Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Harold has elected to split his eligible pension income with his wife Martha who does not have any income in her own right. As the

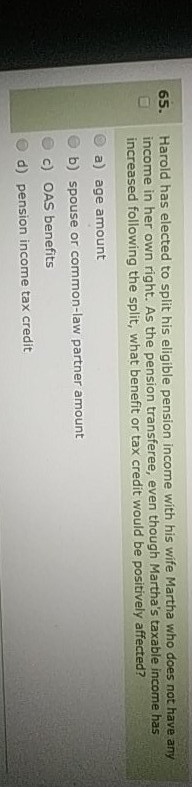

Harold has elected to split his eligible pension income with his wife Martha who does not have any income in her own right. As the pension transferee, even though Martha's taxable income has increased following the split, what benefit or tax credit would be positively affected? a) age amount b) spouse or common-law partner amount c) OAS benefits d) pension income tax credit

Harold has elected to split his eligible pension income with his wife Martha who does not have any income in her own right. As the pension transferee, even though Martha's taxable income has increased following the split, what benefit or tax credit would be positively affected? a) age amount b) spouse or common-law partner amount c) OAS benefits d) pension income tax credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started