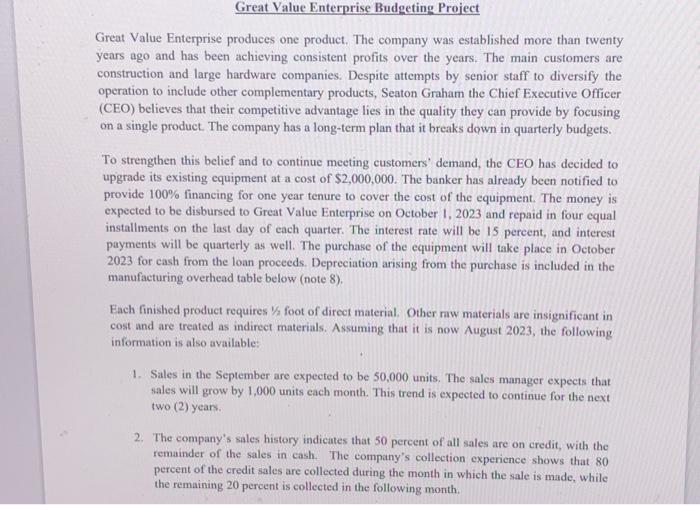

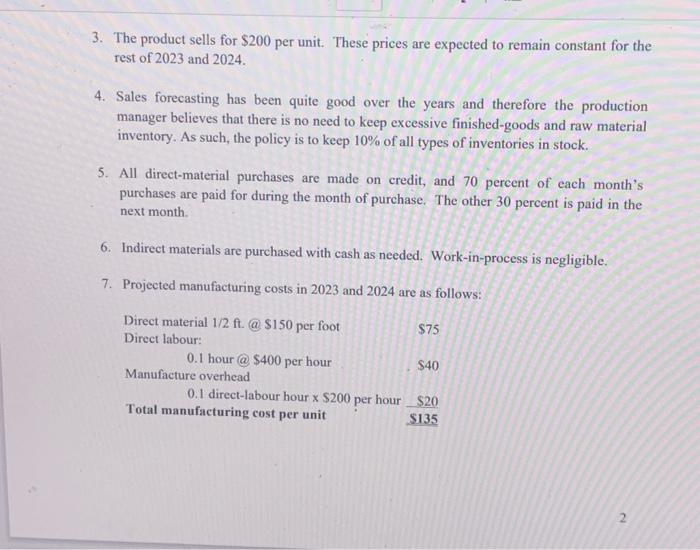

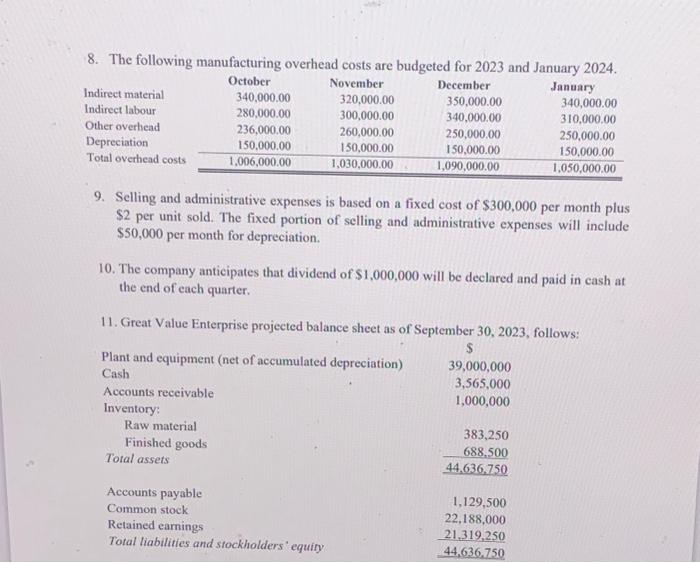

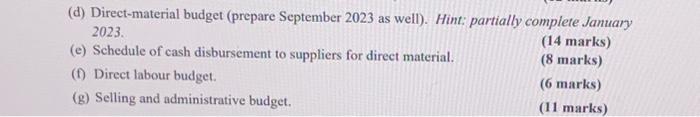

Great Value Enterprise Budgeting Project Great Value Enterprise produces one product. The company was established more than twenty years ago and has been achieving consistent profits over the years. The main customers are construction and large hardware companies. Despite attempts by senior staff to diversify the operation to include other complementary products, Seaton Graham the Chief Executive Officer (CEO) believes that their competitive advantage lies in the quality they can provide by focusing on a single product. The company has a long-term plan that it breaks down in quarterly budgets. To strengthen this belief and to continue meeting customers' demand, the CEO has decided to upgrade its existing equipment at a cost of $2,000,000. The banker has already been notified to provide 100% financing for one year tenure to cover the cost of the equipment. The money is expected to be disbursed to Great Value Enterprise on October 1, 2023 and repaid in four equal installments on the last day of each quarter. The interest rate will be 15 percent, and interest payments will be quarterly as well. The purchase of the equipment will take place in October 2023 for cash from the loan proceeds. Depreciation arising from the purchase is included in the manufacturing overhead table below (note 8 ). Each finished product requires 1/2 foot of direct material. Other raw materials are insignificant in cost and are treated as indirect materials. Assuming that it is now August 2023, the following information is also available: 1. Sales in the September are expected to be 50,000 units. The sales manager expects that sales will grow by 1,000 units each month. This trend is expected to continue for the next two (2) years. 2. The company's sales history indicates that 50 pereent of all sales are on credit, with the remainder of the sales in cash. The company's collection experience shows that 80 percent of the credit sales are collected during the month in which the sale is made, while the remaining 20 percent is collected in the following month. 3. The product sells for $200 per unit. These prices are expected to remain constant for the rest of 2023 and 2024. 4. Sales forecasting has been quite good over the years and therefore the production manager believes that there is no need to keep excessive finished-goods and raw material inventory. As such, the policy is to keep 10% of all types of inventories in stock. 5. All direct-material purchases are made on credit, and 70 percent of each month's purchases are paid for during the month of purchase. The other 30 percent is paid in the next month. 6. Indirect materials are purchased with cash as needed. Work-in-process is negligible. 7. Projected manufacturing costs in 2023 and 2024 are as follows: 8. The following manufacturing overhead costs are budgeted for 2023 and Januarv 2024 9. Selling and administrative expenses is based on a fixed cost of $300,000 per month plus $2 per unit sold. The fixed portion of selling and administrative expenses will include $50,000 per month for depreciation. 10. The company anticipates that dividend of $1,000,000 will be declared and paid in cash at the end of each quarter. 11. Great Value Enterprise projected balance sheet as of September 30,2023 , follows: (d) Direct-material budget (prepare September 2023 as well). Hint: partially complete January 2023. (e) Schedule of cash disbursement to suppliers for direct material. (14 marks) (8 marks) (f) Direct labour budget. ( 6 marks) (g) Selling and administrative budget. (11 marks)