Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Grouper Corporation purchased the net assets of Carla Vista Corporation on January 2, 2020 for $610,400 and also paid $ 21,800 in direct acquisition

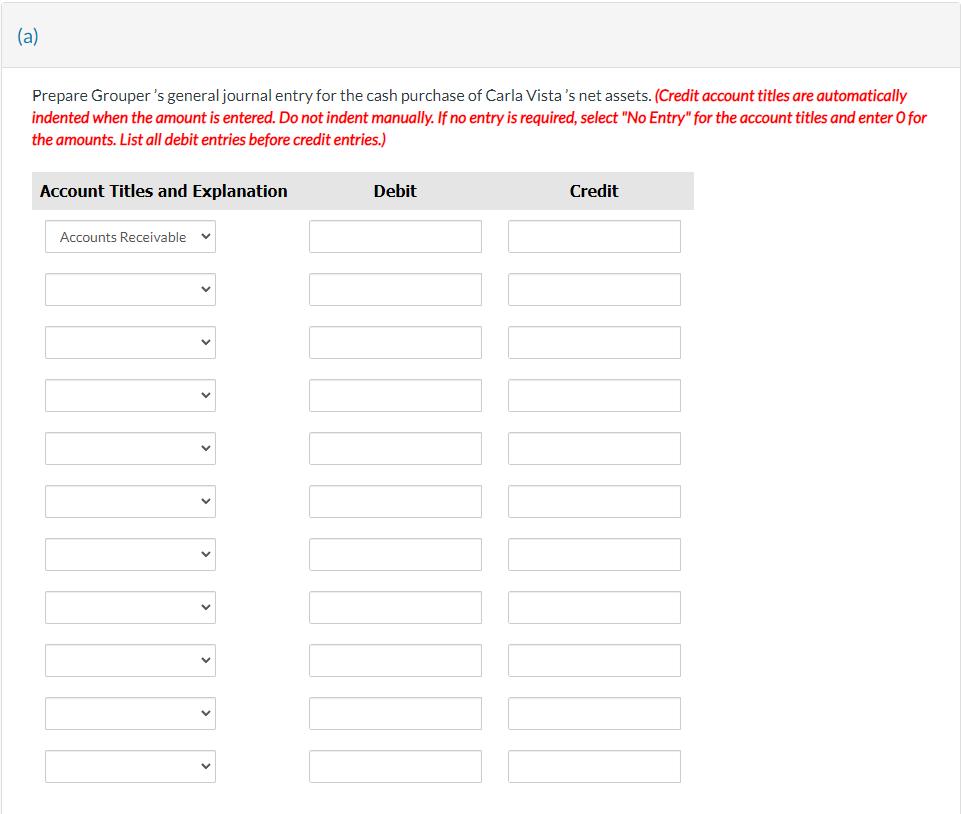

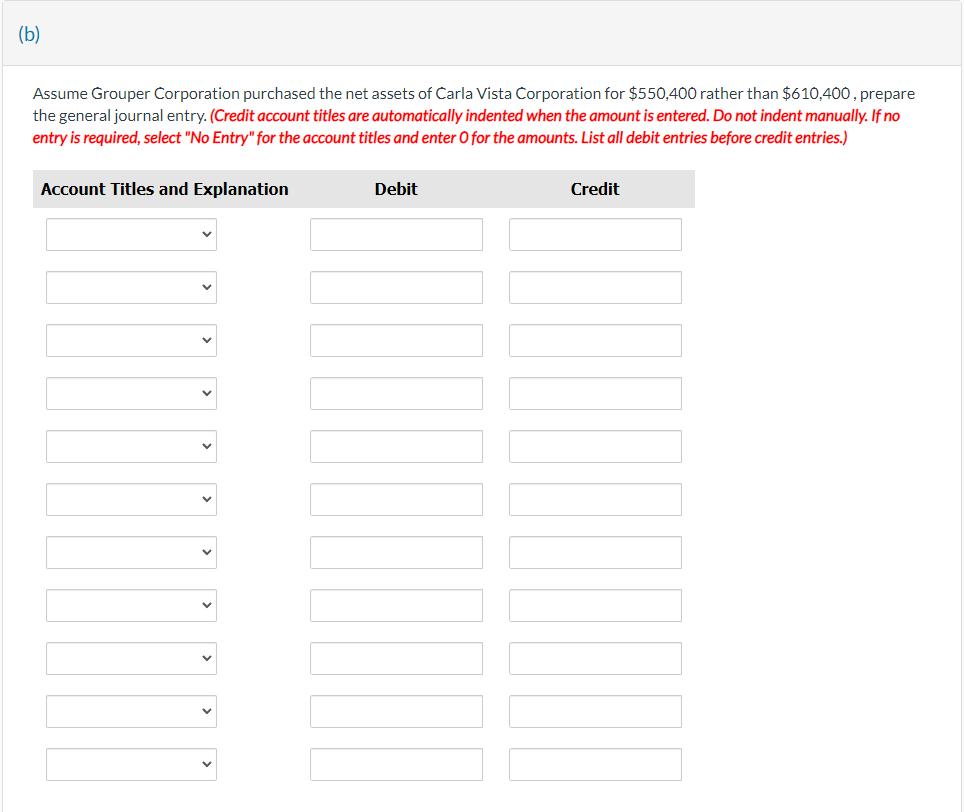

Grouper Corporation purchased the net assets of Carla Vista Corporation on January 2, 2020 for $610,400 and also paid $ 21,800 in direct acquisition costs. Carla Vista's balance sheet on January 1, 2020 was as follows: Accounts receivable-net Inventory Land Building-net Equipment-net Total assets $196,200 392.400 43,600 65,400 87,200 $784,800 Current liabilities Long term debt Common stock ($1 par) Paid-in capital Retained earnings Total liab. & equity $76,300 174,400 21,800 468,700 43,600 $784,800 Fair values agree with book values except for inventory, land, and equipment, which have fair values of $ 432,400, $ 53,600 and $ 77,200, respectively. Carla Vista has patent rights valued at $ 21,800.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a General Journal Entry for the Cash Purchase of Carla Vistas Net Assets Account Titles and Explanat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started