Answered step by step

Verified Expert Solution

Question

1 Approved Answer

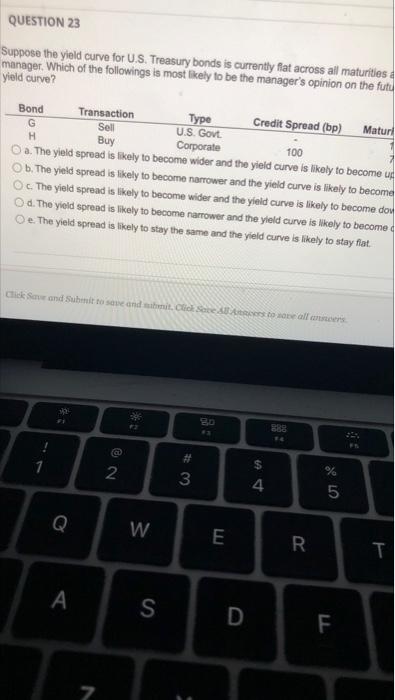

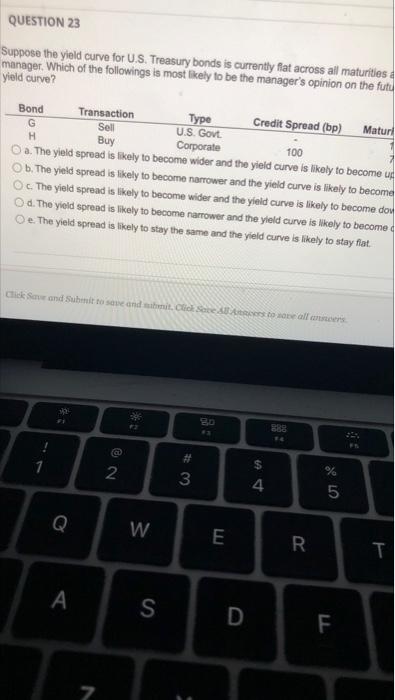

Had to split question into two images to be close enough for a clear image. QUESTION 23 Suppose the yield curve for U.S. Treasury bonds

Had to split question into two images to be close enough for a clear image.

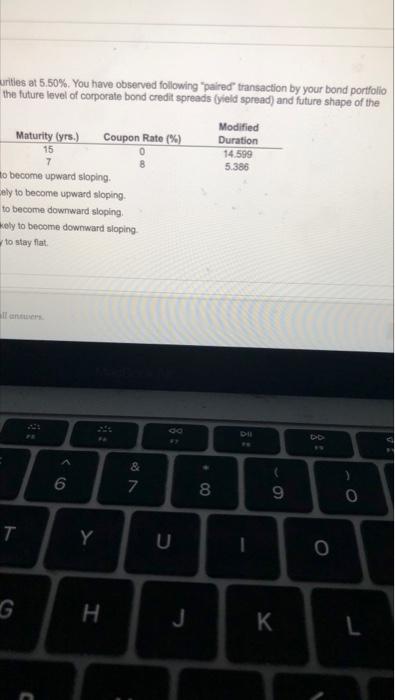

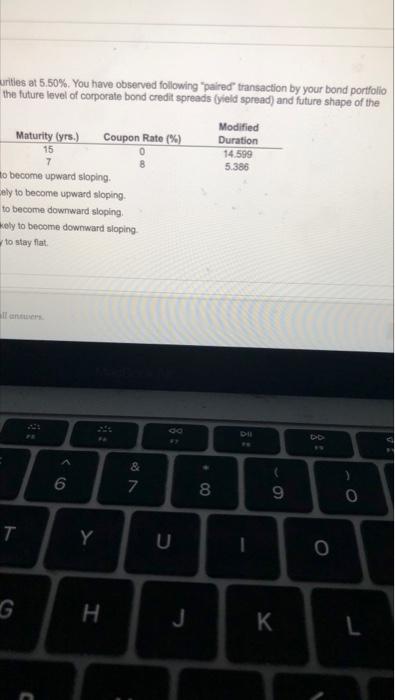

QUESTION 23 Suppose the yield curve for U.S. Treasury bonds is currently flat across all maturities manager. Which of the followings is most likely to be the manager's opinion on the futu yield curve? Bond Transaction Type Credit Spread (bp) Maturl G Sell U.S. Govt H Corporate O a. The yield spread is likely to become wider and the yield curve is likely to become ug Ob. The yield spread is likely to become narrower and the yield Curve is likely to become Oc. The yield spread is likely to become wider and the yield curve is likely to become don Od. The yield spread is likely to become narrower and the yield curve is likely to become Oe. The yield spread is likely to stay the same and the yield curve is likely to stay fiat. Buy 100 Click Save and Submit to save and unit. Click Save As to all * N 1 2 # 3 % 4 5 Q W E R S D F UL 7 aurities at 5.50%. You have observed following paired transaction by your bond portfolio the future level of corporate bond credit spreads (yield spread) and future shape of the Modified Maturity Cyrs.) Coupon Rate(%) Duration 15 14 599 5.386 to become upward sloping bely to become upward sloping to become downward sloping kely to become downward sloping to stay flat DI Db LA + 6 & 7 8 9 0 T Y U 0 G H J

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started