Question

Guadalajara & Blings is a firm that makes Mexican food and princess tiaras. It is a competitor of the firm in the previous problem, so

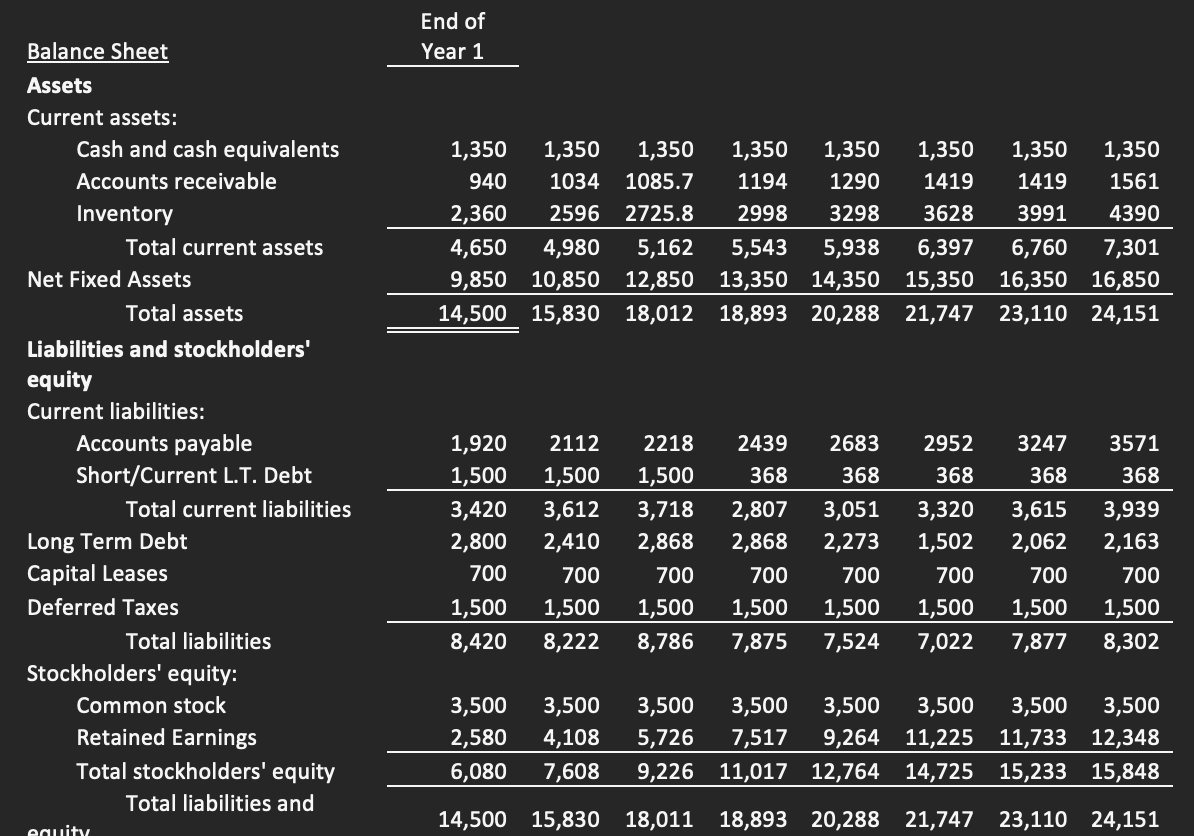

Guadalajara & Blings is a firm that makes Mexican food and princess tiaras. It is a competitor of the firm in the previous problem, so it will have the same cost of capital and the same long-term growth rate (in fact, your keen analysis should notice something fishy its balance sheet looks very similar to its competitor). For the sake of simplicity, we will also assume that it has the same cost of equity (although in reality, this will not be the case if it has a different debt ratio). This firm has 500,000 shares of stock outstanding. The accounting statement is in thousands of dollars on the following pages. Assuming that the projections are correct and that there are no asset sales other than those at book value, compute the stock price per share using:

a) the WACC/FCF method

b) the Flow-to-Equity method

Guadalajara & Blings Financial Statement Projections:

| Income Statement | Year 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| Total Revenue | 17,300 | 19,030 | 19,982 | 21,980 | 23,738 | 26,112 | 26,112 | 28,723 |

| Cost of Goods Sold | 7,000 | 7,700 | 8,085 | 8,894 | 9,783 | 10,761 | 11,837 | 13,021 |

| SG & A | 3,600 | 3,960 | 3,960 | 4,356 | 4,574 | 5,031 | 5,534 | 6,088 |

| Depreciation | 3,250 | 3,575 | 3,933 | 4,326 | 4,758 | 5,234 | 5,758 | 6,333 |

| Earnings Before Interest and Taxes (EBIT) | 3,450 | 3,795 | 4,004 | 4,404 | 4,623 | 5,085 | 2,983 | 3,281 |

| Interest Expense | 680 | 690 | 700 | 710 | 720 | 730 | 740 | 750 |

| Taxable Income | 2,770 | 3,105 | 3,304 | 3,694 | 3,903 | 4,355 | 2,243 | 2,531 |

| Tax Expense | 969.5 | 1087 | 1156 | 1293 | 1366 | 1524 | 785 | 886 |

| Net Income (Loss) | 1,801 | 2,018 | 2,148 | 2,401 | 2,537 | 2,831 | 1,458 | 1,645 |

| Dividends Paid | 450 | 490 | 530 | 610 | 790 | 870 | 950 | 1030 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started