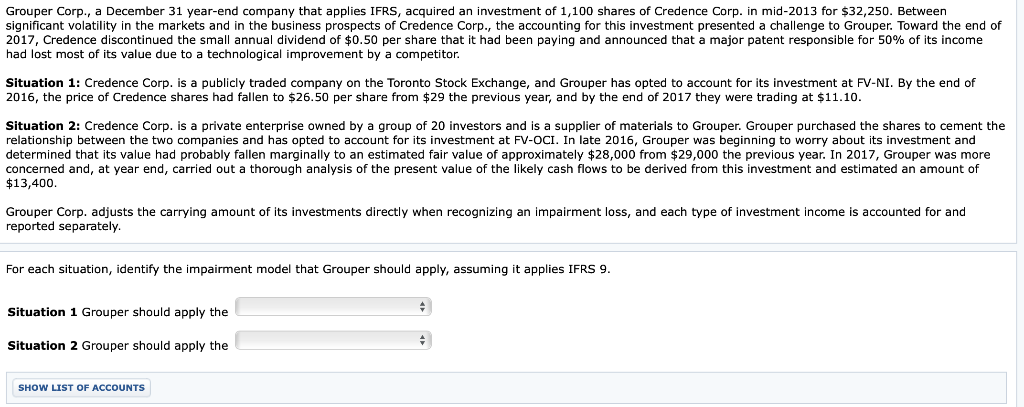

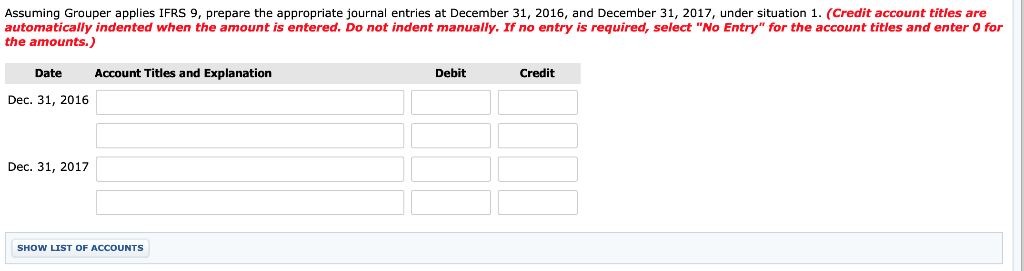

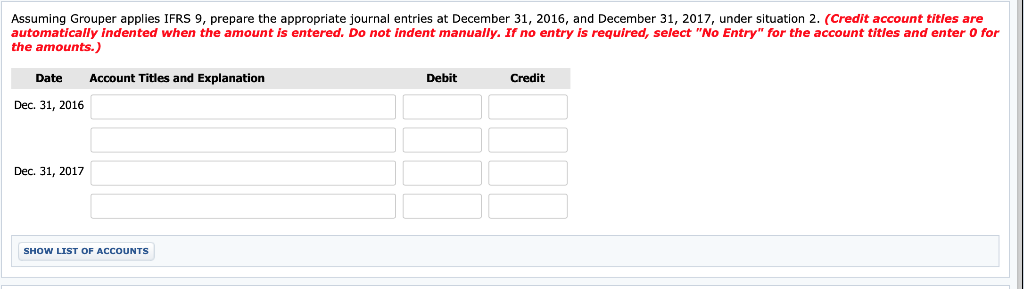

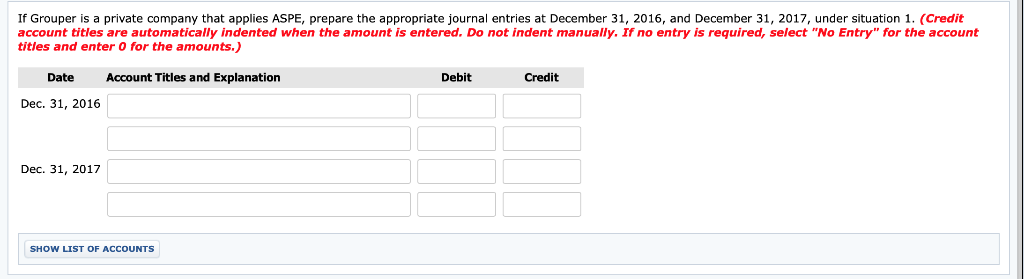

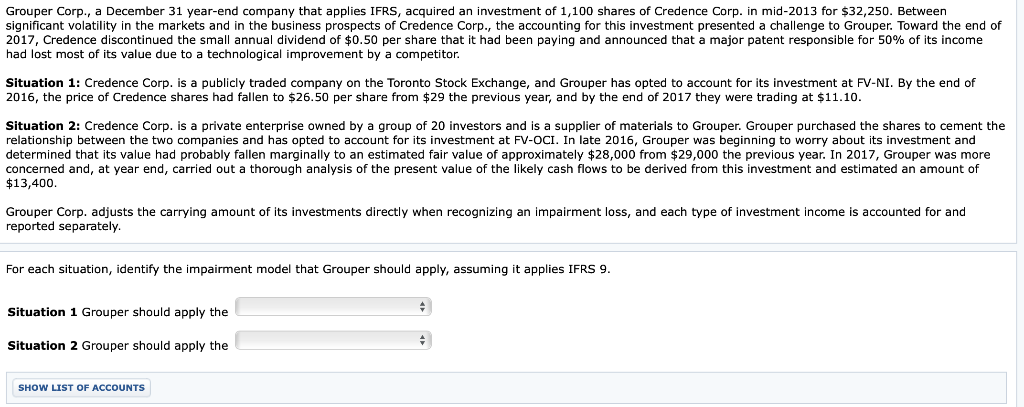

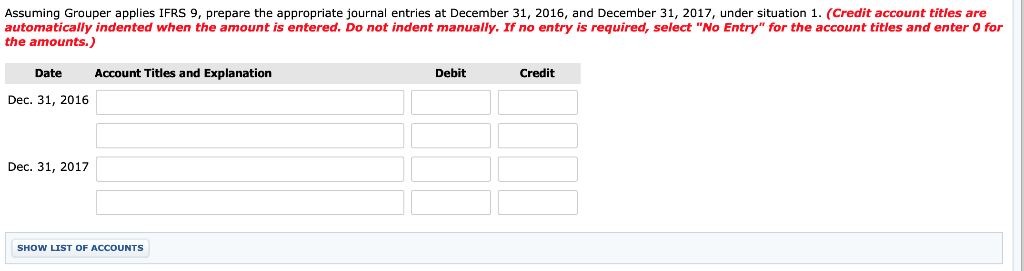

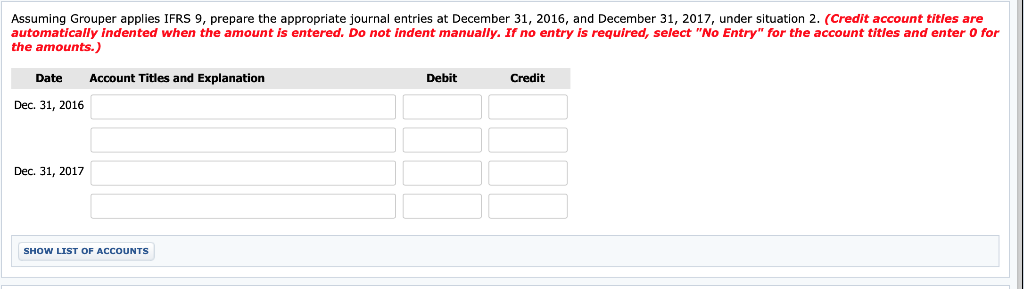

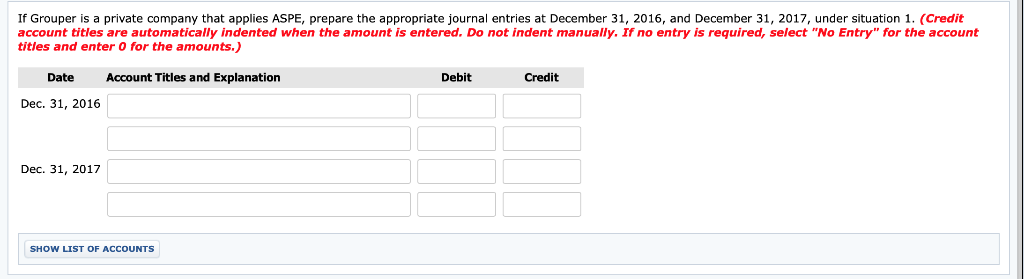

Grouper Corp., a December 31 year-end company that applies IFRS, acquired an investment of 1,100 shares of Credence Corp. in mid-2013 for $32,250. Between significant volatility in the markets and in the business prospects of Credence Corp., the accounting for this investment presented a challenge to Grouper. Toward the end of 2017, Credence discontinued the small annual dividend of $0.50 per share that it had been paying and announced that a major patent responsible for 50% of its income had lost most of its value due to a technological improvement by a competitor Situation 1: Credence Corp. is a publicly traded company on the Toronto Stock Exchange, and Grouper has opted to account for its investment at FV-NI. By the end of 2016, the price of Credence shares had fallen to $26.50 per share from 29 the previous year, and by the end of 2017 they were trading at $11.10 Situation 2: Credence Corp. is a private enterprise owned by a group of 20 investors and is a supplier of materials to Grouper. Grouper purchased the shares to cement the relationship between the two companies and has opted to account for its investment at FV-oCI. In late 2016, Grouper was beginning to worry about its investment and determined that its value had probably fallen marginally to an estimated fair value of approximately $28,000 from $29,000 the previous year. In 2017, Grouper was more concerned and, at year end, carried out a thorough analysis of the present value of the likely cash flows to be derived from this investment and estimated an amount of $13,400 Grouper Corp. adjusts the carrying amount of its investments directly when recognizing an impairment loss, and each type of investment income is accounted for and reported separately. For each situation, identify the impairment model that Grouper should apply, assuming it applies IFRS 9 Situation 1 Grouper should apply the Situation 2 Grouper should apply the SHOW LIST OF ACCOUNTS Assuming Grouper applies IFRS 9, prepare the appropriate journal entries at December 31, 2016, and December 31, 2017, under situation 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2016 Dec. 31, 2017 SHOW LIST OF ACCOUNTS Assuming Grouper applies IFRS 9, prepare the appropriate journal entries at December 31, 2016, and December 31, 2017, under situation 2. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2016 Dec. 31, 2017 SHOW LIST OF ACCOUNTS If Grouper is a private company that applies ASPE, prepare the appropriate journal entries at December 31, 2016, and December 31, 2017, under situation 1. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is reguired, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2016 Dec. 31, 2017 SHOW LIST OF ACCOUNTS