Answered step by step

Verified Expert Solution

Question

1 Approved Answer

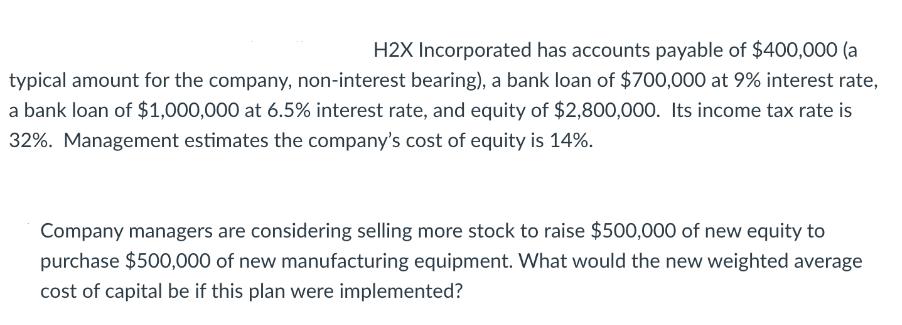

H2X Incorporated has accounts payable of $400,000 (a typical amount for the company, non-interest bearing), a bank loan of $700,000 at 9% interest rate,

H2X Incorporated has accounts payable of $400,000 (a typical amount for the company, non-interest bearing), a bank loan of $700,000 at 9% interest rate, a bank loan of $1,000,000 at 6.5% interest rate, and equity of $2,800,000. Its income tax rate is 32%. Management estimates the company's cost of equity is 14%. Company managers are considering selling more stock to raise $500,000 of new equity to purchase $500,000 of new manufacturing equipment. What would the new weighted average cost of capital be if this plan were implemented? Company managers are projecting that the new manufacturing equipment from above question will produce a return on assets of 11%. Should the company proceed with this plan?

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the new weighted average cost of capital WACC after raising 500000 of new equity and using it to purchase 500000 of new manufacturing equ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started