Answered step by step

Verified Expert Solution

Question

1 Approved Answer

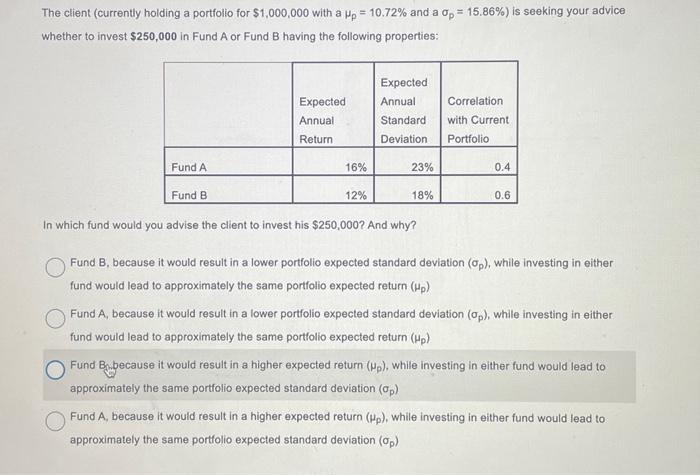

h The client (currently holding a portfolio for $1,000,000 with a p=10.72% and a p=15.86% ) is seeking your advice whether to invest $250,000 in

h

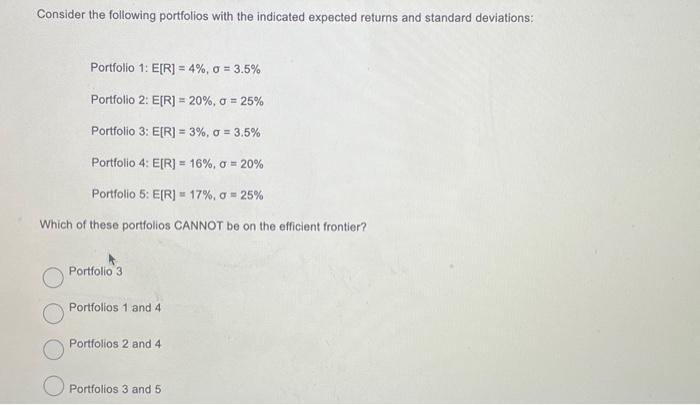

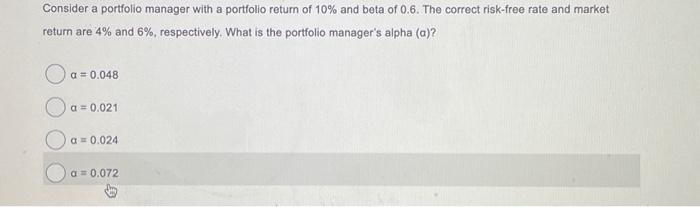

The client (currently holding a portfolio for $1,000,000 with a p=10.72% and a p=15.86% ) is seeking your advice whether to invest $250,000 in Fund A or Fund B having the following properties: In which fund would you advise the client to invest his $250,000 ? And why? Fund B, because it would result in a lower portfolio expected standard deviation (p), while investing in either fund would lead to approximately the same portfolio expected return (p) Fund A, because it would result in a lower portfolio expected standard deviation (p), while investing in either fund would lead to approximately the same portfolio expected return (p) Fund B B because it would result in a higher expected return (p), while investing in either fund would lead to approximately the same portfolio expected standard deviation (p) Fund A, because it would result in a higher expected return (), while investing in either fund would lead to approximately the same portfolio expected standard deviation (p) Consider the following portfolios with the indicated expected returns and standard deviations: Portfolio 1: E[R ]=4%,=3.5% Portfolio 2: E[R]=20%,=25% Portfolio 3: E[R ]=3%,=3.5% Portfolio 4:E[R]=16%,=20% Portfolio 5:E[R]=17%,=25% Which of these portfolios CANNOT be on the efficient frontier? Portfolio 3 Portfolios 1 and 4 Portfolios 2 and 4 Portfolios 3 and 5 Consider a portfolio manager with a portfolio return of 10% and beta of 0.6 . The correct risk-free rate and market return are 4% and 6%, respectively. What is the portfolio manager's alpha (a) ? a=0.048a=0.021 =0.024 a=0.072 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started