Answered step by step

Verified Expert Solution

Question

1 Approved Answer

???????? Happy Releaf Ltd 2018 was a lucky year for Penelope Wildflower! She was one of the first Canadians awarded a license for a cannabis

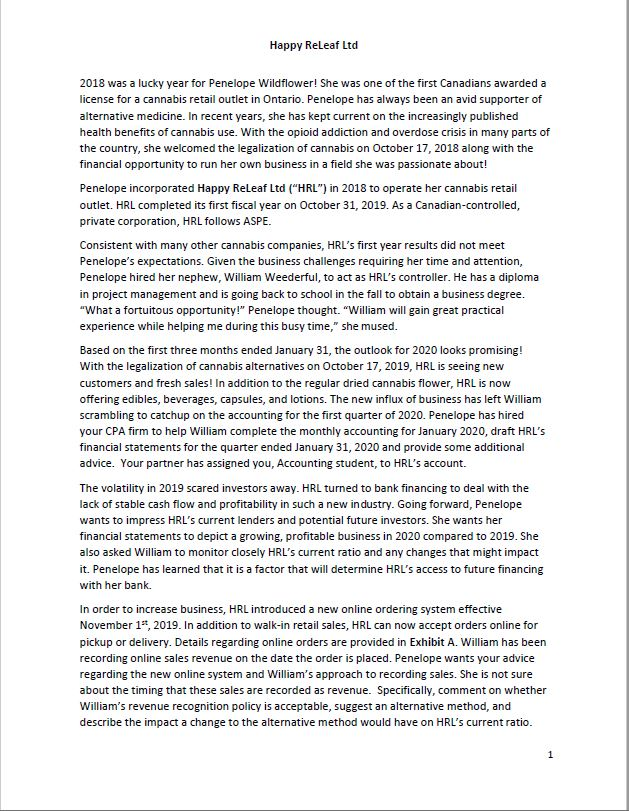

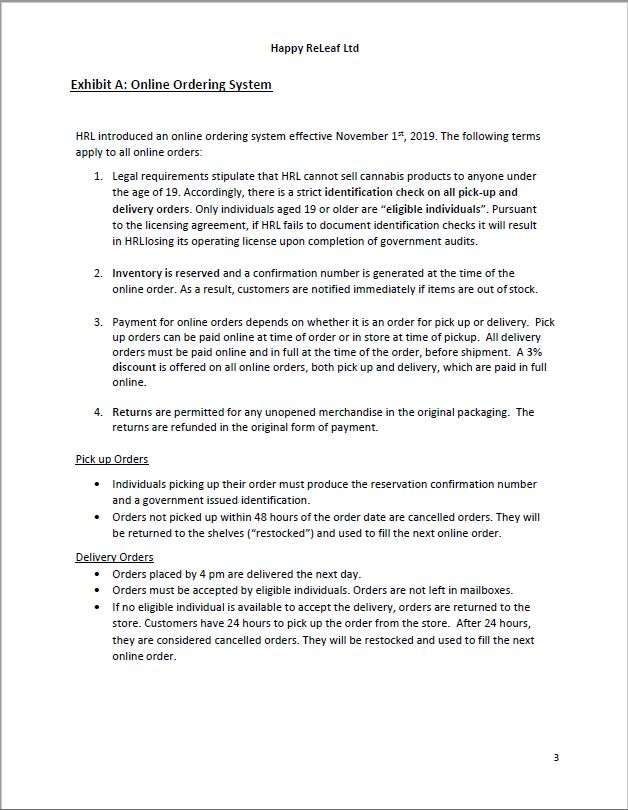

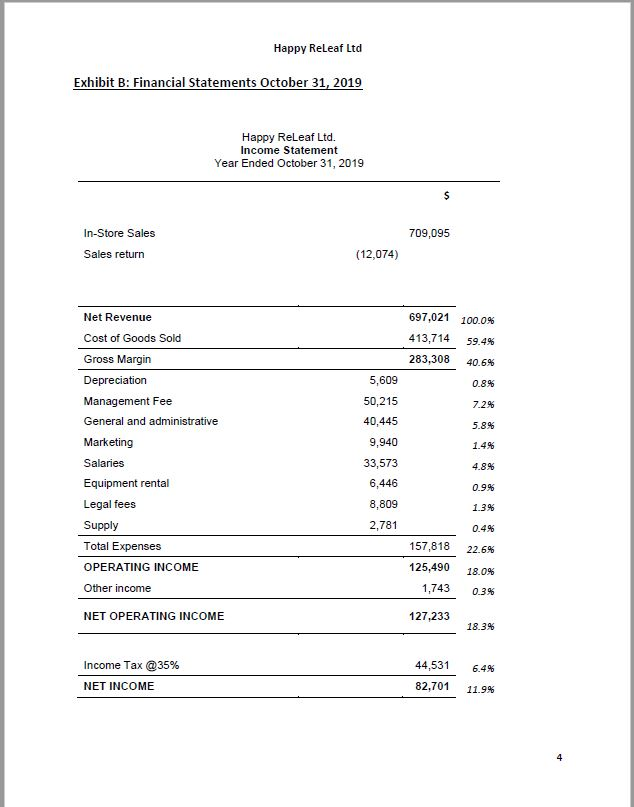

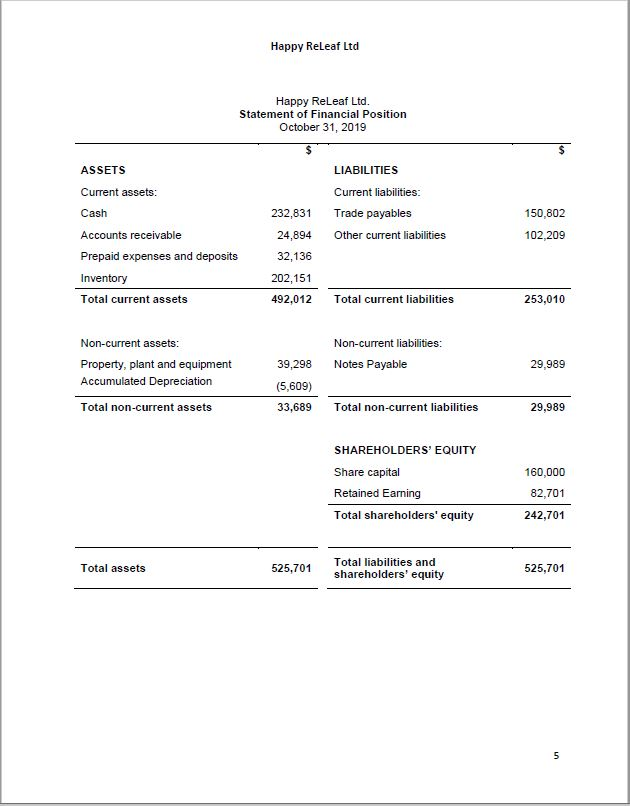

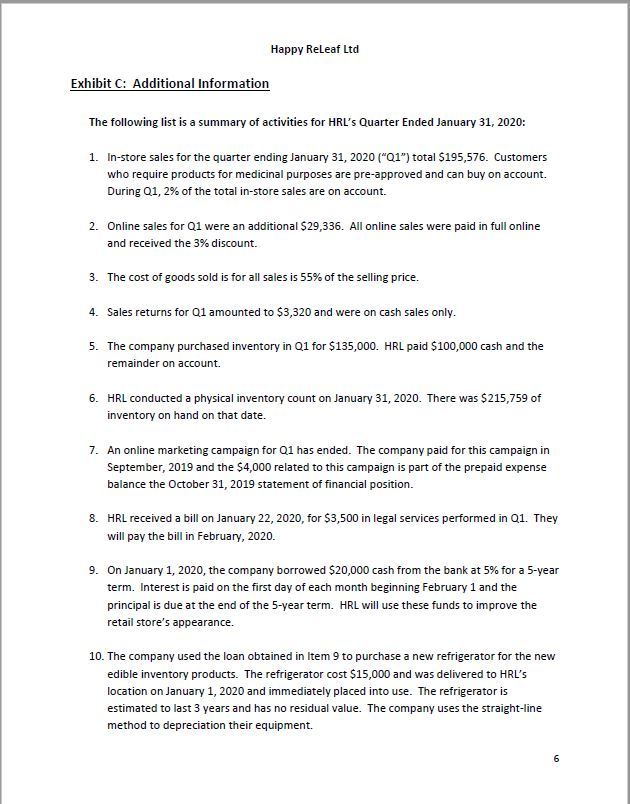

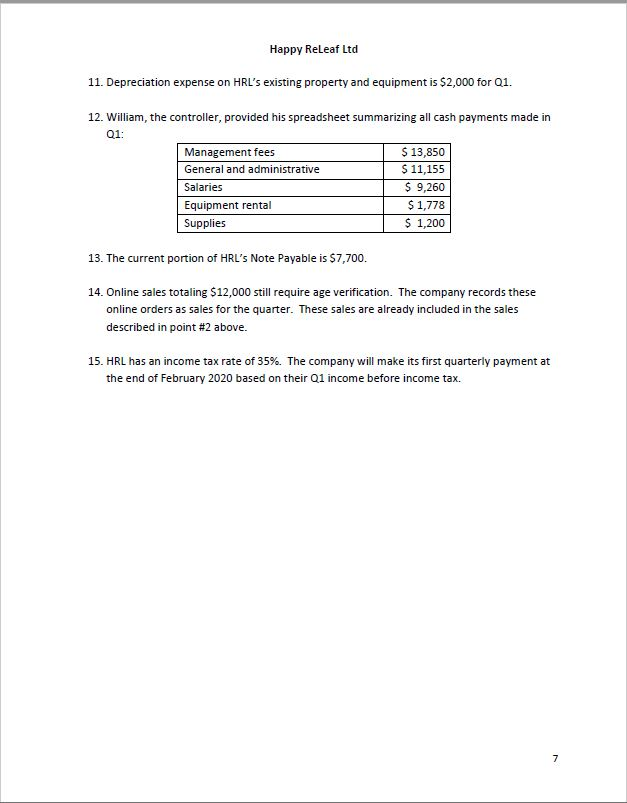

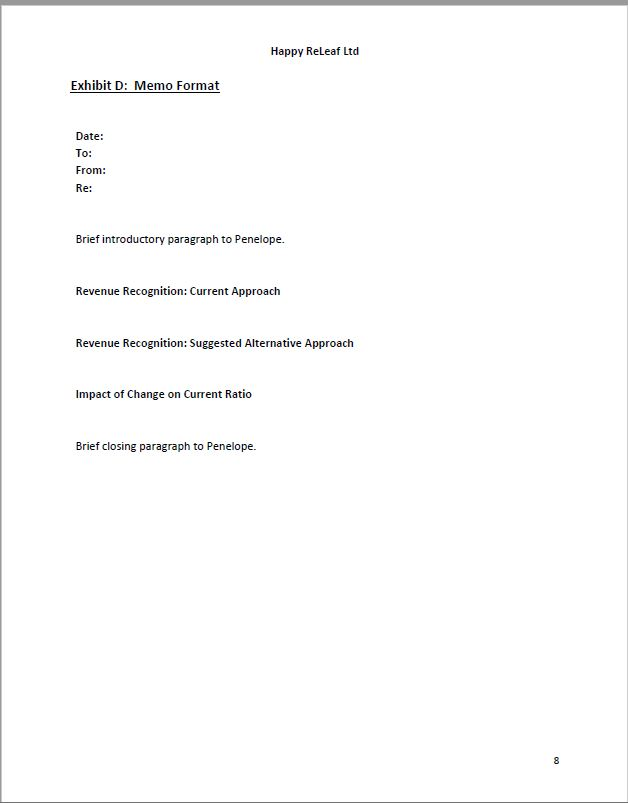

Happy Releaf Ltd 2018 was a lucky year for Penelope Wildflower! She was one of the first Canadians awarded a license for a cannabis retail outlet in Ontario. Penelope has always been an avid supporter of alternative medicine. In recent years, she has kept current on the increasingly published health benefits of cannabis use. With the opioid addiction and overdose crisis in many parts of the country, she welcomed the legalization of cannabis on October 17, 2018 along with the financial opportunity to run her own business in a field she was passionate about! Penelope incorporated Happy Releaf Ltd ("HRL") in 2018 to operate her cannabis retail outlet. HRL completed its first fiscal year on October 31, 2019. As a Canadian-controlled, private corporation, HRL follows ASPE. Consistent with many other cannabis companies, HRL's first year results did not meet