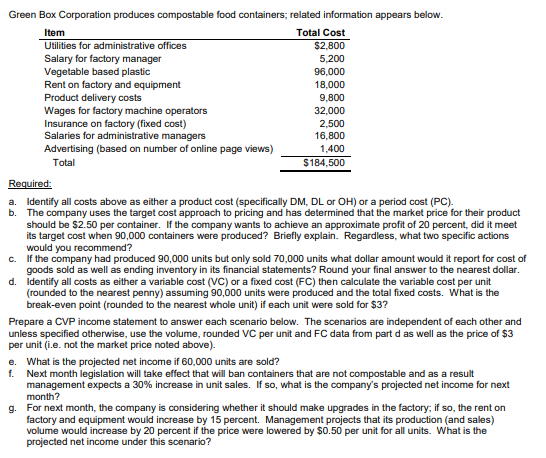

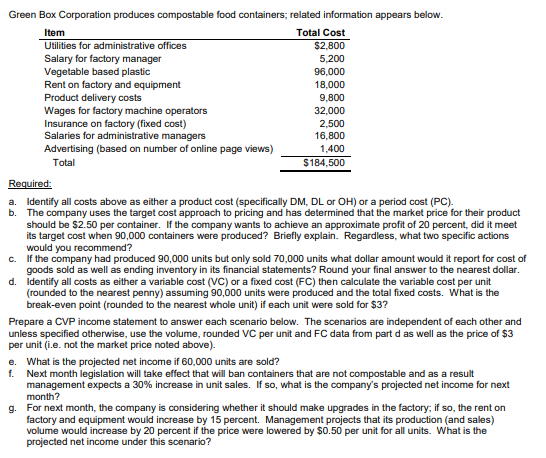

Green Box Corporation produces compostable food containers, related information appears below. Item Total Cost Utilities for administrative offices $2,800 Salary for factory manager 5,200 Vegetable based plastic 96,000 Rent on factory and equipment 18,000 Product delivery costs 9,800 Wages for factory machine operators 32,000 Insurance on factory (fixed cost) 2,500 Salaries for administrative managers 16,800 Advertising (based on number of online page views) 1,400 Total $184,500 Required: a. Identify all costs above as either a product cost (specifically DM, DL O OH) or a period cost (PC). b. The company uses the target cost approach to pricing and has determined that the market price for their product should be $2.50 per container. If the company wants to achieve an approximate profit of 20 percent, did it meet its target cost when 90,000 containers were produced? Briefly explain. Regardless, what two specific actions would you recommend? c. If the company had produced 90,000 units but only sold 70,000 units what dollar amount would it report for cost of goods sold as well as ending inventory in its financial statements? Round your final answer to the nearest dollar. d. Identify all costs as either a variable cost (VC) or a fixed cost (FC) then calculate the variable cost per unit (rounded to the nearest penny) assuming 90,000 units were produced and the total fixed costs. What is the break-even point (rounded to the nearest whole unit) if each unit were sold for $3? Prepare a CVP income statement to answer each scenario below. The scenarios are independent of each other and unless specified otherwise, use the volume, rounded VC per unit and FC data from part d as well as the price of $3 per unit (i.e. not the market price noted above). e. What is the projected net income if 60,000 units are sold? f. Next month legislation will take effect that will ban containers that are not compostable and as a result management expects a 30% increase in unit sales. If so, what is the company's projected net income for next month? g. For next month, the company is considering whether it should make upgrades in the factory, if so, the rent on factory and equipment would increase by 15 percent. Management projects that its production and sales) volume would increase by 20 percent if the price were lowered by $0.50 per unit for all units. What is the projected net income under this scenario? Green Box Corporation produces compostable food containers, related information appears below. Item Total Cost Utilities for administrative offices $2,800 Salary for factory manager 5,200 Vegetable based plastic 96,000 Rent on factory and equipment 18,000 Product delivery costs 9,800 Wages for factory machine operators 32,000 Insurance on factory (fixed cost) 2,500 Salaries for administrative managers 16,800 Advertising (based on number of online page views) 1,400 Total $184,500 Required: a. Identify all costs above as either a product cost (specifically DM, DL O OH) or a period cost (PC). b. The company uses the target cost approach to pricing and has determined that the market price for their product should be $2.50 per container. If the company wants to achieve an approximate profit of 20 percent, did it meet its target cost when 90,000 containers were produced? Briefly explain. Regardless, what two specific actions would you recommend? c. If the company had produced 90,000 units but only sold 70,000 units what dollar amount would it report for cost of goods sold as well as ending inventory in its financial statements? Round your final answer to the nearest dollar. d. Identify all costs as either a variable cost (VC) or a fixed cost (FC) then calculate the variable cost per unit (rounded to the nearest penny) assuming 90,000 units were produced and the total fixed costs. What is the break-even point (rounded to the nearest whole unit) if each unit were sold for $3? Prepare a CVP income statement to answer each scenario below. The scenarios are independent of each other and unless specified otherwise, use the volume, rounded VC per unit and FC data from part d as well as the price of $3 per unit (i.e. not the market price noted above). e. What is the projected net income if 60,000 units are sold? f. Next month legislation will take effect that will ban containers that are not compostable and as a result management expects a 30% increase in unit sales. If so, what is the company's projected net income for next month? g. For next month, the company is considering whether it should make upgrades in the factory, if so, the rent on factory and equipment would increase by 15 percent. Management projects that its production and sales) volume would increase by 20 percent if the price were lowered by $0.50 per unit for all units. What is the projected net income under this scenario