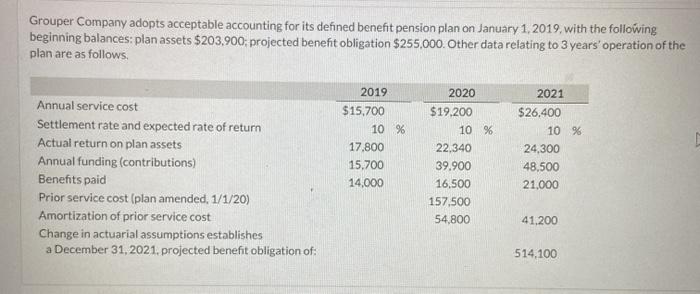

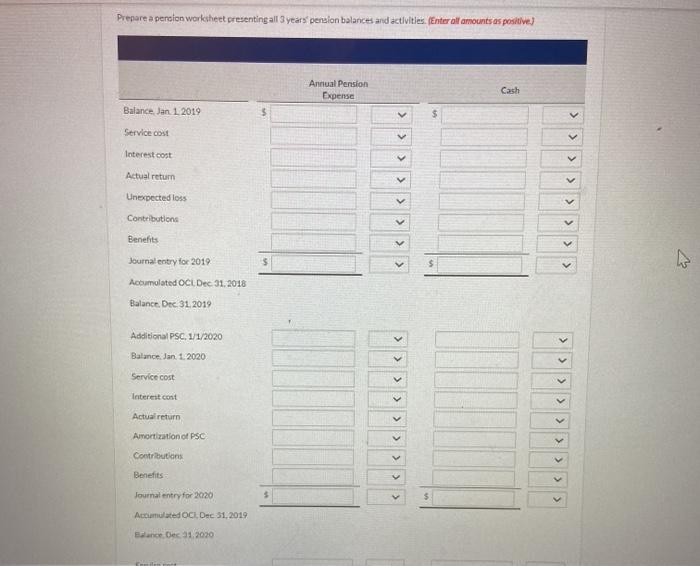

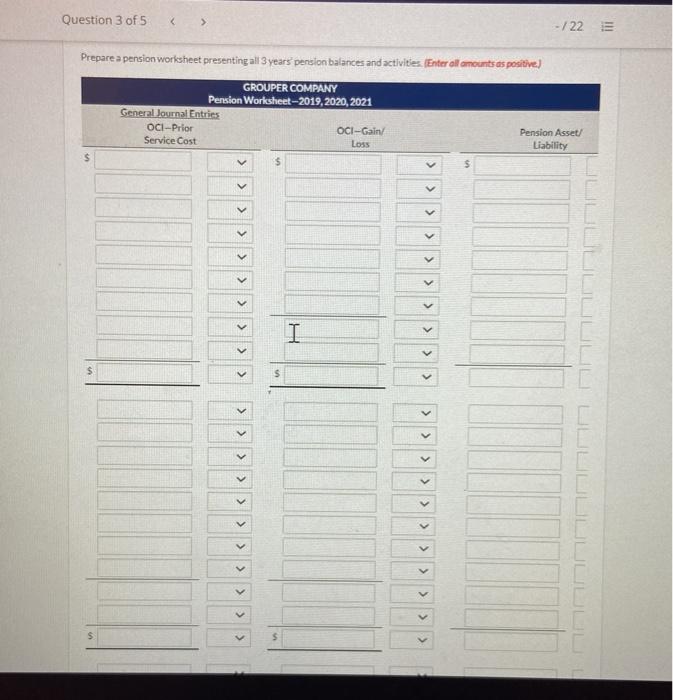

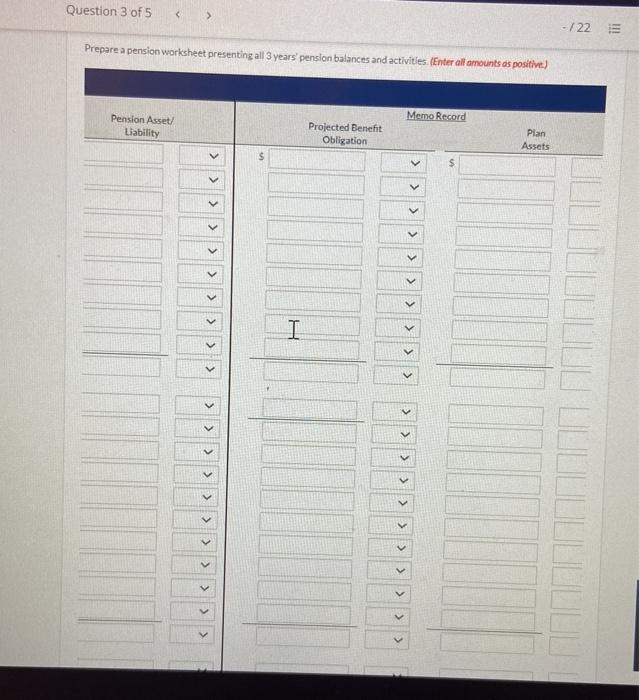

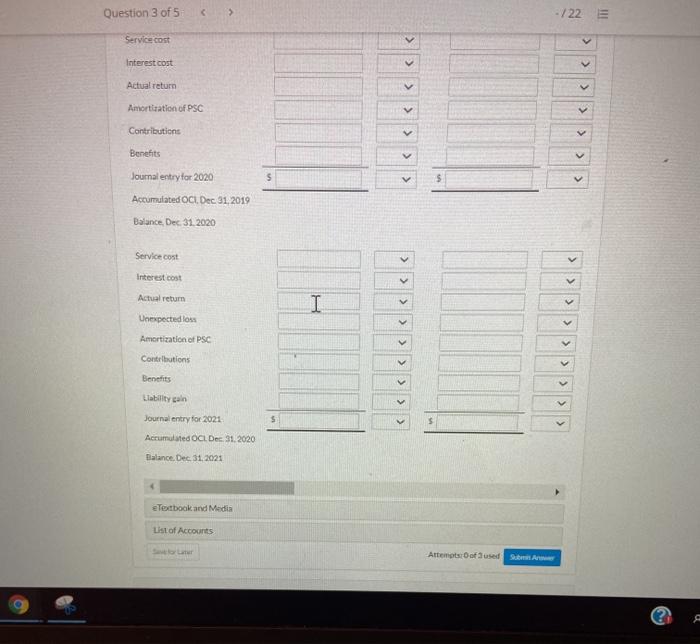

Grouper Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $203,900; projected benefit obligation $255,000. Other data relating to 3 years' operation of the plan are as follows Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/20) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2021. projected benefit obligation of: 2019 $15.700 10 % 17.800 15.700 14,000 2020 $19.200 10 % 22.340 39.900 16,500 157.500 54,800 2021 $26,400 10 % 24,300 48.500 21,000 41.200 514,100 Prepare a pension worksheet presenting all 3 years' pension balances and activities (Enterall amounts as positive) Annual Pension Expense Cash Balance, Jan 1 2019 > > Service cost > Actual return > Contributions Balance, Jan. 1. 2020 Service cost > > Interest cont > > > Benefits Journal entry for 2020 > Accumulated OCI. Dec 31, 2019 Elance Dec 31, 2020 Question 3 of 5 -122 Prepare a pension worksheet presenting all 3 years pension balances and activities (Enter all amounts as positive) GROUPER COMPANY Pension Worksheet-2019, 2020 2021 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Pension Asset/ Liability $ > > > > > > > I > > > > S > > Question 3 of 5 -/22 in Prepare a pension worksheet presenting all 3 years pension balances and activities. (Enter all amounts os positive.) Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets > > > > > > I > > > > > > > > > > Question 3 of 5 > -722 Service cost > Interest cost > Actual return > Amortization of PSC > Benefits > Journal entry for 2020 v V Accumulated OCI, Dec 31, 2019 Balance Dec 31, 2020 Service cost > Interest cost > Actual retum I > Unexpected low > > Amortization of PSC >> Contributions > Benefits > Llability calin > Journal entry for 2021 $ Acumulated OCL Dec 31, 2020 Balance, Dec 31, 2021 eTextbook