Answered step by step

Verified Expert Solution

Question

1 Approved Answer

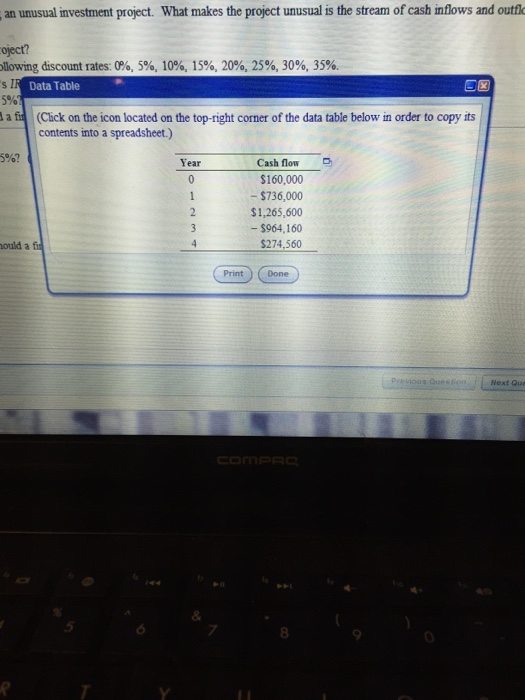

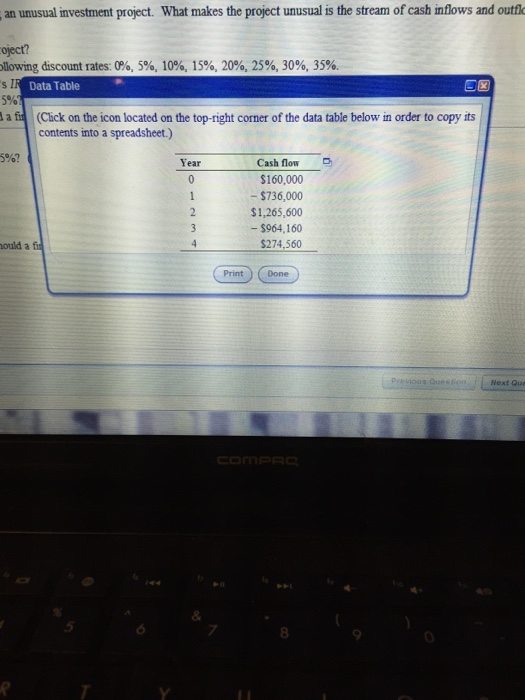

Groove enterprises is evaluating an Unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following

Groove enterprises is evaluating an Unusual investment project. What makes the project unusual is the stream of cash inflows and outflows shown in the following table ( see below)

an unusual investment project. What makes the project unusual is the stream of cash inflows and outfl oject? lowing discount rates:0%, 5%, 10%, 15%, 20%, 25%, 30%, 35% sIR Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) a f 5%? Cash flow $160,000 -$736,000 $1,265,600 - $964,160 $274,560 Year ould a f Prin@ne Print) Done Previous Quesien Next Que 8 1) why is it difficult to calculate the payback period for this project?

A) it is unreal for project to have a cash inflow as an initial investment

B) the short life of the project makes it difficult to compute the paybCk period

C) the oscillating cash flows make it difficult to compute the payback period

D) the huge Amt of cash outflow on year 3 makes the calculation difficult

Round # 2 to two decimal places

2) if the discount rate is 0% the investments NPV is ..

3) if the discount rate is 5%......,,,

4) if discount rate is 10%....

5) if discount rate is 15%.....

6) if discount rate is 20%.....

7) if discount rate is 25%.....

8) if discount rate is 30%...

9) if discount rate is 35%.....

10) what do your answers to question 1 and 2 tell you about the projects IRR

A) there are infinite IRRs for this project

B) there are multiple IRR'S

C) there is no IRR for such cash flows

D) there is only one ITR for this project

11) should froogle invest in this project if it's cost of capitals is 5%?

12)should froogle invest in this project of its cost of capital is 15%?

13) in general when faced with a project like this how should a firm decide whether to invest int he project or reject it?

A) it is best to use the payback period method?

B) it is best to use the NPV method

C) it is best to use the IRR method

D) none of these methods is suitable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started