Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hamlet acquires a 7-year class on November 23, 2017, for $100,000. Hamlet does not elect immediate expensing under special 179. He does not claim any

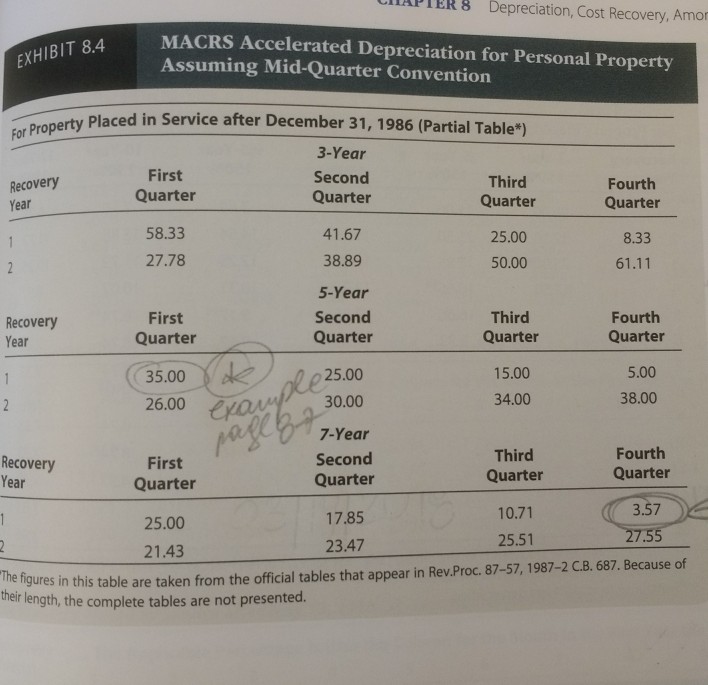

Hamlet acquires a 7-year class on November 23, 2017, for $100,000. Hamlet does not elect immediate expensing under special 179. He does not claim any available additional first-year depreciation. Calculate Hamlet's cost recovery deductions for 2017 and 2018.

CAPTER 8 Depreciation, Cost Recovery, Amor MACRS Accelerated Depreciation for Personal Property Assuming Mid-Quarter Convention EXHIBIT 8.4 Placed in Service after December 31, 1986 (Partial Table*) For Prope 3-Year Second Quarter First Recovery Year Third Fourth Quarter 58.33 27.78 Quarter 25.00 50.00 Quarter 8.33 61.11 41.67 38.89 5-Year Second Quarter First Quarter Third Quarter 15.00 34.00 Fourth Recovery Year Quarter 5.00 38.00 35.0025.00 30.00 7-Year Second Quarter 26.00 Fourth Quarter Third Quarter 10.71 25.51 Recovery Year First Quarter 25.00 21.43 The fgures in this table are taken from the official tabl 3.57 17.85 23.47 es that appear in Rev.Proc. 87-57, 1987-2 C.B. 687. Because of their length, the complete tables are not presented

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started