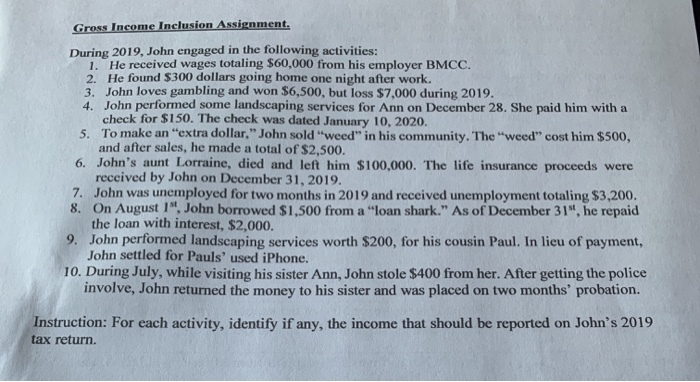

Gross Income Inclusion Assignment. During 2019, John engaged in the following activities: 1. He received wages totaling $60,000 from his employer BMCC. 2. He found $300 dollars going home one night after work. 3. John loves gambling and won $6,500, but loss $7,000 during 2019. 4. John performed some landscaping services for Ann on December 28. She paid him with a check for $150. The check was dated January 10, 2020. 5. To make an extra dollar," John sold "weed" in his community. The "weed" cost him $500, and after sales, he made a total of $2,500. 6. John's aunt Lorraine, died and left him $100,000. The life insurance proceeds were received by John on December 31, 2019. 7. John was unemployed for two months in 2019 and received unemployment totaling $3,200. 8. On August 1", John borrowed $1,500 from a "loan shark." As of December 31", he repaid the loan with interest, $2,000. 9. John performed landscaping services worth $200, for his cousin Paul. In lieu of payment, John settled for Pauls' used iPhone. 10. During July, while visiting his sister Ann, John stole $400 from her. After getting the police involve, John returned the money to his sister and was placed on two months' probation. Instruction: For each activity, identify if any, the income that should be reported on John's 2019 tax return. Gross Income Inclusion Assignment. During 2019, John engaged in the following activities: 1. He received wages totaling $60,000 from his employer BMCC. 2. He found $300 dollars going home one night after work. 3. John loves gambling and won $6,500, but loss $7,000 during 2019. 4. John performed some landscaping services for Ann on December 28. She paid him with a check for $150. The check was dated January 10, 2020. 5. To make an extra dollar," John sold "weed" in his community. The "weed" cost him $500, and after sales, he made a total of $2,500. 6. John's aunt Lorraine, died and left him $100,000. The life insurance proceeds were received by John on December 31, 2019. 7. John was unemployed for two months in 2019 and received unemployment totaling $3,200. 8. On August 1", John borrowed $1,500 from a "loan shark." As of December 31", he repaid the loan with interest, $2,000. 9. John performed landscaping services worth $200, for his cousin Paul. In lieu of payment, John settled for Pauls' used iPhone. 10. During July, while visiting his sister Ann, John stole $400 from her. After getting the police involve, John returned the money to his sister and was placed on two months' probation. Instruction: For each activity, identify if any, the income that should be reported on John's 2019 tax return