Answered step by step

Verified Expert Solution

Question

1 Approved Answer

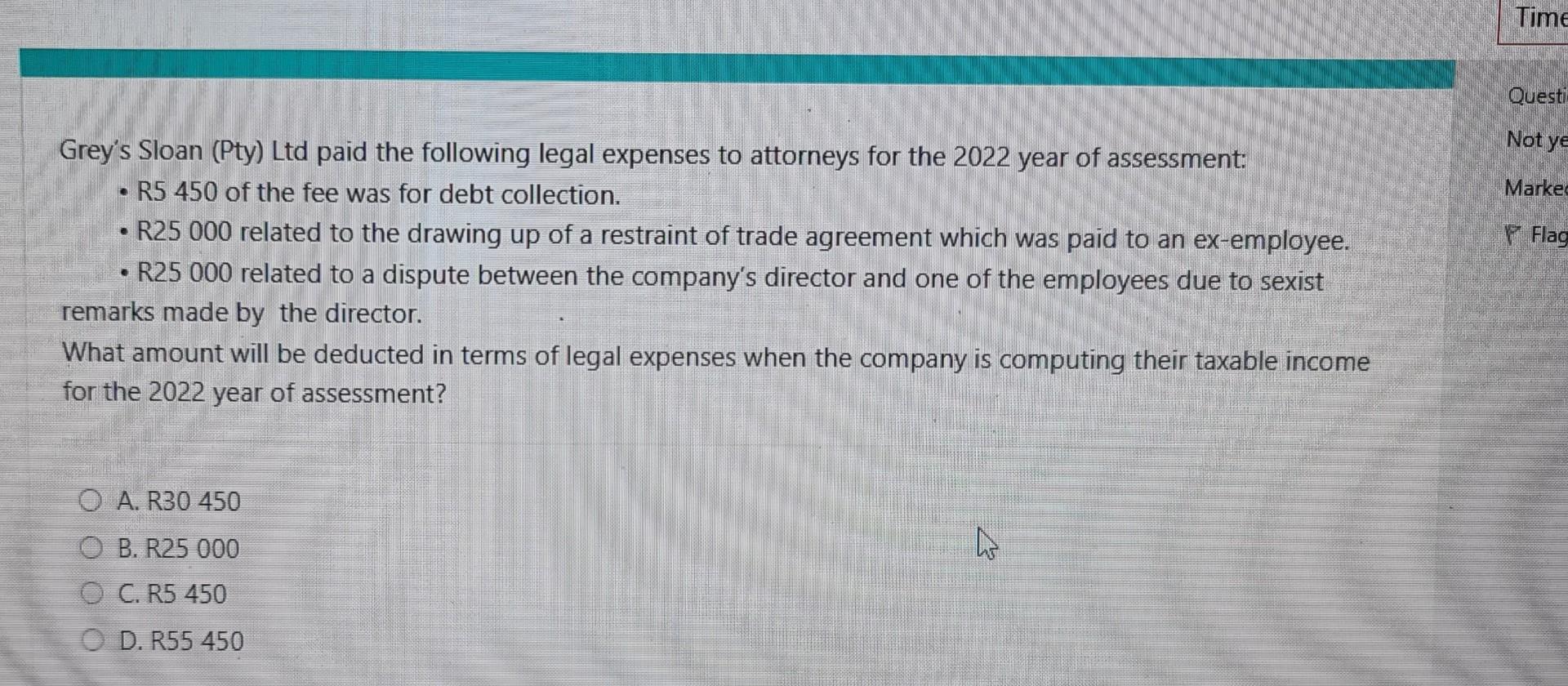

Grey's Sloan (Pty) Ltd paid the following legal expenses to attorneys for the 2022 year of assessment: - R5 450 of the fee was for

