Answered step by step

Verified Expert Solution

Question

1 Approved Answer

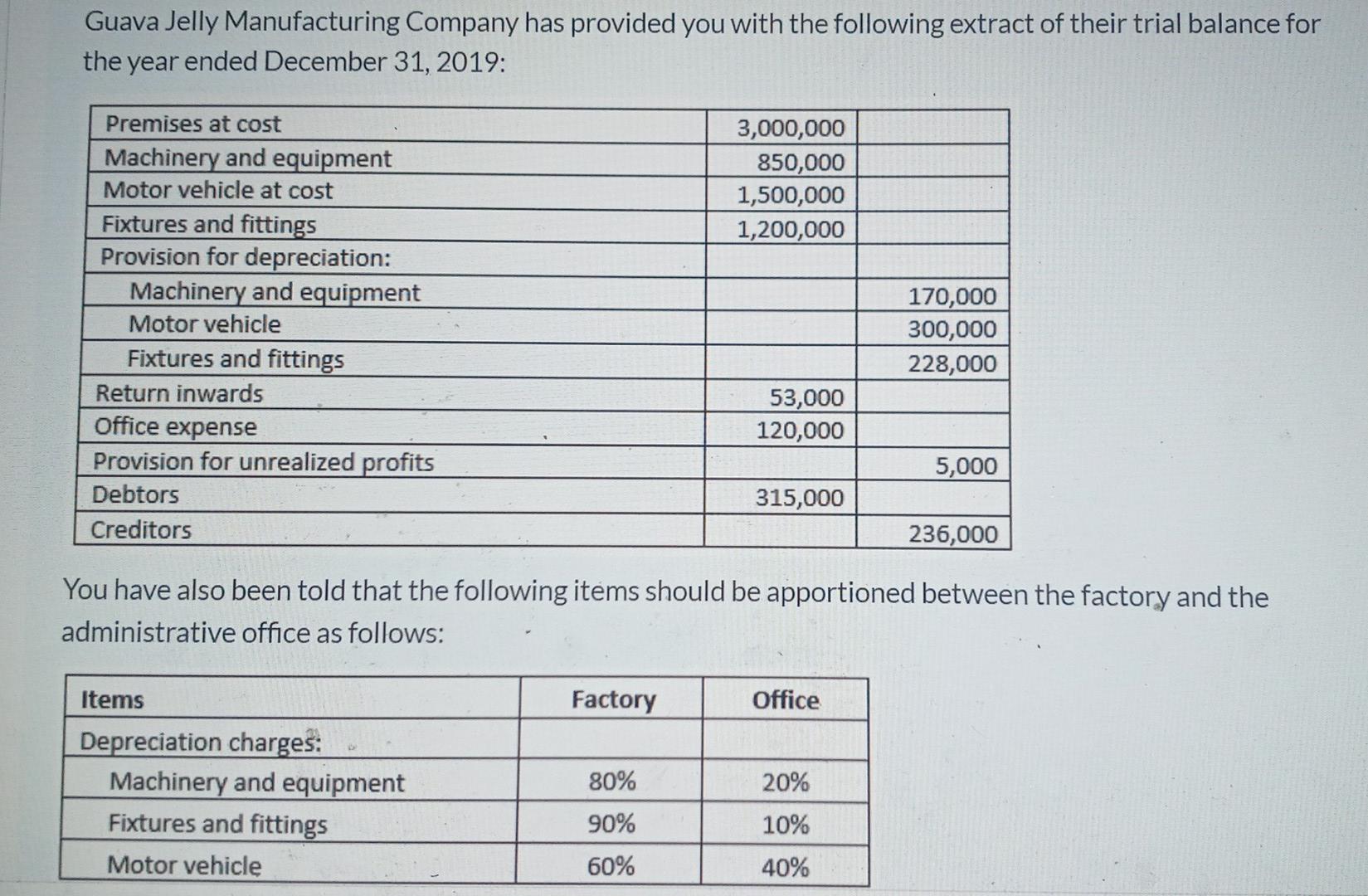

Guava Jelly Manufacturing Company has provided you with the following extract of their trial balance for the year ended December 31, 2019: 3,000,000 850,000 1,500,000

