Answered step by step

Verified Expert Solution

Question

1 Approved Answer

h) Explain to Aunt Nelly what Exchange-Traded Funds (ETFs) are. (.25 marks) i) Provide Aunt Nelly with three (3) benefits that ETFs have that are

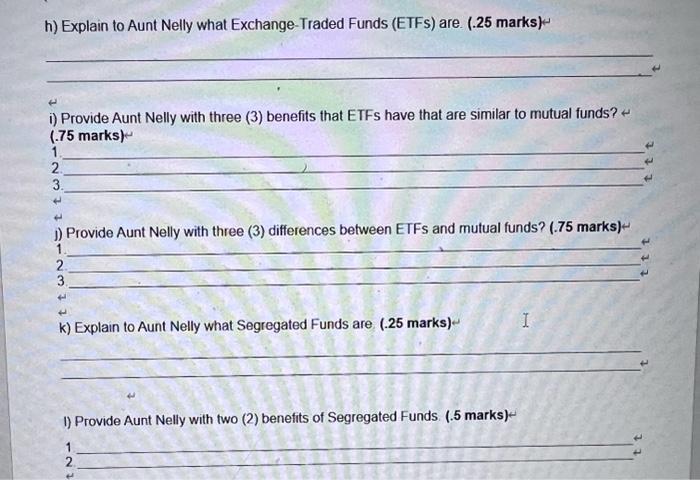

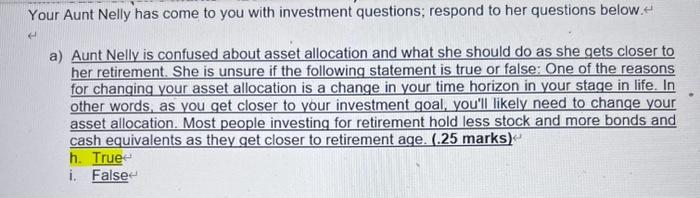

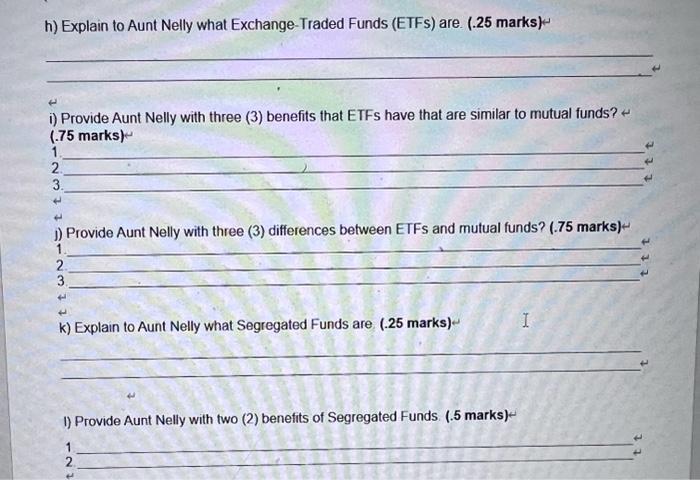

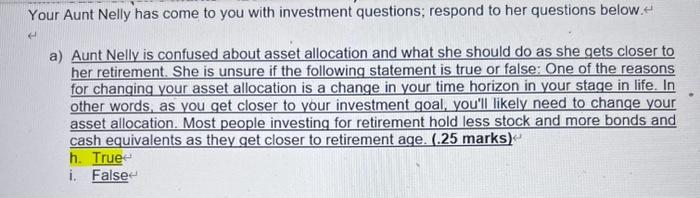

h) Explain to Aunt Nelly what Exchange-Traded Funds (ETFs) are. (.25 marks) i) Provide Aunt Nelly with three (3) benefits that ETFs have that are similar to mutual funds? (.75 marks) 1. 3. j) Provide Aunt Nelly with three (3) differences between ETFs and mutual funds? (.75 marks) 1. 2. 3. k) Explain to Aunt Nelly what Segregated Funds are (.25 marks) 1) Provide Aunt Nelly with two (2) benefits of Segregated Funds. (.5 marks) Your Aunt Nelly has come to you with investment questions; respond to her questions below. a) Aunt Nelly is confused about asset allocation and what she should do as she gets closer to her retirement. She is unsure if the following statement is true or false: One of the reasons for changing your asset allocation is a change in your time horizon in your stage in life. In other words, as you get closer to your investment goal, you'll likely need to change your asset allocation. Most people investing for retirement hold less stock and more bonds and cash equivalents as they get closer to retirement age. (.25 marks) h. True i. False

h) Explain to Aunt Nelly what Exchange-Traded Funds (ETFs) are. (.25 marks) i) Provide Aunt Nelly with three (3) benefits that ETFs have that are similar to mutual funds? (.75 marks) 1. 3. j) Provide Aunt Nelly with three (3) differences between ETFs and mutual funds? (.75 marks) 1. 2. 3. k) Explain to Aunt Nelly what Segregated Funds are (.25 marks) 1) Provide Aunt Nelly with two (2) benefits of Segregated Funds. (.5 marks) Your Aunt Nelly has come to you with investment questions; respond to her questions below. a) Aunt Nelly is confused about asset allocation and what she should do as she gets closer to her retirement. She is unsure if the following statement is true or false: One of the reasons for changing your asset allocation is a change in your time horizon in your stage in life. In other words, as you get closer to your investment goal, you'll likely need to change your asset allocation. Most people investing for retirement hold less stock and more bonds and cash equivalents as they get closer to retirement age. (.25 marks) h. True i. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started