Answered step by step

Verified Expert Solution

Question

1 Approved Answer

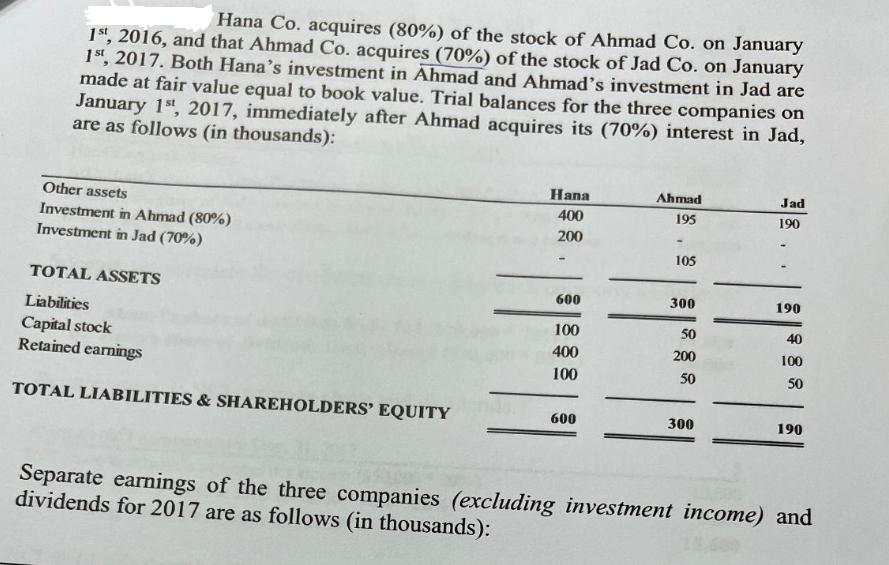

Hana Co. acquires (80%) of the stock of Ahmad Co. on January 1st, 2016, and that Ahmad Co. acquires (70%) of the stock of

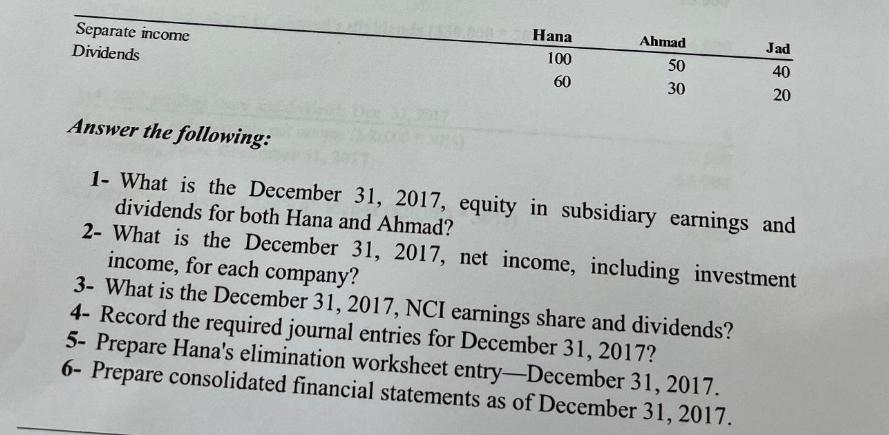

Hana Co. acquires (80%) of the stock of Ahmad Co. on January 1st, 2016, and that Ahmad Co. acquires (70%) of the stock of Jad Co. on January 1st, 2017. Both Hana's investment in Ahmad and Ahmad's investment in Jad are made at fair value equal to book value. Trial balances for the three companies on January 1st, 2017, immediately after Ahmad acquires its (70 %) interest in Jad, are as follows (in thousands): Other assets Investment in Ahmad (80%) Investment in Jad (70%) TOTAL ASSETS Liabilities Capital stock Retained earnings TOTAL LIABILITIES & SHAREHOLDERS' EQUITY Hana 400 200 600 100 400 100 600 Ahmad 195 - 105 300 50 200 50 300 Jad 190 190 40 100 50 190 Separate earnings of the three companies (excluding investment income) and dividends for 2017 are as follows (in thousands): Separate income Dividends Hana 100 60 S Ahmad 50 30 Answer the following: 1- What is the December 31, 2017, equity in subsidiary earnings and dividends for both Hana and Ahmad? 2- What is the December 31, 2017, net income, including investment income, for each company? 3- What is the December 31, 2017, NCI earnings share and dividends? Jad 40 20 4- Record the required journal entries for December 31, 2017? 5- Prepare Hana's elimination worksheet entry-December 31, 2017. 6- Prepare consolidated financial statements as of December 31, 2017.

Step by Step Solution

★★★★★

3.45 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

1 Equity in subsidiary earnings and dividends for December 31 2017 Hana Equity in Ahmads earnings 80 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started