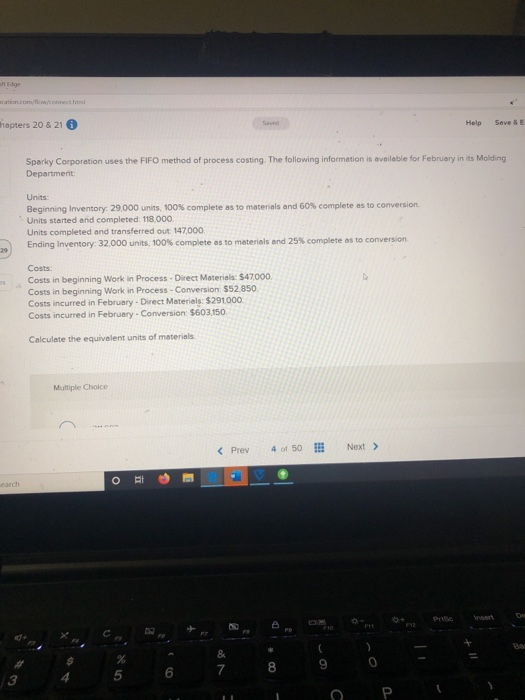

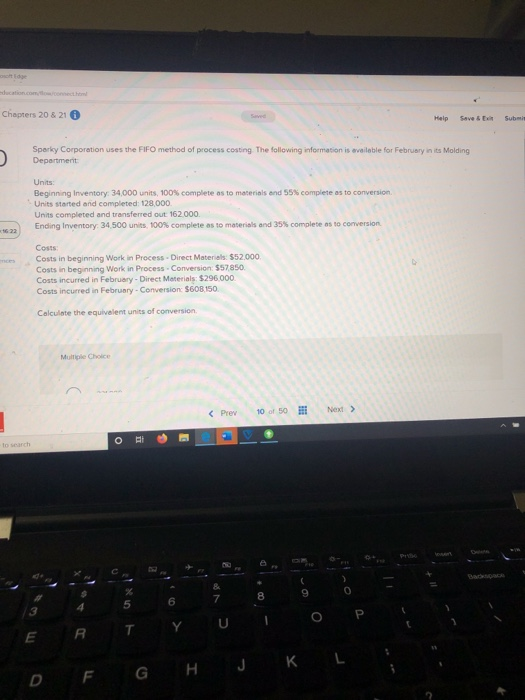

hapters 20 & 21 Help Save & Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department Units: Beginning Inventory: 29.000 units, 100% complete as to materials and 60% complete as to conversion Units started and completed: 118,000. Units completed and transferred out: 147,000 Ending Inventory: 32,000 units, 100% complete as to materials and 25% complete as to conversion Costs Costs in beginning Work in Process Direct Materials: $47.000 Costs in beginning Work in Process - Conversion: $52.850. Costs incurred in February - Direct Materials: $291000. Costs incurred in February - Conversion: 5603,150. Calculate the equivalent units of materials Multiple Choice Search Chapters 20 & 21 Help Save & Submit Sparky Corporation uses the FIFO method of process costing The following information is available for February in its Molding Department Units Beginning Inventory: 34,000 units, 100% complete as to materials and 55% complete as to conversion Units started and completed: 128,000 Units completed and transferred out 162 000 Ending Inventory 34,500 units, 100% complete as to materials and 35% complete as to conversion Costs Costs in beginning Work in Process Direct Materials: 552,000 Costs in beginning Work in Process - Conversion: $57850. Costs incurred in February - Direct Materials: $296.000 Costs incurred in February - Conversion $608,150 Calculate the equivalent units of conversion Multi Chale 50 Next > to search 7 8 9 P A T Y U D F G H J K L hapters 20 & 21 Help Save & Sparky Corporation uses the FIFO method of process costing. The following information is available for February in its Molding Department Units: Beginning Inventory: 29.000 units, 100% complete as to materials and 60% complete as to conversion Units started and completed: 118,000. Units completed and transferred out: 147,000 Ending Inventory: 32,000 units, 100% complete as to materials and 25% complete as to conversion Costs Costs in beginning Work in Process Direct Materials: $47.000 Costs in beginning Work in Process - Conversion: $52.850. Costs incurred in February - Direct Materials: $291000. Costs incurred in February - Conversion: 5603,150. Calculate the equivalent units of materials Multiple Choice Search Chapters 20 & 21 Help Save & Submit Sparky Corporation uses the FIFO method of process costing The following information is available for February in its Molding Department Units Beginning Inventory: 34,000 units, 100% complete as to materials and 55% complete as to conversion Units started and completed: 128,000 Units completed and transferred out 162 000 Ending Inventory 34,500 units, 100% complete as to materials and 35% complete as to conversion Costs Costs in beginning Work in Process Direct Materials: 552,000 Costs in beginning Work in Process - Conversion: $57850. Costs incurred in February - Direct Materials: $296.000 Costs incurred in February - Conversion $608,150 Calculate the equivalent units of conversion Multi Chale 50 Next > to search 7 8 9 P A T Y U D F G H J K L