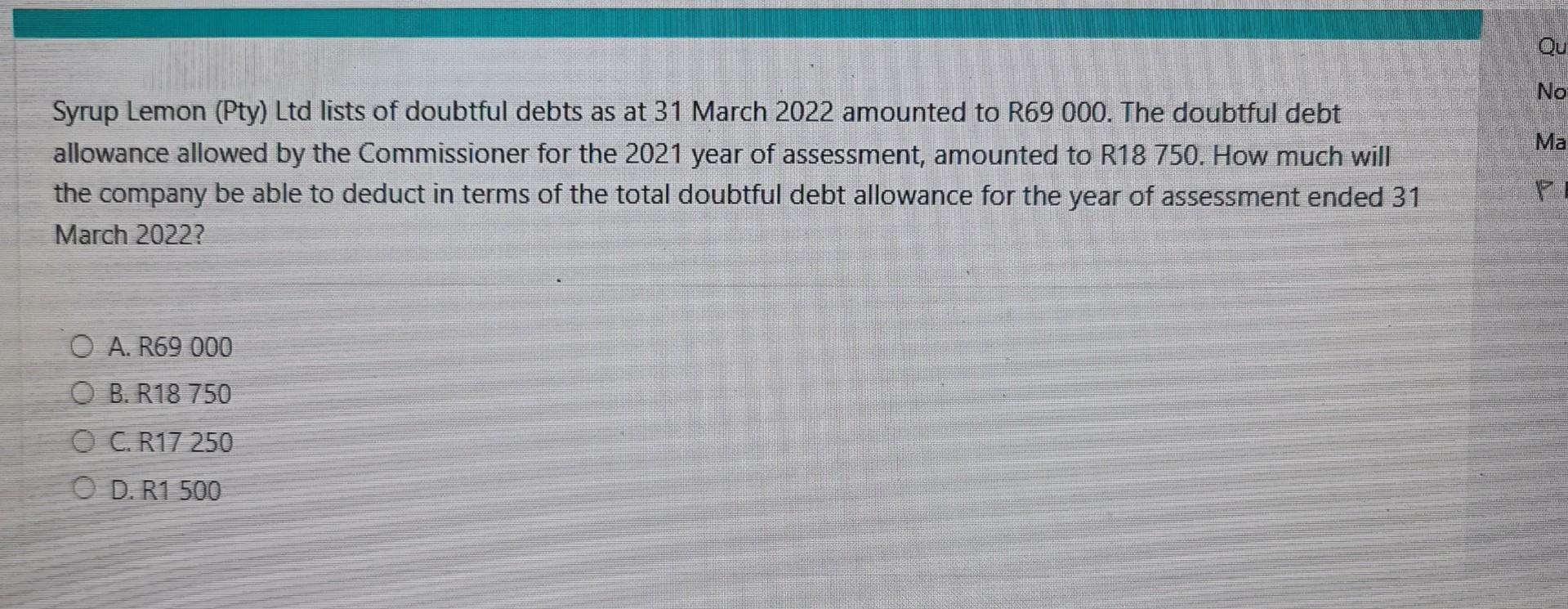

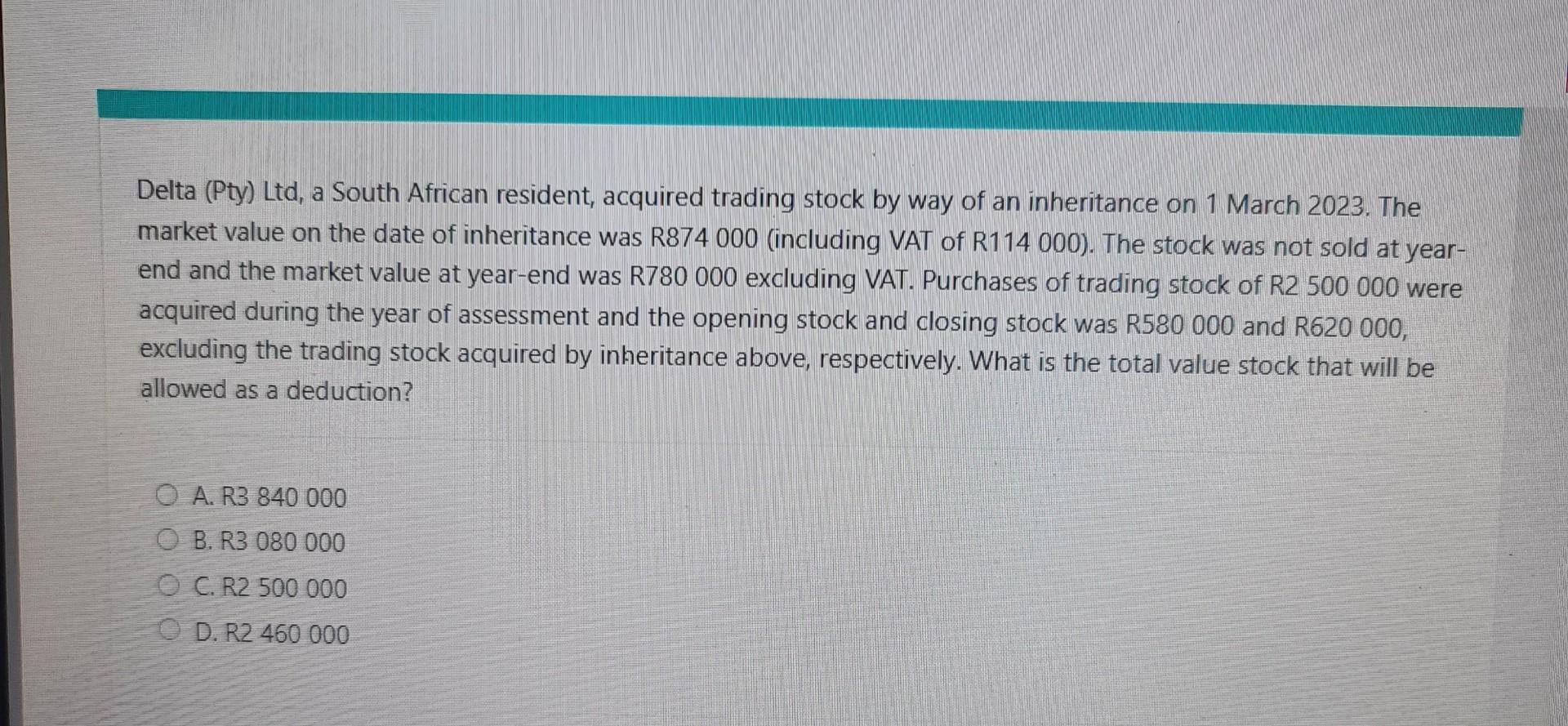

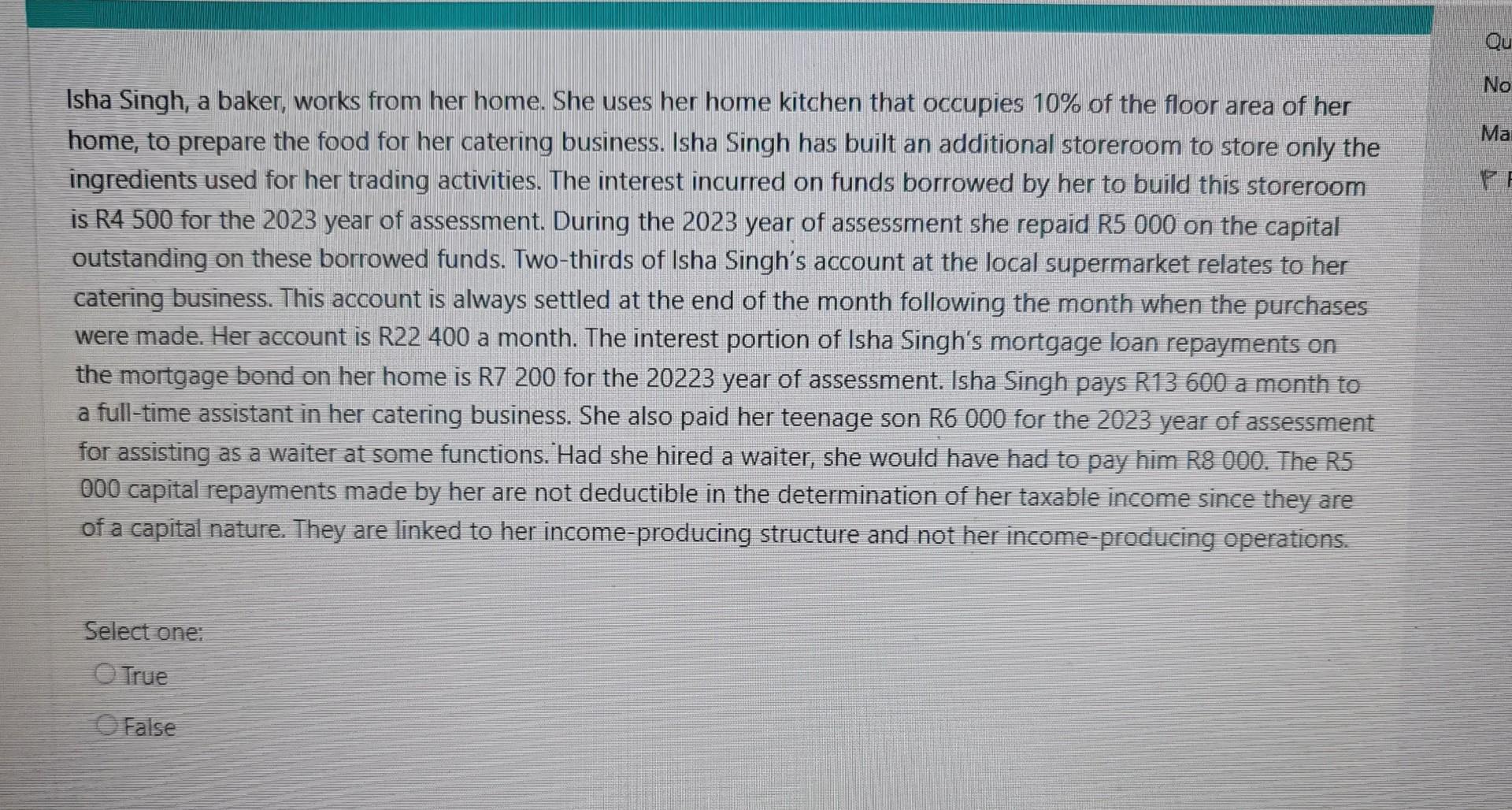

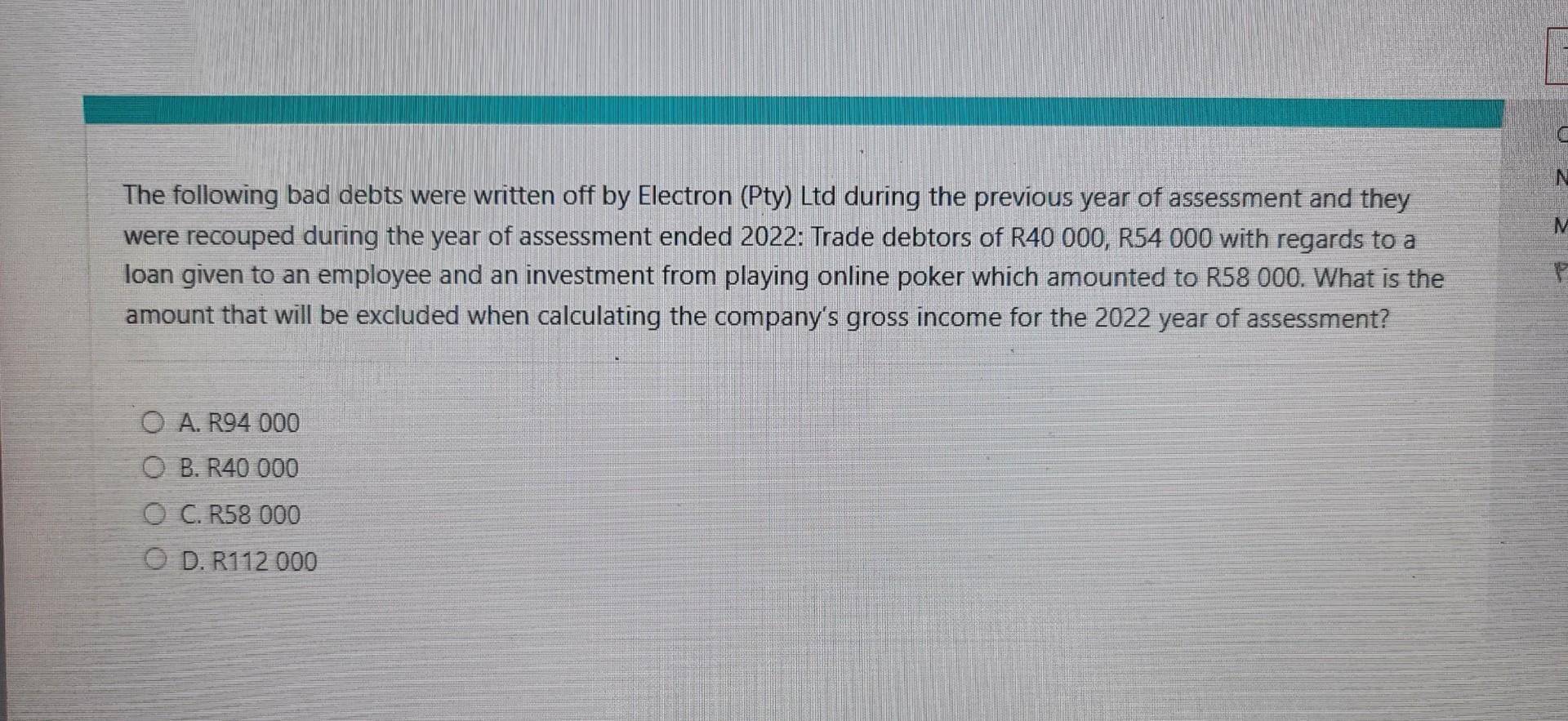

Grey's Sloan (Pty) Ltd paid the following legal expenses to attorneys for the 2022 year of assessment: - R5 450 of the fee was for debt collection. - R25 000 related to the drawing up of a restraint of trade agreement which was paid to an ex-employee. - R25 000 related to a dispute between the company's director and one of the employees due to sexist remarks made by the director. What amount will be deducted in terms of legal expenses when the company is computing their taxable income for the 2022 year of assessment? A. R30 450 B. R25 000 C. R5 450 D. R55 450 Syrup Lemon (Pty) Ltd lists of doubtful debts as at 31 March 2022 amounted to R69 000. The doubtful debt allowance allowed by the Commissioner for the 2021 year of assessment, amounted