and Media List of Accounts Attempts of used Grouper Company adopts acceptable accounting for its defined benefit pension plan on January 1, 2019, with the following beginning balances: plan assets $203,900; projected benefit obligation $255,000. Other data relating to 3 years' operation of the plan are as follows Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/20) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2021. projected benefit obligation of: 2019 $15.700 10 % 17.800 15.700 14,000 2020 $19.200 10 % 22.340 39.900 16,500 157.500 54,800 2021 $26,400 10 % 24,300 48.500 21,000 41.200 514,100 Prepare a pension worksheet presenting all 3 years' pension balances and activities (Enterall amounts as positive) Annual Pension Expense Cash Balance, Jan 1 2019 > > Service cost > Actual return > Contributions Balance, Jan. 1. 2020 Service cost > > Interest cont > > > Benefits Journal entry for 2020 > Accumulated OCI. Dec 31, 2019 Elance Dec 31, 2020 Question 3 of 5 -122 Prepare a pension worksheet presenting all 3 years pension balances and activities (Enter all amounts as positive) GROUPER COMPANY Pension Worksheet-2019, 2020 2021 General Journal Entries OCI-Prior OCI-Gain/ Service Cost Loss Pension Asset/ Liability $ > > > > > > > I > > > > S > > Question 3 of 5 -/22 in Prepare a pension worksheet presenting all 3 years pension balances and activities. (Enter all amounts os positive.) Memo Record Pension Asset/ Liability Projected Benefit Obligation Plan Assets > > > > > > I > > > > > > > > > > Question 3 of 5 > -722 Service cost > Interest cost > Actual return > Amortization of PSC > Benefits > Journal entry for 2020 v V Accumulated OCI, Dec 31, 2019 Balance Dec 31, 2020 Service cost > Interest cost > Actual retum I > Unexpected low > > Amortization of PSC >> Contributions > Benefits > Llability calin > Journal entry for 2021 $ Acumulated OCL Dec 31, 2020 Balance, Dec 31, 2021 eTextbook and Media List of Accounts Attempts of used