period of sales at December 204 was: Multiple Choice Equal or above 54 days Between 26 and 53 days Not enough data provided to calculate it Between 13 and 25 days Equal or below 12 days

Great Lakes Manufacturing Inc. comparative Statement of Financial Position at December 31 in (000) 's Additional Information: - Operating expenses include depreciation expense of $3,500,000 - Accounts Payable related to the purchase of inventory - Equipment that cost $3,900,000 was sold at a gain of $1,000,000 - New equipment was purchased during the year for $2,500,000 - Dividends declared and paid in 204 totaled $1,900,000 - Common shares were sold for $2,000,000 cash - Interest payable in 204 was $240,000 greater than interest payable in 20X The average collection period of sales at December 204 was: The average collection period of sales at December 204 was: Multiple Choice Equal or above 54 days Between 26 and 53 days Not enough data provided to calculate it Between 13 and 25 days Equal or below 12 days

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started