Guidance for Company Report 1. To which industry/sector does this company belong? What are the major issues facing this industry? Is your company a

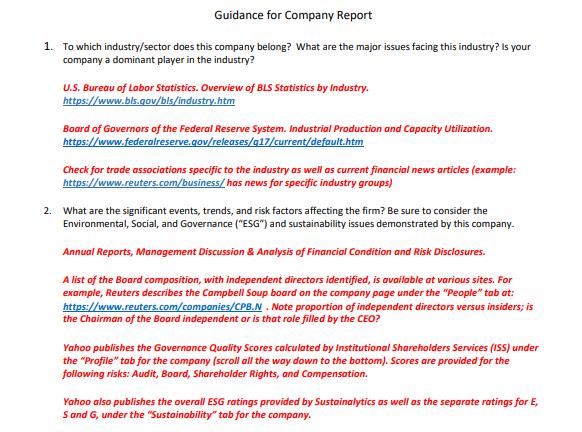

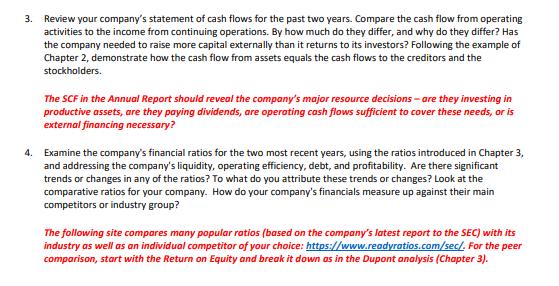

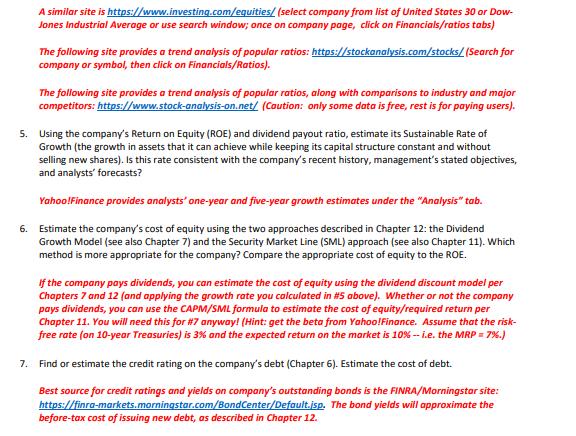

Guidance for Company Report 1. To which industry/sector does this company belong? What are the major issues facing this industry? Is your company a dominant player in the industry? U.S. Bureau of Labor Statistics. Overview of BLS Statistics by Industry. https://www.bls.gov/bls/industry.htm Board of Governors of the Federal Reserve System. Industrial Production and Capacity Utilization. https://www.federalreserve.gov/releases/q17/current/default.htm Check for trade associations specific to the industry as well as current financial news articles (example: https://www.reuters.com/business/has news for specific industry groups) 2. What are the significant events, trends, and risk factors affecting the firm? Be sure to consider the Environmental, Social, and Governance ("ESG") and sustainability issues demonstrated by this company. Annual Reports, Management Discussion & Analysis of Financial Condition and Risk Disclosures. A list of the Board composition, with independent directors identified, is available at various sites. For example, Reuters describes the Campbell Soup board on the company page under the "People" tab at: https://www.reuters.com/companies/CPB.N. Note proportion of independent directors versus insiders; is the Chairman of the Board independent or is that role filled by the CEO? Yahoo publishes the Governance Quality Scores calculated by Institutional Shareholders Services (ISS) under the "Profile" tab for the company (scroll all the way down to the bottom). Scores are provided for the following risks: Audit, Board, Shareholder Rights, and Compensation. Yahoo also publishes the overall ESG ratings provided by Sustainalytics as well as the separate ratings for E, S and G, under the "Sustainability" tab for the company. 3. Review your company's statement of cash flows for the past two years. Compare the cash flow from operating activities to the income from continuing operations. By how much do they differ, and why do they differ? Has the company needed to raise more capital externally than it returns to its investors? Following the example of Chapter 2, demonstrate how the cash flow from assets equals the cash flows to the creditors and the stockholders. The SCF in the Annual Report should reveal the company's major resource decisions are they investing in productive assets, are they paying dividends, are operating cash flows sufficient to cover these needs, or is external financing necessary? 4. Examine the company's financial ratios for the two most recent years, using the ratios introduced in Chapter 3, and addressing the company's liquidity, operating efficiency, debt, and profitability. Are there significant trends or changes in any of the ratios? To what do you attribute these trends or changes? Look at the comparative ratios for your company. How do your company's financials measure up against their main competitors or industry group? The following site compares many popular ratios (based on the company's latest report to the SEC) with its industry as well as an individual competitor of your choice: https://www.readyratios.com/sec/. For the peer comparison, start with the Return on Equity and break it down as in the Dupont analysis (Chapter 3). A similar site is https://www.investing.com/equities/ (select company from list of United States 30 or Dow- Jones Industrial Average or use search window; once on company page, click on Financials/ratios tabs) The following site provides a trend analysis of popular ratios: https://stockanalysis.com/stocks/(Search for company or symbol, then click on Financials/Ratios). The following site provides a trend analysis of popular ratios, along with comparisons to industry and major competitors: https://www.stock-analysis-on.net/ (Caution: only some data is free, rest is for paying users). 