Answered step by step

Verified Expert Solution

Question

1 Approved Answer

h Hello there ^_^ I was wondering if Anyone can help me with these questions, because I'm kinda lost thanks Question One: 30 marks Jefry's

h

Hello there ^_^ I was wondering if Anyone can help me with these questions, because I'm kinda lost thanks

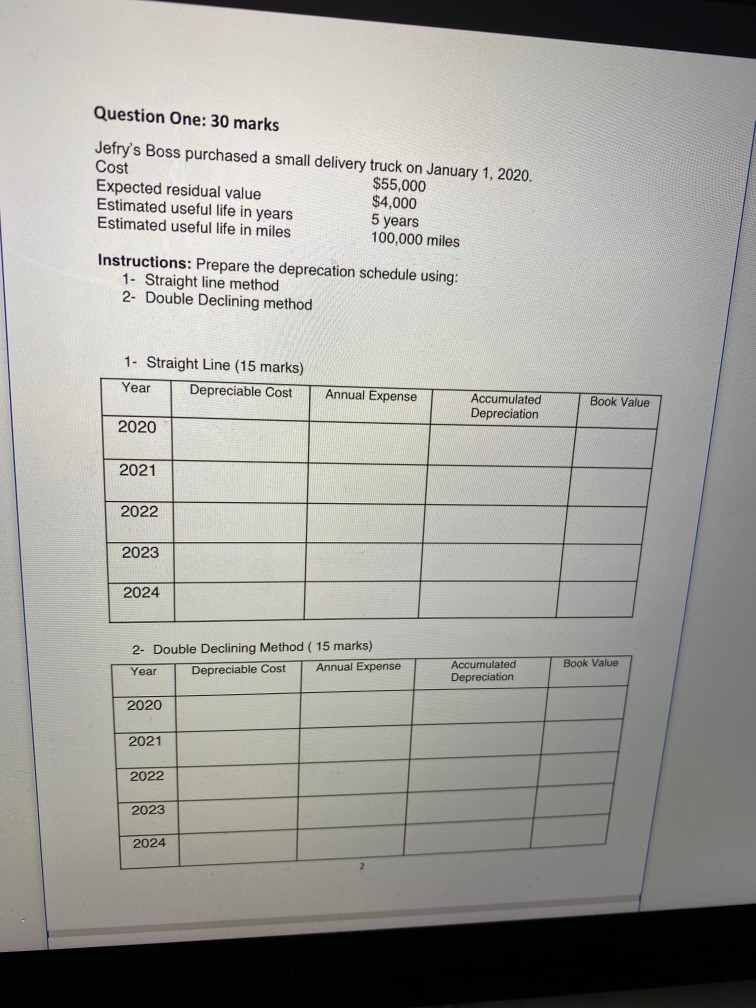

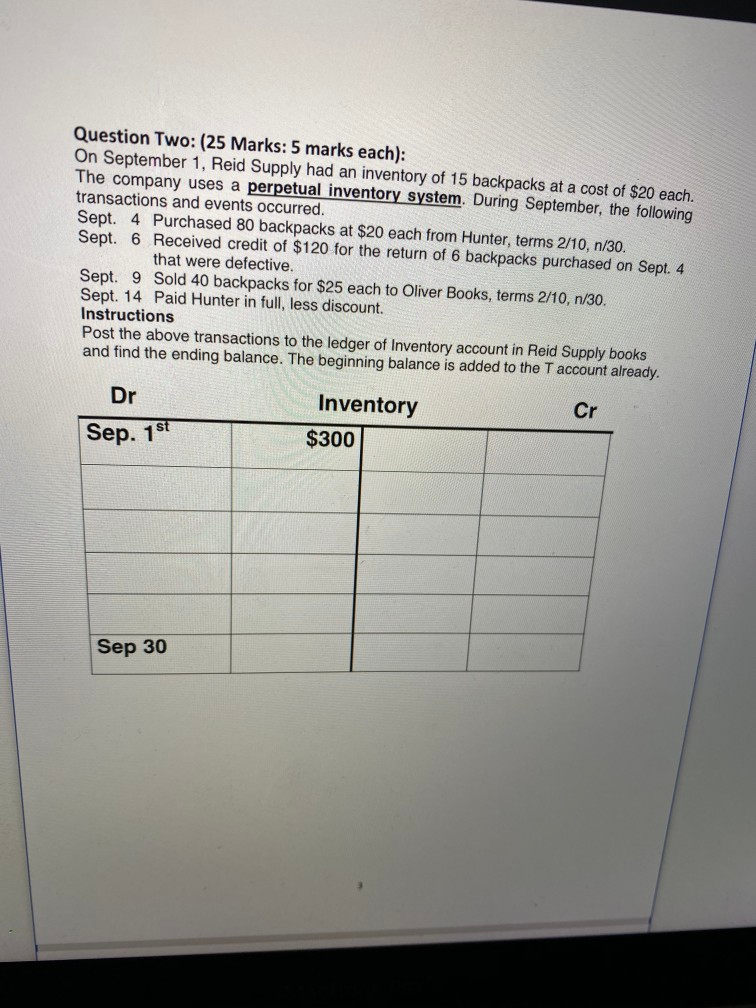

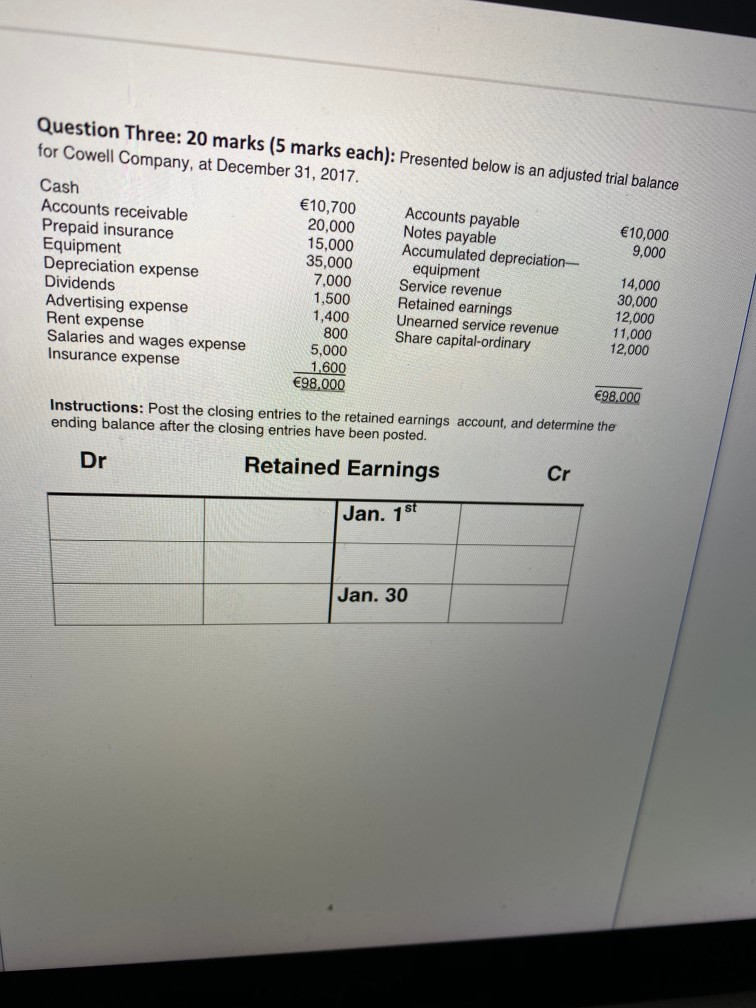

Question One: 30 marks Jefry's Boss purchased a small delivery truck on January 1, 2020. Cost $55,000 Expected residual value $4,000 Estimated useful life in years 5 years Estimated useful life in miles 100,000 miles Instructions: Prepare the deprecation schedule using: 1- Straight line method 2- Double Declining method 1- Straight Line (15 marks) Year Depreciable Cost Annual Expense Accumulated Depreciation Book Value 2020 2021 2022 2023 2024 2- Double Declining Method ( 15 marks) Year Depreciable Cost Annual Expense Book Value Accumulated Depreciation 2020 2021 2022 2023 2024 Question Two: (25 Marks: 5 marks each): On September 1, Reid Supply had an inventory of 15 backpacks at a cost of $20 each. The company uses a perpetual inventory system. During September, the following transactions and events occurred. Sept. 4 Purchased 80 backpacks at $20 each from