Answered step by step

Verified Expert Solution

Question

1 Approved Answer

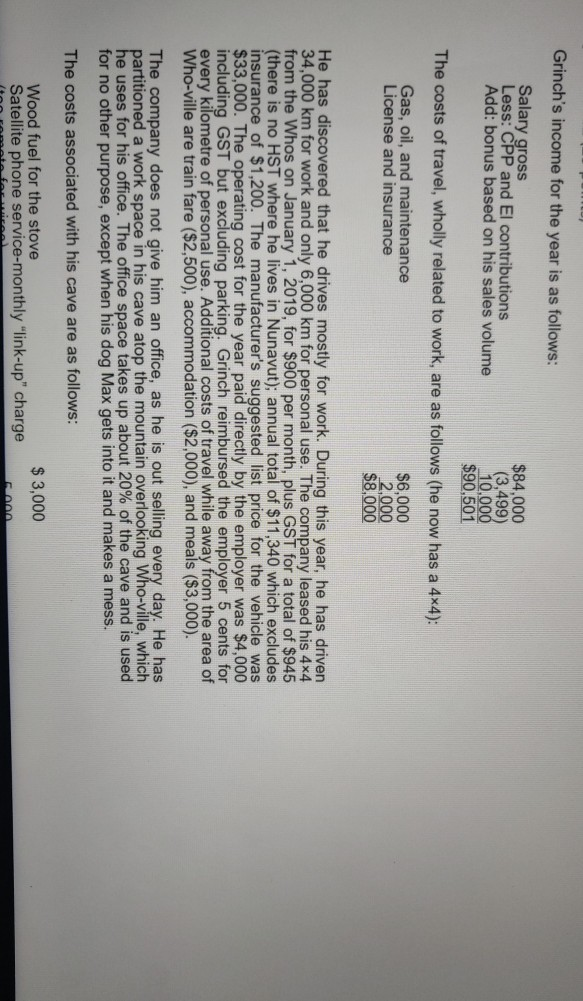

Grinch's income for the year is as follows: Salary gross $84.000 Less: CPP and El contributions (3,499) Add: bonus based on his sales volume 10.000

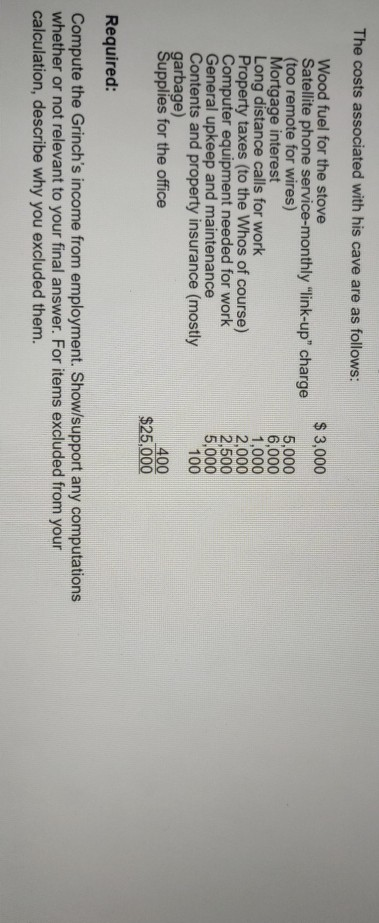

Grinch's income for the year is as follows: Salary gross $84.000 Less: CPP and El contributions (3,499) Add: bonus based on his sales volume 10.000 $90,501 The costs of travel, wholly related to work, are as follows (he now has a 4x4): Gas, oil, and maintenance $6,000 License and insurance 2,000 $8,000 He has discovered that he drives mostly for work. During this year, he has driven 34,000 km for work and only 6,000 km for personal use. The company leased his 4x4 from the Whos on January 1, 2019, for $900 per month, plus GST for a total of $945 (there is no HST where he lives in Nunavut); annual total of $11,340 which excludes insurance of $1,200. The manufacturer's suggested list price for the vehicle was $33,000. The operating cost for the year paid directly by the employer was $4,000 including GST but excluding parking. Grinch reimbursed the employer 5 cents for every kilometre of personal use. Additional costs of travel while away from the area of Who-ville are train fare ($2,500), accommodation ($2,000), and meals ($3,000). The company does not give him an office, as he is out selling every day. He has partitioned a work space in his cave atop the mountain overlooking Who-ville, which he uses for his office. The office space takes up about 20% of the cave and is used for no other purpose, except when his dog Max gets into it and makes a mess. The costs associated with his cave are as follows: $ 3,000 Wood fuel for the stove Satellite phone service-monthly "link-up" charge The costs associated with his cave are as follows: $ 3,000 Wood fuel for the stove Satellite phone service-monthly "link-up" charge (too remote for wires) Mortgage interest Long distance calls for work Property taxes (to the Whos of course) Computer equipment needed for work General upkeep and maintenance Contents and property insurance (mostly garbage) Supplies for the office 5.000 6,000 1,000 2,000 2,500 5,000 100 400 $25,000 Required: Compute the Grinch's income from employment. Show/support any computations whether or not relevant to your final answer. For items excluded from your calculation, describe why you excluded them. Grinch's income for the year is as follows: Salary gross $84.000 Less: CPP and El contributions (3,499) Add: bonus based on his sales volume 10.000 $90,501 The costs of travel, wholly related to work, are as follows (he now has a 4x4): Gas, oil, and maintenance $6,000 License and insurance 2,000 $8,000 He has discovered that he drives mostly for work. During this year, he has driven 34,000 km for work and only 6,000 km for personal use. The company leased his 4x4 from the Whos on January 1, 2019, for $900 per month, plus GST for a total of $945 (there is no HST where he lives in Nunavut); annual total of $11,340 which excludes insurance of $1,200. The manufacturer's suggested list price for the vehicle was $33,000. The operating cost for the year paid directly by the employer was $4,000 including GST but excluding parking. Grinch reimbursed the employer 5 cents for every kilometre of personal use. Additional costs of travel while away from the area of Who-ville are train fare ($2,500), accommodation ($2,000), and meals ($3,000). The company does not give him an office, as he is out selling every day. He has partitioned a work space in his cave atop the mountain overlooking Who-ville, which he uses for his office. The office space takes up about 20% of the cave and is used for no other purpose, except when his dog Max gets into it and makes a mess. The costs associated with his cave are as follows: $ 3,000 Wood fuel for the stove Satellite phone service-monthly "link-up" charge The costs associated with his cave are as follows: $ 3,000 Wood fuel for the stove Satellite phone service-monthly "link-up" charge (too remote for wires) Mortgage interest Long distance calls for work Property taxes (to the Whos of course) Computer equipment needed for work General upkeep and maintenance Contents and property insurance (mostly garbage) Supplies for the office 5.000 6,000 1,000 2,000 2,500 5,000 100 400 $25,000 Required: Compute the Grinch's income from employment. Show/support any computations whether or not relevant to your final answer. For items excluded from your calculation, describe why you excluded them

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started