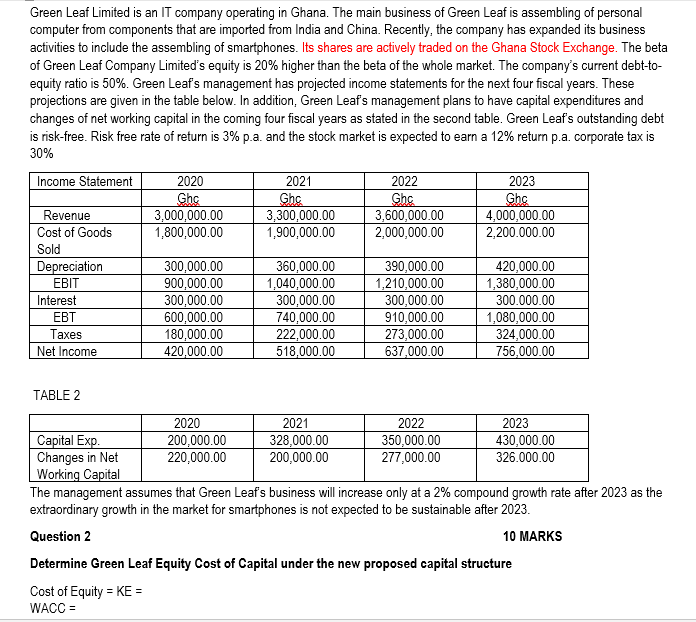

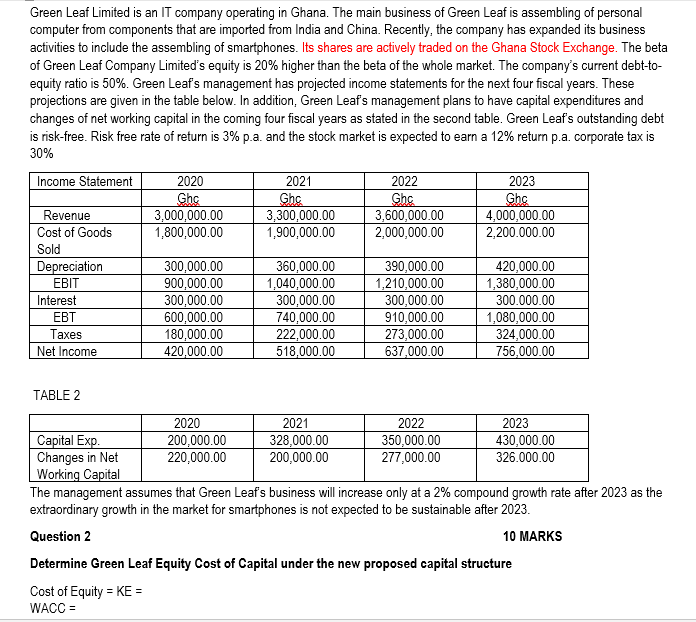

Green Leaf Limited is an IT company operating in Ghana. The main business of Green Leaf is assembling of personal computer from components that are imported from India and China. Recently, the company has expanded its business activities to include the assembling of smartphones. Its shares are actively traded on the Ghana Stock Exchange. The beta of Green Leaf Company Limited's equity is 20% higher than the beta of the whole market. The company's current debt-toequity ratio is 50%. Green Leaf's management has projected income statements for the next four fiscal years. These projections are given in the table below. In addition, Green Leaf's management plans to have capital expenditures and changes of net working capital in the coming four fiscal years as stated in the second table. Green Leaf's outstanding debt is risk-free. Risk free rate of return is 3% p.a. and the stock market is expected to earn a 12% return p.a. corporate tax is 30% TABLE 2 The management assumes that Green Leaf's business will increase only at a 2% compound growth rate after 2023 as the extraordinary growth in the market for smartphones is not expected to be sustainable after 2023. Question 2 10 MARKS Determine Green Leaf Equity Cost of Capital under the new proposed capital structure Cost of Equity = KE = WACC = Green Leaf Limited is an IT company operating in Ghana. The main business of Green Leaf is assembling of personal computer from components that are imported from India and China. Recently, the company has expanded its business activities to include the assembling of smartphones. Its shares are actively traded on the Ghana Stock Exchange. The beta of Green Leaf Company Limited's equity is 20% higher than the beta of the whole market. The company's current debt-toequity ratio is 50%. Green Leaf's management has projected income statements for the next four fiscal years. These projections are given in the table below. In addition, Green Leaf's management plans to have capital expenditures and changes of net working capital in the coming four fiscal years as stated in the second table. Green Leaf's outstanding debt is risk-free. Risk free rate of return is 3% p.a. and the stock market is expected to earn a 12% return p.a. corporate tax is 30% TABLE 2 The management assumes that Green Leaf's business will increase only at a 2% compound growth rate after 2023 as the extraordinary growth in the market for smartphones is not expected to be sustainable after 2023. Question 2 10 MARKS Determine Green Leaf Equity Cost of Capital under the new proposed capital structure Cost of Equity = KE = WACC =