Hunter, terms 2/10, n/30. Sept. 6 Received credit of $120 for the return of 6 backpacks purchased on Sept. 4 that were defective. Sept. 9 Sold 40 backpacks for $25 each to Oliver Books, terms 2/10, n/30. Sept. 14 Paid Hunter in full, less discount. Instructions Post the above transactions to the ledger of Inventory account in Reid Supply books and find the ending balance. The beginning balance is added to the T account already. Dr Cr Inventory $300 Sep. 1st Sep 30 Question Three: 20 marks (5 marks each): Presented below is an adjusted trial balance for Cowell Company, at December 31, 2017. Cash 10,700 Accounts payable 10,000 Accounts receivable 20,000 Notes payable 9,000 Prepaid insurance 15,000 Accumulated depreciation Equipment 35,000 equipment 14,000 Depreciation expense 7,000 Service revenue 30,000 Dividends 1,500 Retained earnings 12,000 Advertising expense 1,400 Unearned service revenue 11,000 Rent expense 800 Share capital-ordinary 12,000 Salaries and wages expense 5,000 Insurance expense 1,600 98.000 98.000 Instructions: Post the closing entries to the retained earnings account, and determine the ending balance after the closing entries have been posted. Dr Retained Earnings Cr Jan. 150 Jan. 30 Question Four: 25 marks: Explain the Accounting cycleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started