to R18 750. How much will the company be able to deduct in terms of the total doubtful debt allowance for the year of assessment ended 31 March 2022? A. R69000 B. R18 750 C. R17 250 D. R1 500 Delta (Pty) Ltd, a South African resident, acquired trading stock by way of an inheritance on 1March2023. The market value on the date of inheritance was R874 000 (including VAT of R114 000). The stock was not sold at yearend and the market value at year-end was R780 000 excluding VAT. Purchases of trading stock of R2 500000 were acquired during the year of assessment and the opening stock and closing stock was R580 000 and R620 000, excluding the trading stock acquired by inheritance above, respectively. What is the total value stock that will be allowed as a deduction? A. R3 840000 B. R3 080000 C. R2 500000 D. R2 460000 Isha Singh, a baker, works from her home. She uses her home kitchen that occupies 10% of the floor area of her home, to prepare the food for her catering business. Isha Singh has built an additional storeroom to store only the ingredients used for her trading activities. The interest incurred on funds borrowed by her to build this storeroom is R4 500 for the 2023 year of assessment. During the 2023 year of assessment she repaid R5 000 on the capital outstanding on these borrowed funds. Two-thirds of Isha Singh's account at the local supermarket relates to her catering business. This account is always settled at the end of the month following the month when the purchases were made. Her account is R22 400 a month. The interest portion of Isha Singh's mortgage loan repayments on the mortgage bond on her home is R 200 for the 20223 year of assessment. Isha Singh pays R13 600 a month to a full-time assistant in her catering business. She also paid her teenage son R6000 for the 2023 year of assessment for assisting as a waiter at some functions. Had she hired a waiter, she would have had to pay him R8 000. The R5 000 capital repayments made by her are not deductible in the determination of her taxable income since they are of a capital nature. They are linked to her income-producing structure and not her income-producing operations. Select one: True False The following bad debts were written off by Electron (Pty) Ltd during the previous year of assessment and they were recouped during the year of assessment ended 2022: Trade debtors of R40 000, R54 000 with regards to a loan given to an employee and an investment from playing online poker which amounted to R58 000 . What is the amount that will be excluded when calculating the company's gross income for the 2022 year of assessment? A. R94 000 B. R40 000 C. R58 000 D. R112000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started