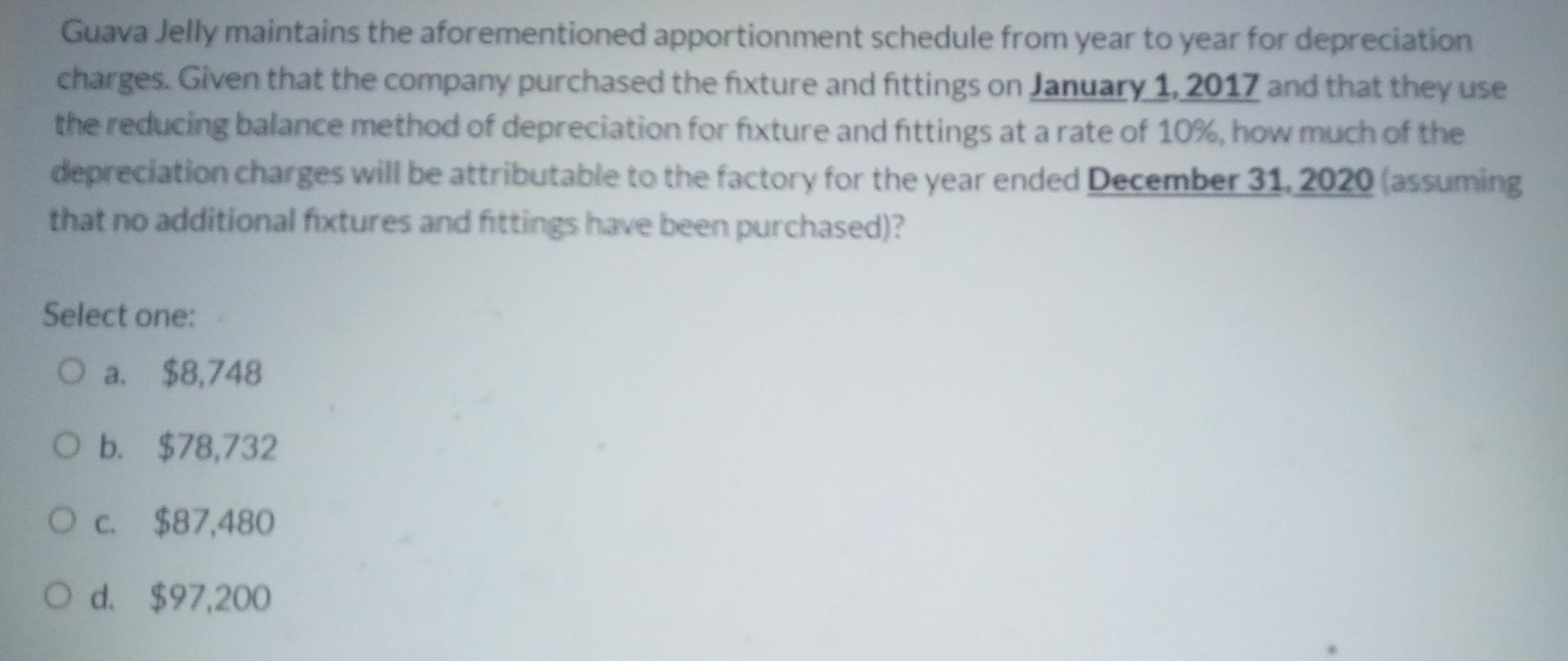

Guava Jelly Manufacturing Company has provided you with the following extract of their trial balance for the year ended December 31, 2019: 3,000,000 850,000 1,500,000 1,200,000 Premises at cost Machinery and equipment Motor vehicle at cost Fixtures and fittings Provision for depreciation: Machinery and equipment Motor vehicle Fixtures and fittings Return inwards Office expense Provision for unrealized profits Debtors Creditors 170,000 300,000 228,000 53,000 120,000 5,000 315,000 236,000 You have also been told that the following items should be apportioned between the factory and the administrative office as follows: Factory Office Items Depreciation charges: Machinery and equipment Fixtures and fittings Motor vehicle 80% 20% 90% 10% 60% 40% Guava Jelly maintains the aforementioned apportionment schedule from year to year for depreciation charges. Given that the company purchased the fixture and fittings on January 1, 2017 and that they use the reducing balance method of depreciation for fixture and fittings at a rate of 10%, how much of the depreciation charges will be attributable to the factory for the year ended December 31, 2020 (assuming that no additional fixtures and fittings have been purchased)? Select one: O a $8,748 O b. $78,732 Oc. $87,480 O d. $97,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started