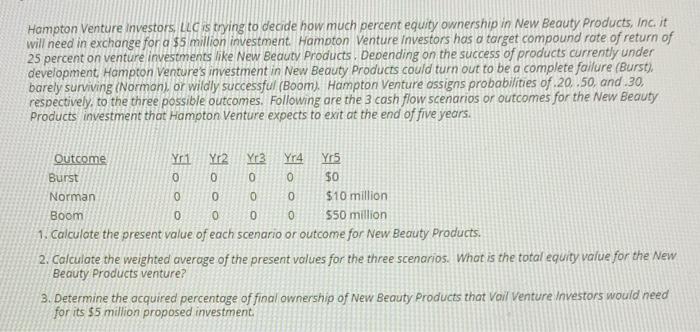

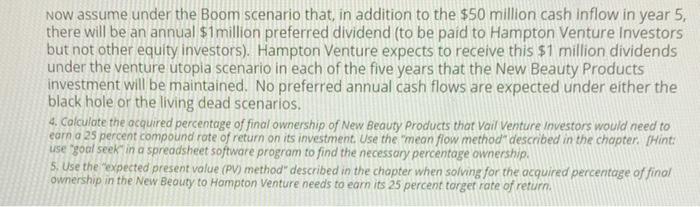

Hampton Venture investors LLC is trying to decide how much percent equity ownership in New Beauty Products, Inc. it will need in exchange for a $5 million investment Hampton Venture Investors has o target compound rote of return of 25 percent on venture investments like New Beauty Products. Depending on the success of products currently under development Hampton Ventures investment in New Beauty Products could turn out to be a complete failure (Burst). barely surviving (Norman) or wildly successful (Boom). Hampton Venture assigns probabilities of 20.50, and 30, respectively, to the three possible outcomes. Following are the 3 cash flow scenarios or outcomes for the New Beauty Products investment that Hampton Venture expects to exit at the end of five years. 0 0 0 0 Outcome Yri Y2 Yra Yr4 Yr5 Burst 0 0 $0 Norman 0 0 0 0 $10 million Boom 0 0 $50 million 1. Calculate the present value of each scenario or outcome for New Beauty Products. 2. Calculate the weighted average of the present values for the three scenarios. What is the total equity value for the New Beauty Products venture? 3. Determine the acquired percentage of final ownership of New Beauty Products that Voil Venture Investors would need for its $5 million proposed investment Now assume under the Boom scenario that, in addition to the $50 million cash inflow in year 5, there will be an annual $1million preferred dividend (to be paid to Hampton Venture Investors but not other equity investors). Hampton Venture expects to receive this $1 million dividends under the venture utopia scenario in each of the five years that the New Beauty Products investment will be maintained. No preferred annual cash flows are expected under either the black hole or the living dead scenarios. 4. Calculate the acquired percentage of final ownership of New Beauty Products that Vail Venture Investors would need to earn a 25 percent compound rote of return on its investment. Use the mean flow method" described in the chapter. (Hint: use "goal seek in a spreadsheet software program to find the necessary percentage ownership, 5. Use the expected present value (PV) method" described in the chapter when solving for the acquired percentage of fino! ownership in the New Beauty to Hampton Venture needs to earn its 25 percent torget rate of return. Hampton Venture investors LLC is trying to decide how much percent equity ownership in New Beauty Products, Inc. it will need in exchange for a $5 million investment Hampton Venture Investors has o target compound rote of return of 25 percent on venture investments like New Beauty Products. Depending on the success of products currently under development Hampton Ventures investment in New Beauty Products could turn out to be a complete failure (Burst). barely surviving (Norman) or wildly successful (Boom). Hampton Venture assigns probabilities of 20.50, and 30, respectively, to the three possible outcomes. Following are the 3 cash flow scenarios or outcomes for the New Beauty Products investment that Hampton Venture expects to exit at the end of five years. 0 0 0 0 Outcome Yri Y2 Yra Yr4 Yr5 Burst 0 0 $0 Norman 0 0 0 0 $10 million Boom 0 0 $50 million 1. Calculate the present value of each scenario or outcome for New Beauty Products. 2. Calculate the weighted average of the present values for the three scenarios. What is the total equity value for the New Beauty Products venture? 3. Determine the acquired percentage of final ownership of New Beauty Products that Voil Venture Investors would need for its $5 million proposed investment Now assume under the Boom scenario that, in addition to the $50 million cash inflow in year 5, there will be an annual $1million preferred dividend (to be paid to Hampton Venture Investors but not other equity investors). Hampton Venture expects to receive this $1 million dividends under the venture utopia scenario in each of the five years that the New Beauty Products investment will be maintained. No preferred annual cash flows are expected under either the black hole or the living dead scenarios. 4. Calculate the acquired percentage of final ownership of New Beauty Products that Vail Venture Investors would need to earn a 25 percent compound rote of return on its investment. Use the mean flow method" described in the chapter. (Hint: use "goal seek in a spreadsheet software program to find the necessary percentage ownership, 5. Use the expected present value (PV) method" described in the chapter when solving for the acquired percentage of fino! ownership in the New Beauty to Hampton Venture needs to earn its 25 percent torget rate of return