Answered step by step

Verified Expert Solution

Question

1 Approved Answer

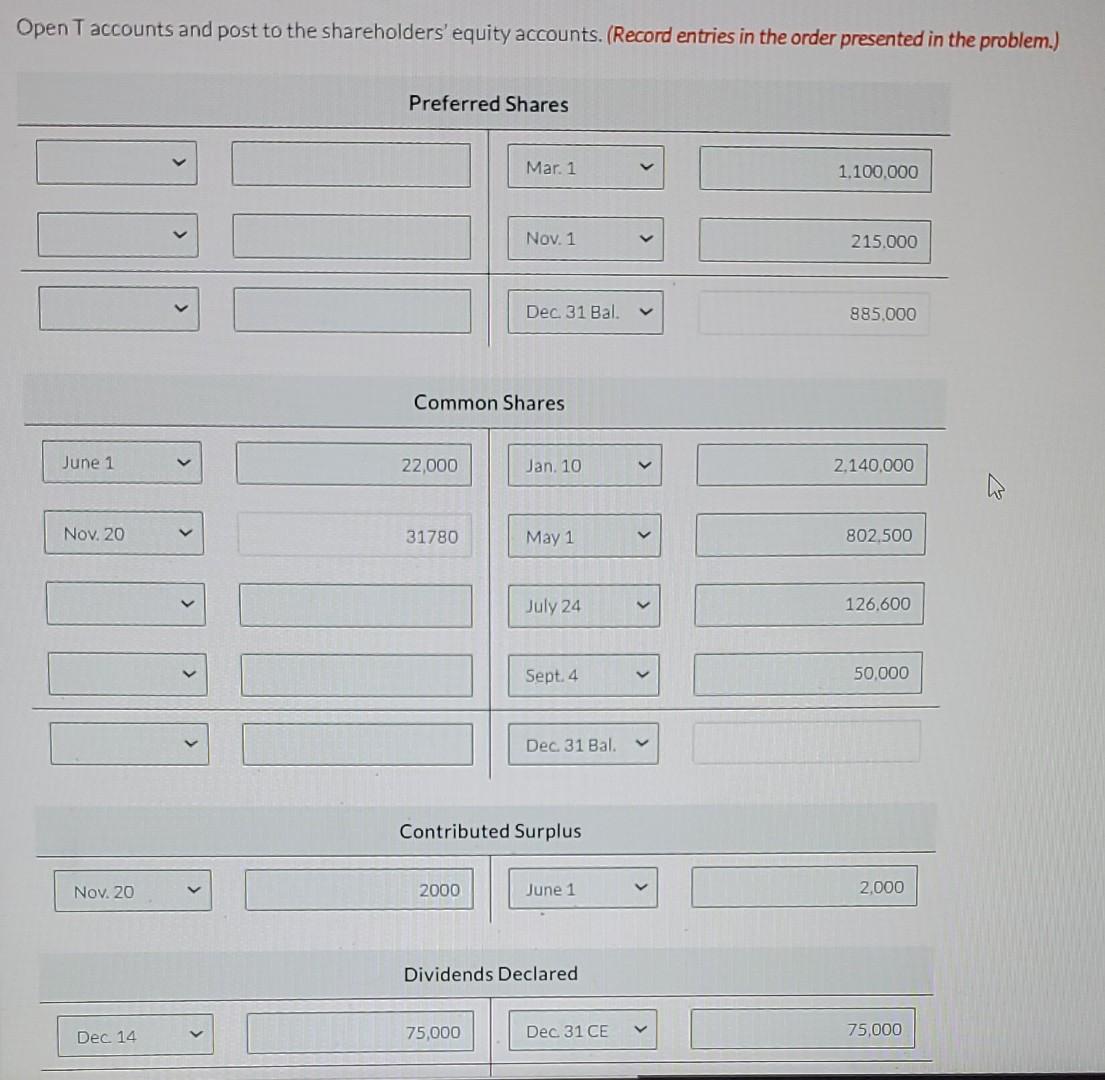

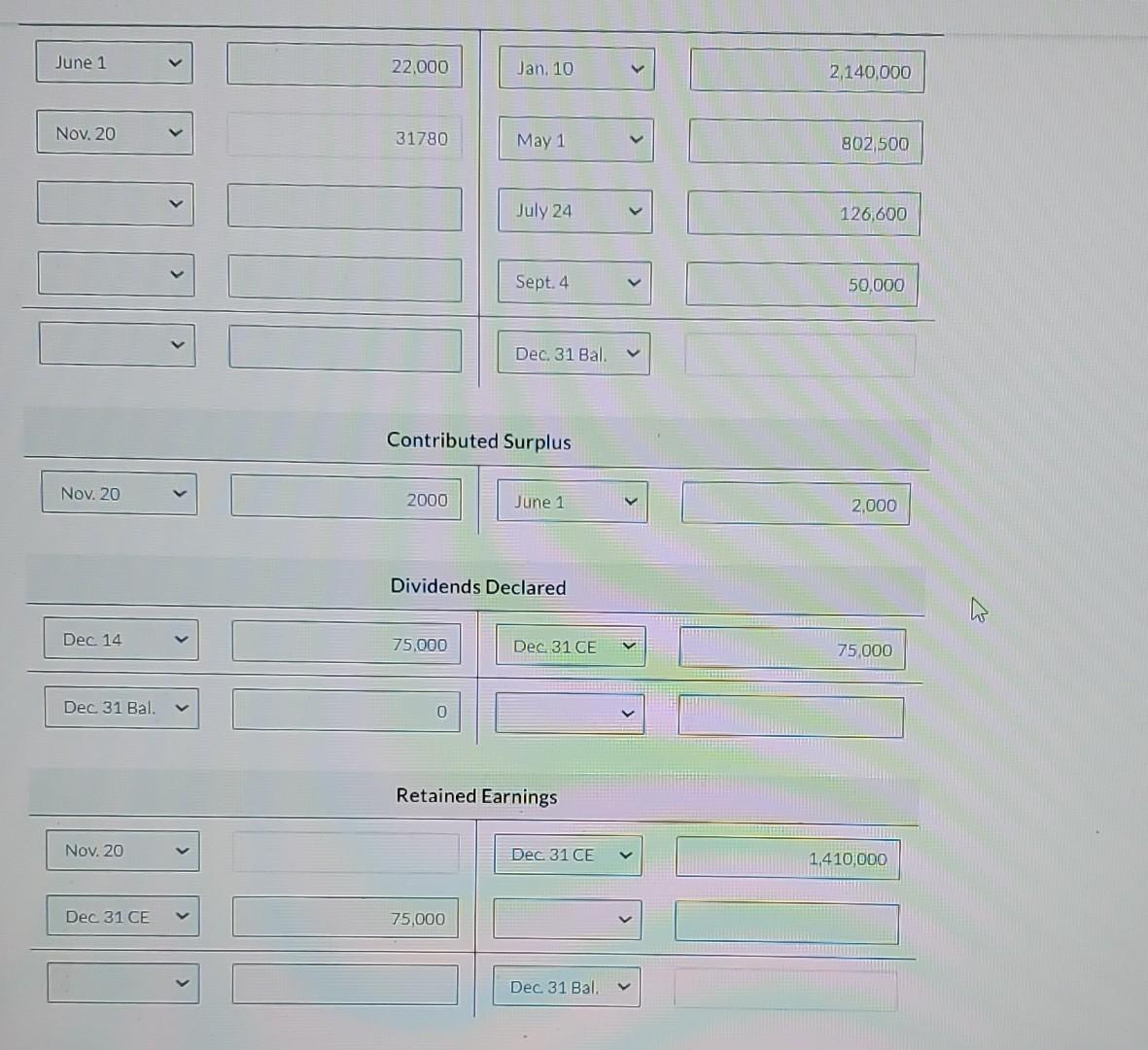

Green parts are correct, white parts are incorrect. please help me complete this Open T accounts and post to the shareholders' equity accounts.(Record entries in

