Answered step by step

Verified Expert Solution

Question

1 Approved Answer

GUARANTEED LIKE - if you solve this!! f) To help expand operations, Led borrowed $250,000 on January 1 in exchange for a 5-year note payable

GUARANTEED LIKE - if you solve this!!

f) To help expand operations, Led borrowed $250,000 on January 1 in exchange for a 5-year note payable with an annual interest rate of 5%. Led agreed to make equal principal repayments of $50,000 annually until the loan is paid off on December 31, 2026. Principal and interest payments are due annually on December 31, beginning in 2022. It is now December 31, 2022 and nothing is recorded in Leds books related to the note.

PLEASE HELP THANK YOU BLESS YOUR SOUL

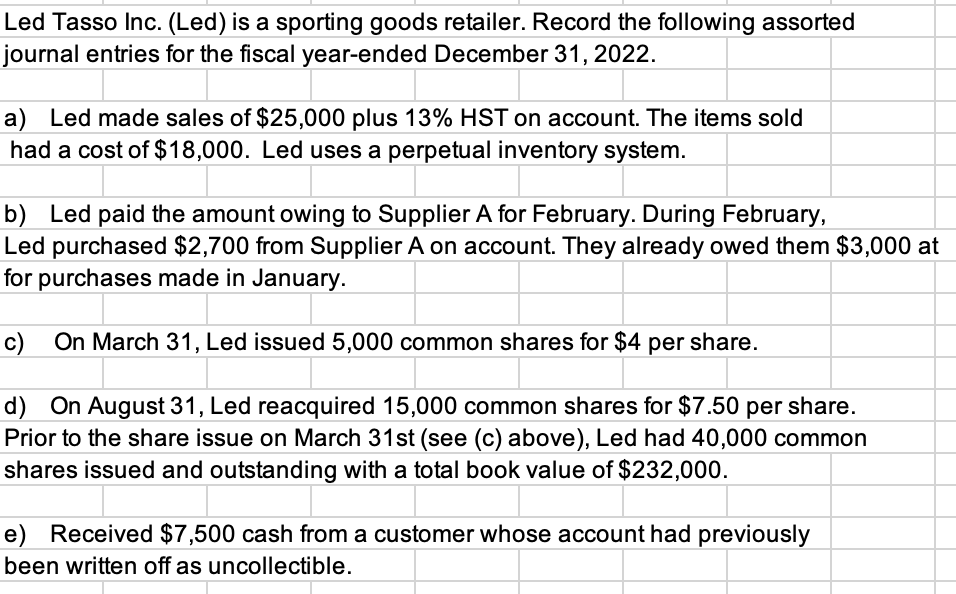

based on the information attached in the photo:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started