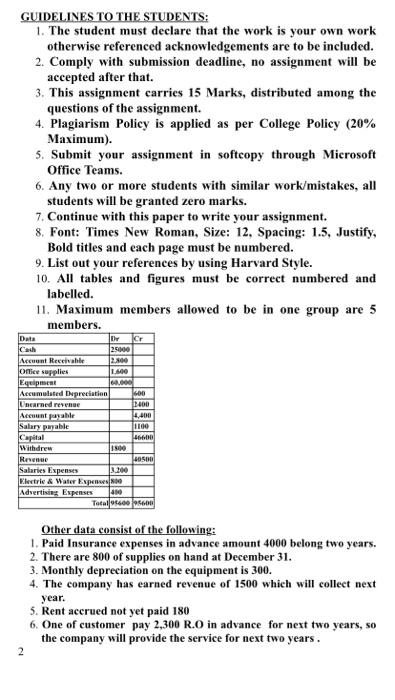

GUIDELINES TO THE STUDENTS: 1. The student must declare that the work is your own work otherwise referenced acknowledgements are to be included. 2. Comply with submission deadline, no assignment will be accepted after that. 3. This assignment carries 15 Marks, distributed among the questions of the assignment. 4. Plagiarism Policy is applied as per College Policy (20% Maximum). 5. Submit your assignment in softcopy through Microsoft Office Teams. 6. Any two or more students with similar work/mistakes, all students will be granted zero marks. 7. Continue with this paper to write your assignment. 8. Font: Times New Roman, Size: 12, Spacing: 1.5, Justify, Bold titles and each page must be numbered. 9. List out your references by using Harvard Style. 10. All tables and figures must be correct numbered and labelled. 11. Maximum members allowed to be in one group are 5 members. Data Cash 25000 Account Receivable Office supplies 1.400 Equipment 60.000 Accumulated Depreciation 00 nearned 1400 Accountable 14.400 Salary payable 1100 Capital 166.00 Withdrew 10 Rene 0500 Salaries Expenses 3.200 Electrie & Water Expenses 800 Advertising Expenses 400 Tocal 95600 5600 Other data consist of the following: 1. Paid Insurance expenses in advance amount 4000 belong two years. 2. There are 800 of supplies on hand at December 31. 3. Monthly depreciation on the equipment is 300. 4. The company has earned revenue of 1500 which will collect next year. 5. Rent accrued not yet paid 180 6. One of customer pay 2,300 R.O in advance for next two years, so the company will provide the service for next two years. 2 GUIDELINES TO THE STUDENTS: 1. The student must declare that the work is your own work otherwise referenced acknowledgements are to be included. 2. Comply with submission deadline, no assignment will be accepted after that. 3. This assignment carries 15 Marks, distributed among the questions of the assignment. 4. Plagiarism Policy is applied as per College Policy (20% Maximum). 5. Submit your assignment in softcopy through Microsoft Office Teams. 6. Any two or more students with similar work/mistakes, all students will be granted zero marks. 7. Continue with this paper to write your assignment. 8. Font: Times New Roman, Size: 12, Spacing: 1.5, Justify, Bold titles and each page must be numbered. 9. List out your references by using Harvard Style. 10. All tables and figures must be correct numbered and labelled. 11. Maximum members allowed to be in one group are 5 members. Data Cash 25000 Account Receivable Office supplies 1.400 Equipment 60.000 Accumulated Depreciation 00 nearned 1400 Accountable 14.400 Salary payable 1100 Capital 166.00 Withdrew 10 Rene 0500 Salaries Expenses 3.200 Electrie & Water Expenses 800 Advertising Expenses 400 Tocal 95600 5600 Other data consist of the following: 1. Paid Insurance expenses in advance amount 4000 belong two years. 2. There are 800 of supplies on hand at December 31. 3. Monthly depreciation on the equipment is 300. 4. The company has earned revenue of 1500 which will collect next year. 5. Rent accrued not yet paid 180 6. One of customer pay 2,300 R.O in advance for next two years, so the company will provide the service for next two years. 2