Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Greatly appreciated if both questions where answered, Thank you! question 1 question 2 This option is (recommended or not recommended) as it (decreases or increases)

Greatly appreciated if both questions where answered, Thank you!

question 1

question 2

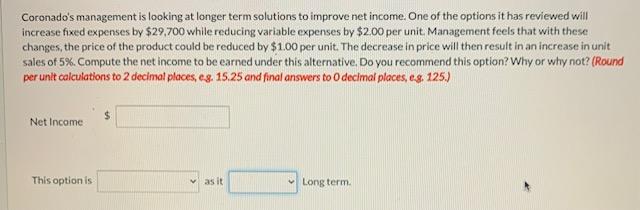

This option is (recommended or not recommended) as it (decreases or increases) long term.

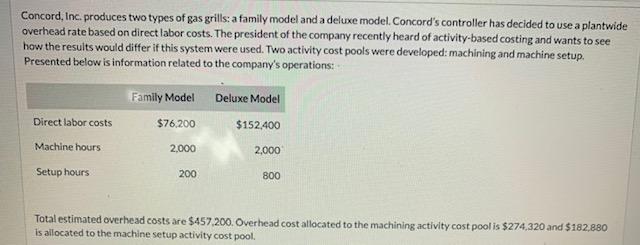

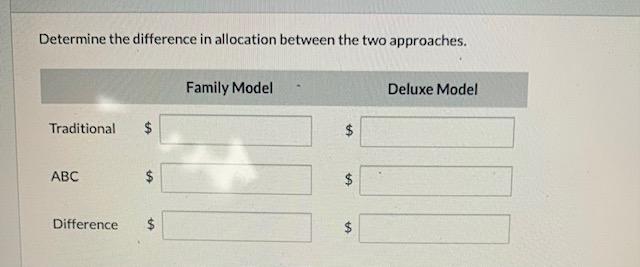

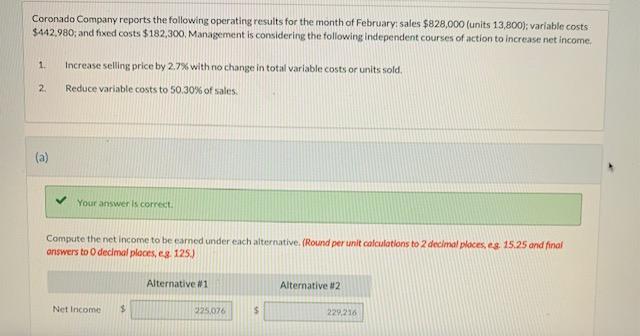

Concord, inc. produces two types of gas grills: a family model and a deluxe model. Concord's controller has decided to use a plantwide overhead rate based on direct labor costs. The president of the company recently heard of activity-based costing and wants to see how the results would differ if this system were used. Two activity cost pools were developed: machining and machine setup. Presented below is information related to the company's operations: Total estimated overhead costs are $457,200. Overhead cost allocated to the machining activity cost pool is $274,320 and $182,880 is allocated to the machine setup activity cost pool. Determine the difference in allocation between the two approaches. Coronado Company reports the following operating results for the month of February: sales $828,000 (units 13,800 ): variable costs: $442,980; and fixed costs $182,300. Management is considering the following independent courses of action to increase net income. 1. Increase selling price by 2.7 with no change in total variable costs or units sold. 2. Reduce variable costs to 50.30% of sales. (a) Your answer is correct. Compute the net income to be earned under each alternative. (Round per unit calculations to 2 decimal ploces, es. 15.25 and final answers to 0 decimal pleces, eg. 125. Coronado's management is looking at longer term solutions to improve net income. One of the options it has reviewed will increase fixed expenses by $29,700 while reducing variable expenses by $2.00 per unit. Management feels that with these changes, the price of the product could be reduced by $1.00 per unit. The decrease in price will then result in an increase in unit sales of 5%. Compute the net income to be earned under this alternative. Do you recommend this option? Why or why not? (Round per unit calculations to 2 decimal places, eg. 15.25 and final answers to 0 decimal places, e.g. 125.) Net Income This option is Long termStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started