Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider a market of two assets, namely a risky asset S and a risk-free asset B. For simplicity, we assume that the interest rate

![b. (5 marks) Find expressions for V, and 8 in terms of the E (ST), E (Cr), Var(Sr), and Cov(St, CT) that minimize E[v] Here,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2022/09/63301be0d1948_1664097274648.jpg)

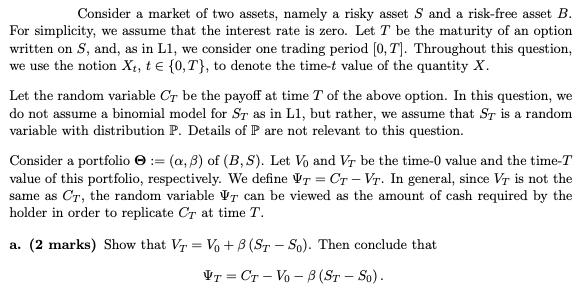

Consider a market of two assets, namely a risky asset S and a risk-free asset B. For simplicity, we assume that the interest rate is zero. Let T be the maturity of an option written on S, and, as in L1, we consider one trading period [0, T]. Throughout this question, we use the notion Xt, t = {0, T}, to denote the time-t value of the quantity X. Let the random variable Cr be the payoff at time T of the above option. In this question, we do not assume a binomial model for ST as in L1, but rather, we assume that ST is a random variable with distribution P. Details of P are not relevant to this question. Consider a portfolio : (a, 3) of (B, S). Let Vo and Vr be the time-0 value and the time-T value of this portfolio, respectively. We define VT = CT - Vr. In general, since VT is not the same as Cr, the random variable VT can be viewed as the amount of cash required by the holder in order to replicate Cr at time T. a. (2 marks) Show that VT = Vo +3 (ST-So). Then conclude that VTCT-Vo-B (ST - So). = b. (5 marks) Find expressions for V and 3 in terms of the E[ST], E [CT], Var[ST], and Cov[ST, CT] that minimize E [V]. Here, E [-], Var[-], and Cov[.,] respectively denote the expectation, variance, and covari- ance operators.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

a Given the definition of the portfolio we have that the value of the portfolio at time t is Vt at B...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started