5. Using the company's Return on Equity (ROE) and dividend payout ratio, estimate its Sustainable Rate of Growth (the growth in assets that it can achieve while keeping its capital structure constant and without selling new shares). Is this rate consistent with the company's recent history, management's stated objectives, and analysts' forecasts? Yahoo!Finance provides analysts' one-year and five-year growth estimates under the "Analysis" tab. 6. Estimate the company's cost of equity using the two approaches described in Chapter 12: the Dividend Growth Model (see also Chapter 7) and the Security Market Line (SML) approach (see also Chapter 11). Which method is more appropriate for the company? Compare the appropriate cost of equity to the ROE. If the company pays dividends, you can estimate the cost of equity using the dividend discount model per Chapters 7 and 12 (and applying the growth rate you calculated in #5 above). Whether or not the company pays dividends, you can use the CAPM/SML formula to estimate the cost of equity/required return per Chapter 11. You will need this for #7 anyway! (Hint: get the beta from Yahoo!Finance. Assume that the risk- free rate (on 10-year Treasuries) is 3% and the expected return on the market is 10%-- i.e. the MRP = 7%.) 7. Find or estimate the credit rating on the company's debt (Chapter 6). Estimate the cost of debt. Best source for credit ratings and yields on company's outstanding bonds is the FINRA/Morningstar site: https://finra-markets.morningstar.com/BondCenter/Default.jsp. The bond yields will approximate the before-tax cost of issuing new debt, as described in Chapter 12. Using the market value of the equity and the book value of the debt, compute the relative weights of the debt and the equity components in the overall capital structure. With these weights calculate the Weighted Average Cost of Capital (WACC) as in Chapter 12. Compare the WACC with the Return on invested Capital. Think of this as the summary of all the company's capital budgeting investment decisions (Chapters 8, 9). In its investment decisions, does the company create value for its investors? If you have access to the Bloomberg terminals in the computer lab, use the WACC function and note the comparison to Return on Invested Capital (ROIC) and the Economic Value Added (EVA). EVA calculators are available at: https://www.omnicalculator.com/finance/economic-value-added and https://goodcalculators.com/eva-calculator/ 8. Compare your company's required return based on the SML (per Chapter 11) with the expected return based on the analysts' mean target price and expected dividends (per Chapter 7). Do you expect the company to deliver value for an investor over the next year? Longer-term? A readily available source for analysts' mean target price, and forward dividends is Yahoo!Finance.

Step by Step Solution

3.37 Rating (153 Votes )

There are 3 Steps involved in it

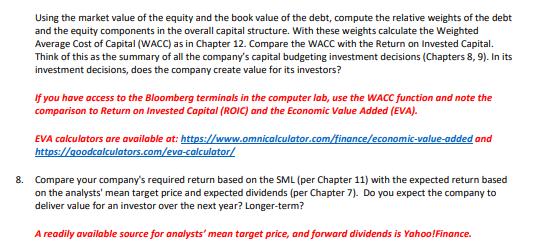

Step: 1

COMPANY REPORTQ3 CASH FLOW Cash flow is the movement of money in and out of a firm or a company Cash received by the company signifies inflows while cash spent by the company signifies outflows The ca...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started