Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In addition to this question what is the exact seperation between Net Income before expansion and Expected project income before interest and income tax. Also

In addition to this question what is the exact seperation between "Net Income before expansion" and "Expected project income before interest and income tax". Also Please explain the exact meaning of Net Income for this question in detail.

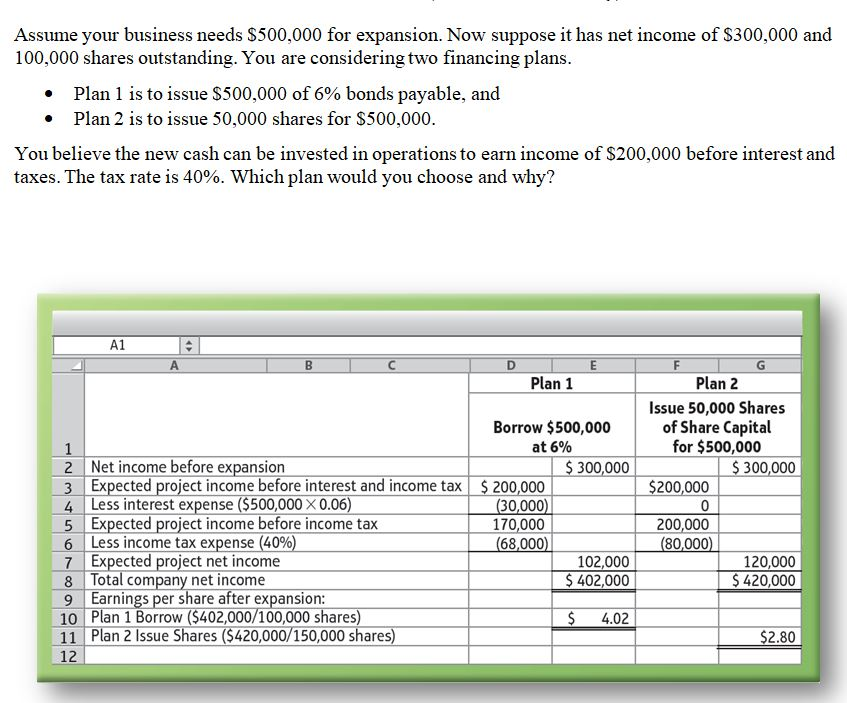

Assume your business needs S500,000 for expansion. Now suppose it has net income of S300,000 and 100,000 shares outstanding. You are considering two financing plans Plan 1 is to issue $500,000 of 6% bonds payable, and Plan 2 is to issue 50,000 shares for S500,000 . . You believe the new cash can be invested in operations to earn income of $200,000 before interest and taxes. The tax rate is 40%. Which plan would you choose and why? A1 Plan 1 Plan 2 Issue 50,000 Shares of Share Capital Borrow $500,000 at 6% for $500,000 2 Net income before expansion 300,000 $300,000 Expected project income before interest and income tax 200,000 30,000 200,000 4 | Less interest expense ($500,000 0.06) Expected project income before income tax 6 | Less income tax expense (40% 7Expected project net income 8 Total company net income 9 Earnings per share after expansion: 10 Plan 1 Borrow ($402,000/100,000 shares) 11 Plan 2 Issue Shares ($420,000/150,000 shares) 12 170,000 68,000] 200,000 80,000 102,000 402,000 120,000 420,000 4.02 2.80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started