Answered step by step

Verified Expert Solution

Question

1 Approved Answer

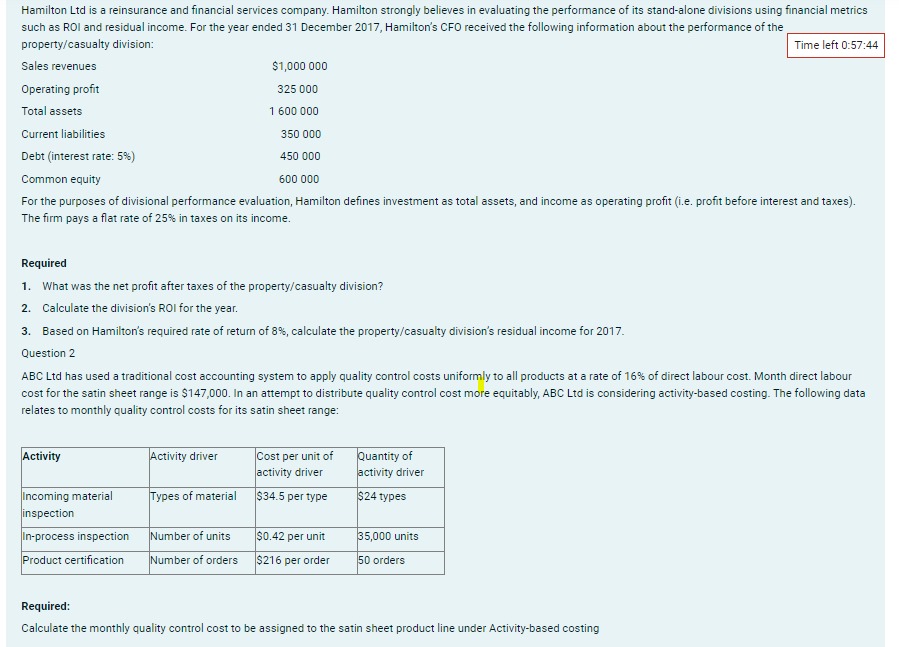

Hamilton Ltd is a reinsurance and financial services company. Hamilton strongly believes in evaluating the performance of its stand - alone divisions using financial metrics

Hamilton Ltd is a reinsurance and financial services company. Hamilton strongly believes in evaluating the performance of its standalone divisions using financial metrics such as ROI and residual income. For the year ended December Hamilton's CFO received the following information about the performance of the propertycasualty division:

For the purposes of divisional performance evaluation, Hamilton defines investment as total assets, and income as operating profit ie profit before interest and taxes The firm pays a flat rate of in taxes on its income.

Required

What was the net profit after taxes of the propertycasualty division?

Calculate the division's ROI for the year.

Based on Hamilton's required rate of return of calculate the propertycasualty division's residual income for

Question

ABC Ltd has used a traditional cost accounting system to apply quality control costs uniformly to all products at a rate of of direct labour cost. Month direct labour cost for the satin sheet range is $ In an attempt to distribute quality control cost more equitably, ABC Ltd is considering activitybased costing. The following data relates to monthly quality control costs for its satin sheet range:

Required:

Calculate the monthly quality control cost to be assigned to the satin sheet product line under Activitybased costing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started