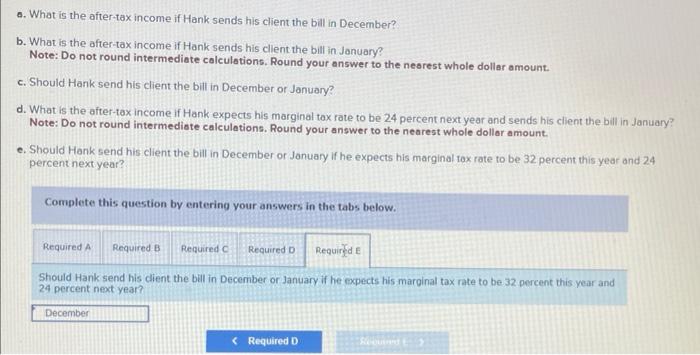

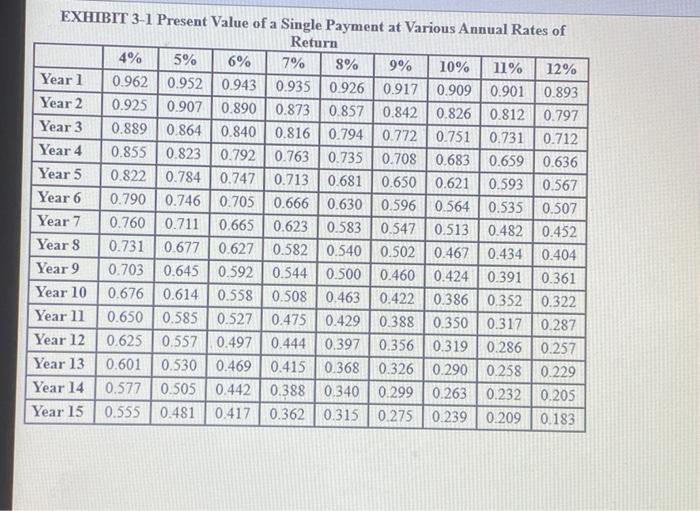

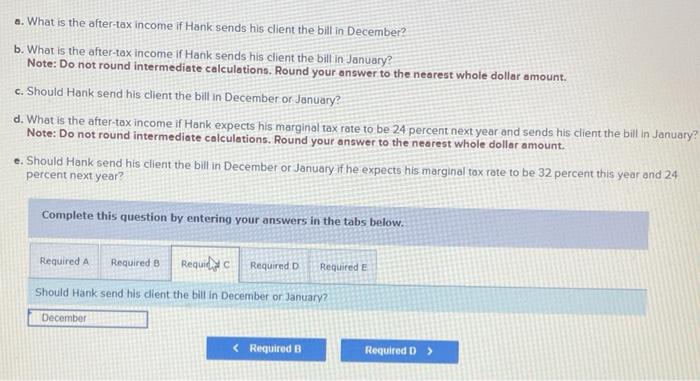

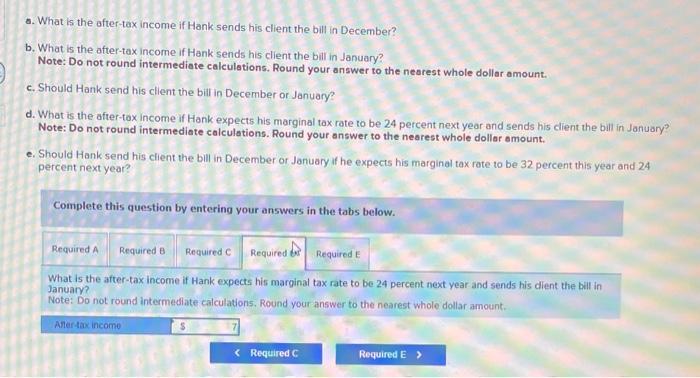

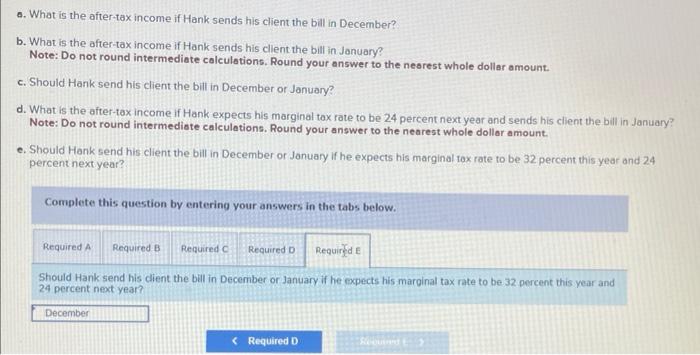

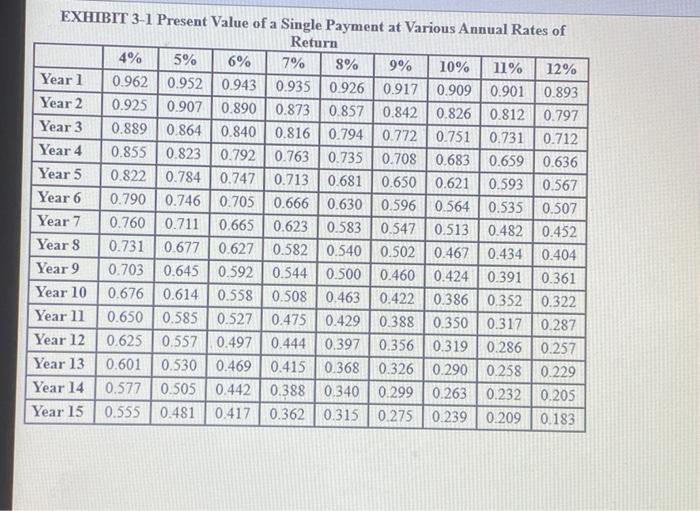

Hank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December, he performed $26,000 of legal services for a client. Hank typically requires his clients to pay his bills immediately upon receipt. Assume his marginal tax rate is 32 percent this year and will be 35 percent next year, and that he can earn an after-tax rate of return of 12 percent on his investments, Use Exhibit 31 Required: o. What is the after-tax income if Hank sends his client the bill in December? b. What is the after-tax income if Hank sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. Should Hank send his client the bill in December or January? d. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. e. Should Hank send his client the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year? Complete this question by entering your answers in the tabs below. What is the after-tax income if Hank sends his client the bill in December? Fank, a calendar-year taxpayer, uses the cash method of accounting for his sole proprietorship. In late December, he performed $26,000 of legal services for a client. Hank typically requires his clients to pay his bills immediately upon receipt Assume his margina investments. Use Exhibit 3.1. Required: a. What is the after-tax income if Hank sends his client the bill in December? b. What is the after-tax income if Hank sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. Should Hank send his client the bill in December or January? d. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. e. Should Hank send his cllent the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year? Complete this question by entering your answers in the tabs below. What is the after-tax income if Hank sends his dient the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dolfar iimgint. a. What is the after-tax income if Hank sends his client the bill in December? b. What is the after-tax income if Hank sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. Should Hank send his client the bill in December or January? d. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. e. Should Hank send his client the bill in December or January if he expects his marginal tox rate to be 32 percent this year and 24 percent next year? Complete this question by entering your answers in the tabs below. Should Hank send his client the bill in December or January? a. What is the after-tax income if Hank sends his client the bill in December? b. What is the after-tax income if Hank sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. Should Hank send his cllent the bill in December or January? d. What is the after-tox income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. e. Should Hank send his client the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year? Complete this question by entering your answers in the tabs below. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his dient the bill in January? Note: Do not round intermediate calculations, Round your answer to the nearest whole dollar amount. a. What is the after-tax income if Hank sends his client the bill in December? b. What is the after-tax income if Hank sends his cllent the bill in Jonuary? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. c. Should Hank send his client the bill in December or January? d. What is the after-tax income if Hank expects his marginal tax rate to be 24 percent next year and sends his client the bill in January? Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar amount. e. Should Honk send his client the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year? Complete this question by entering your answers in the tabs below. Should Hank send his client the bill in December or January if he expects his marginal tax rate to be 32 percent this year and 24 percent next year? EXHIBIT 3-1 Present Value of a Single Payment at Various Annual Rates of