Green parts are correct, white parts are incorrect. please help me complete this

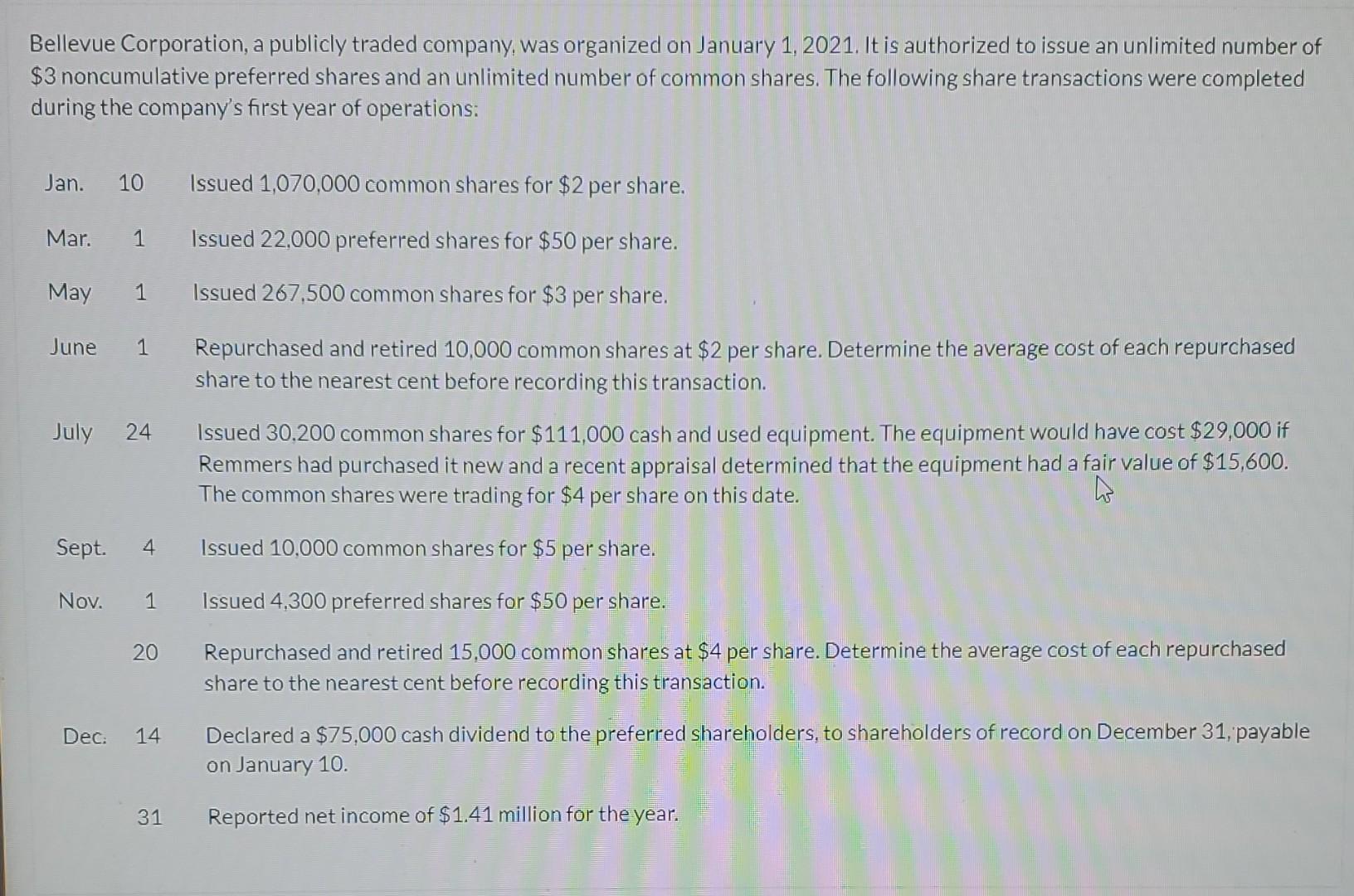

Open T accounts and post to the shareholders' equity accounts.(Record entries in the order presented in the problem.) Preferred Shares Mar. 1 1.100.000 Nov. 1 215.000 Dec 31 Bal. 885.000 Common Shares June 1 22,000 Jan. 10 2.140,000 W Nov. 20 31780 May 1 802.500 July 24 126.600 Sept. 4 50.000 Dec 31 Bal. Contributed Surplus Nov. 20 2000 June 1 2,000 Dividends Declared Dec 14 75,000 Dec 31 CE 75,000 June 1 22,000 Jan. 10 2,140,000 Nov. 20 31780 May 1 802,500 July 24 126,600 Sept. 4 50.000 Dec. 31 Bal. Contributed Surplus Nov. 20 2000 June 1 2,000 Dividends Declared Dec 14 V 75.000 Dec 31 CE 75.000 Dec 31 Bal. 0 Retained Earnings Nov. 20 Dec 31 CE 1,410,000 Dec 31 CE 75,000 Dec 31 Bal. Bellevue Corporation, a publicly traded company, was organized on January 1, 2021. It is authorized to issue an unlimited number of $3 noncumulative preferred shares and an unlimited number of common shares. The following share transactions were completed during the company's first year of operations: Jan. 10 Issued 1,070,000 common shares for $2 per share. Mar. 1 Issued 22,000 preferred shares for $50 per share. May 1 Issued 267,500 common shares for $3 per share. June 1 Repurchased and retired 10,000 common shares at $2 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. July 24 Issued 30,200 common shares for $111,000 cash and used equipment. The equipment would have cost $29,000 if Remmers had purchased it new and a recent appraisal determined that the equipment had a fair value of $15,600. The common shares were trading for $4 per share on this date. Sept. 4 Issued 10,000 common shares for $5 per share. Nov. 1 Issued 4,300 preferred shares for $50 per share. 20 Repurchased and retired 15,000 common shares at $4 per share. Determine the average cost of each repurchased share to the nearest cent before recording this transaction. Dec. 14 Declared a $75,000 cash dividend to the preferred shareholders, to shareholders of record on December 31, payable on January 10. 31 Reported net income of $1.41 million for the yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started