Question

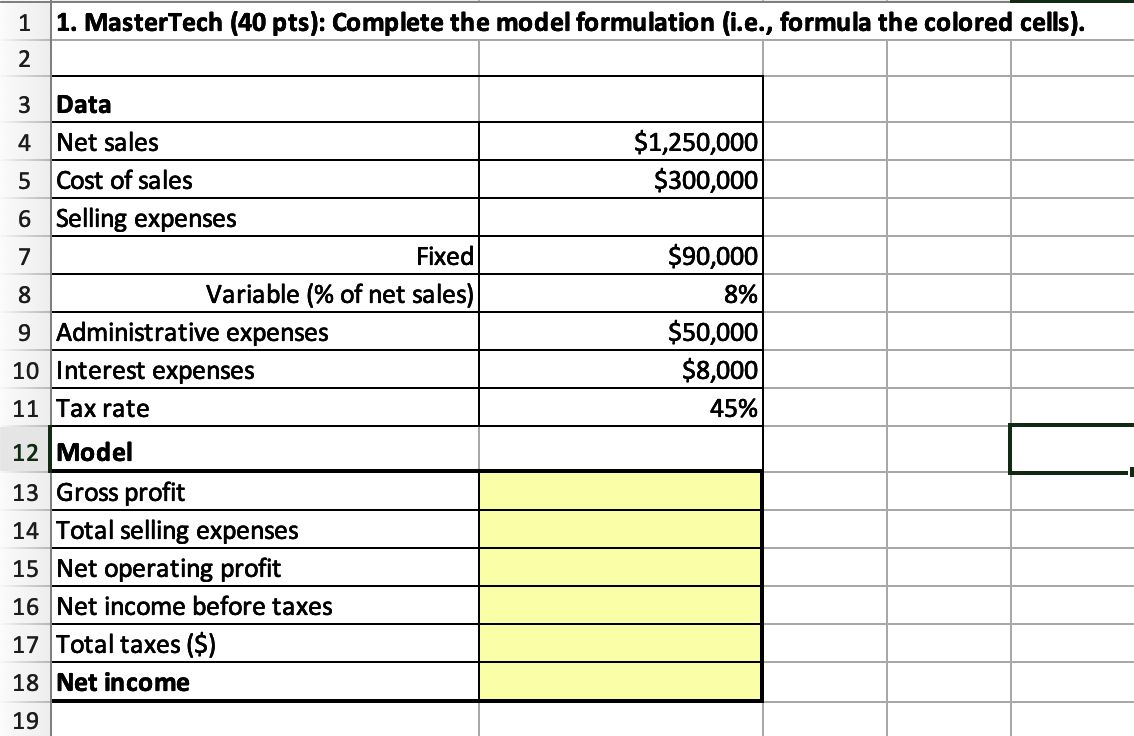

Gross profit = Net sales Cost of sales Net operating profit = Gross profit - Total selling expenses - Administrative expenses Net income before taxes

Gross profit = Net sales Cost of sales

Net operating profit = Gross profit - Total selling expenses - Administrative expenses

Net income before taxes = Net operating profit Interest expenses

Net income = Net income before taxes Taxes

Net sales are expected to be $1,250,000. The cost of sales is estimated to be $300,000. Selling expenses have a fixed component estimated to be $90,000 and a variable component estimated to be 8% of net sales. Administrative fees and interest expenses are $50,000 and $8,000, respectively. The company is taxed at a 50% rate.

Develop a spreadsheet model to calculate the net income. Design your spreadsheet model using sound spreadsheet engineering principles

\begin{tabular}{|c|l|r|} \hline 1 & 1. MasterTech (40 pts): Complete the model formulation (i.e., \\ \hline 2 & & \\ \hline 3 & Data & \\ \hline 4 & Net sales & $1,250,000 \\ \hline 5 & Cost of sales & $300,000 \\ \hline 6 & Selling expenses & \\ \hline 7 & \multicolumn{1}{|c|}{ Variable (\% of net sales) } & \\ \hline 8 & \multicolumn{1}{|c|}{$90,000} \\ \hline 9 & Administrative expenses & 8% \\ \hline 10 & Interest expenses & $50,000 \\ \hline 11 & Tax rate & $8,000 \\ \hline 12 & Model & 45% \\ \hline 13 & Gross profit & \\ \hline 14 & Total selling expenses & \\ \hline 15 & Net operating profit & \\ \hline 16 & Net income before taxes & \\ \hline 17 & Total taxes (\$) & \\ \hline 18 & Net income & \\ \hline 19 & & \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started