Penelope's expectations. Given the business challenges requiring her time and attention, Penelope hired her nephew, William Weederful, to act as HRL's controller. He has a diploma in project management and is going back to school in the fall to obtain a business degree. "What a fortuitous opportunity!" Penelope thought. "William will gain great practical experience while helping me during this busy time," she mused. Based on the first three months ended January 31, the outlook for 2020 looks promising! With the legalization of cannabis alternatives on October 17, 2019, HRL is seeing new customers and fresh sales! In addition to the regular dried cannabis flower, HRL is now offering edibles, beverages, capsules, and lotions. The new influx of business has left William scrambling to catchup on the accounting for the first quarter of 2020. Penelope has hired your CPA firm to help William complete the monthly accounting for January 2020, draft HRL's financial statements for the quarter ended January 31, 2020 and provide some additional advice. Your partner has assigned you, Accounting student, to HRL's account. The volatility in 2019 scared investors away. HRL turned to bank financing to deal with the lack of stable cash filow and profitability in such a new industry. Going forward, Penelope wants to impress HRL's current lenders and potential future investors. She wants her financial statements to depict a growing, profitable business in 2020 compared to 2019. She also asked William to monitor closely HRL's current ratio and any changes that might impact it. Penelope has learned that it is a factor that will determine HRL's access to future financing with her bank. In order to increase business, HRL introduced a new online ordering system effective November 1*, 2019. In addition to walk-in retail sales, HRL can now accept orders online for pickup or delivery. Details regarding online orders are provided in Exhibit A. William has been recording online sales revenue on the date the order is placed. Penelope wants your advice regarding the new online system and William's approach to recording sales. She is not sure about the timing that these sales are recorded as revenue. Specifically, comment on whether William's revenue recognition policy is acceptable, suggest an alternative method, and describe the impact a change to the alternative method would have on HRL's current ratio. 1

Step by Step Solution

★★★★★

3.51 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Journal entries to be recorded are as follows 1 Cash Ac Dr 191664 Accounts receivables Ac Dr 3912 Sales Ac Cr 195576 2 Cash Ac Dr 28456 Discount allowed Ac Dr 880 Sales Ac Cr 29336 3 Cost of go...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started