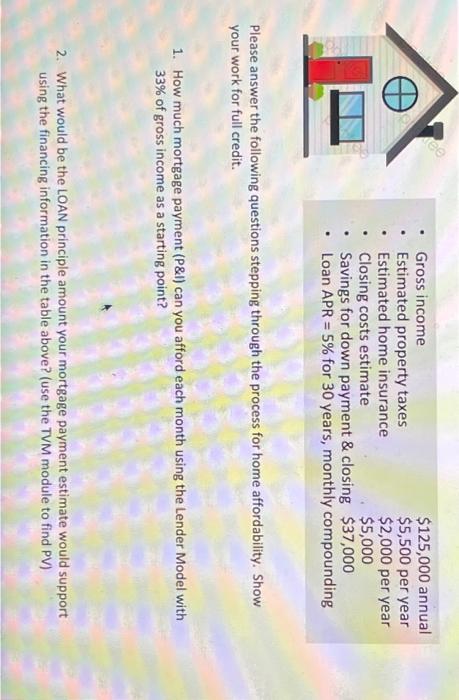

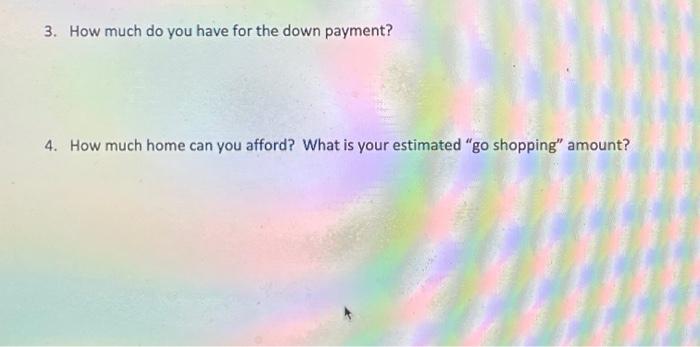

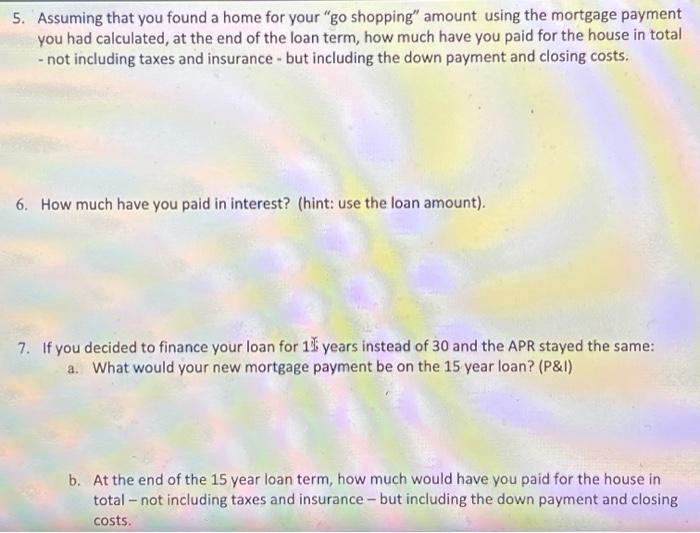

. . . Gross income $125,000 annual Estimated property taxes $5,500 per year Estimated home insurance $2,000 per year Closing costs estimate $5,000 Savings for down payment & closing $37,000 Loan APR = 5% for 30 years, monthly compounding . Please answer the following questions stepping through the process for home affordability. Show your work for full credit. 1. How much mortgage payment (P&I) can you afford each month using the Lender Model with 33% of gross income as a starting point? 2. What would be the LOAN principle amount your mortgage payment estimate would support using the financing information in the table above? (use the TVM module to find PV) 3. How much do you have for the down payment? 4. How much home can you afford? What is your estimated "go shopping" amount? 5. Assuming that you found a home for your "go shopping" amount using the mortgage payment you had calculated, at the end of the loan term, how much have you paid for the house in total - not including taxes and insurance - but including the down payment and closing costs. 6. How much have you paid in interest? (hint: use the loan amount). 7. If you decided to finance your loan for 18 years instead of 30 and the APR stayed the same: a. What would your new mortgage payment be on the 15 year loan? (P&I) b. At the end of the 15 year loan term, how much would have you paid for the house in total - not including taxes and insurance - but including the down payment and closing costs. 8. If your home appreciated in value by 3% each year, what would the value be at the end of the 30 year loan term? (hint: use the price paid as PV). . . . Gross income $125,000 annual Estimated property taxes $5,500 per year Estimated home insurance $2,000 per year Closing costs estimate $5,000 Savings for down payment & closing $37,000 Loan APR = 5% for 30 years, monthly compounding . Please answer the following questions stepping through the process for home affordability. Show your work for full credit. 1. How much mortgage payment (P&I) can you afford each month using the Lender Model with 33% of gross income as a starting point? 2. What would be the LOAN principle amount your mortgage payment estimate would support using the financing information in the table above? (use the TVM module to find PV) 3. How much do you have for the down payment? 4. How much home can you afford? What is your estimated "go shopping" amount? 5. Assuming that you found a home for your "go shopping" amount using the mortgage payment you had calculated, at the end of the loan term, how much have you paid for the house in total - not including taxes and insurance - but including the down payment and closing costs. 6. How much have you paid in interest? (hint: use the loan amount). 7. If you decided to finance your loan for 18 years instead of 30 and the APR stayed the same: a. What would your new mortgage payment be on the 15 year loan? (P&I) b. At the end of the 15 year loan term, how much would have you paid for the house in total - not including taxes and insurance - but including the down payment and closing costs. 8. If your home appreciated in value by 3% each year, what would the value be at the end of the 30 year loan term? (hint: use the price paid as PV)