Answered step by step

Verified Expert Solution

Question

1 Approved Answer

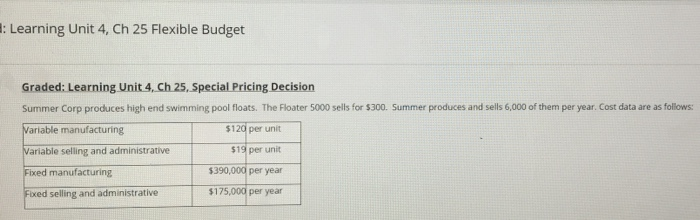

Pools R Us asked Summer Corp to produce 50 units at a special price of $240 per unit for a one-time only sale. The sale

Pools R Us asked Summer Corp to produce 50 units at a special price of $240 per unit for a one-time only sale. The sale will not negatively impact the companys regular sales activities and will require the normal variable manufacturing costs and selling and administrative costs. There is plenty of excess capacity and the deal will not impact fixed costs. Create a Differencial Analysis of a Special Pricing Decision showing the expected increase or decrease in operating income if this order is accepted. This assignment must be submitted in EXCEL with working formulas in at least two cells.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started