Question

Harry and Belinda Johnson are considering trading their car in for a newer used vehicle so that Harry can have dependable transportation for commuting to

Harry and Belinda Johnson are considering trading their car in for a newer used vehicle so that Harry can have dependable transportation for commuting to work. The couple still owes $5,130 to the credit union for their current car, or $285 per month for the remaining 18 months of the 48-month loan. The trade-in value of this car plus $1,000 that Harry earned from a freelance interior design job should allow the couple to pay off the auto loan and leave $1,250 for a down payment on the newer car. The Johnsons have agreed on a sales price for the newer car of $21,000.

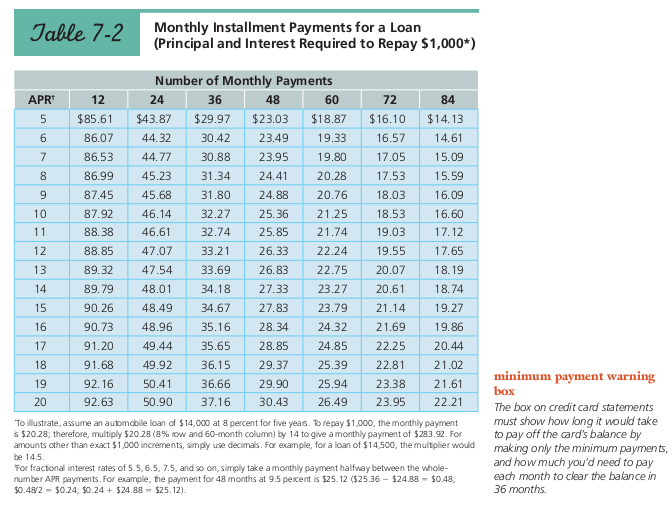

(a) Make recommendations to Harry and Belinda regarding where to seek financing and what APR to expect (please see Table 7-2 below for guidance).

Jable 7-2Monthly Installment Payments for a Loa (Principal and Interest Required to Repay $1,000*) Number of Monthly Payments 24 APR 12 48 60 72 84 5 $85.61 $43.87$29.97 $23.03 $18.87 $16.10 $14.13 3 16.57 14.6 17.05 15.09 17.53 15.59 87.45 45.68 31.80 24.8820.76 18.03 16.09 87.92 46.14 32.2725.36 21.25 18.53 16.60 32.74 25.85 21.74 19.03 17.12 88.85 47.07 33.21 26.33 22.24 19.55 17.65 89.32 47.54 33.69 26.83 22.75 20.07 18.19 18.74 90.26 48.49 34.67 27.83 23.79 21.14 19.27 90.73 48.96 35.16 28.3424.32 21.69 19.86 91.20 49.44 35.65 28.85 24.85 22.25 20.44 91.68 49.92 36.15 29.3725.39 22.81 21.02 92.16 50.41 36.66 29.90 25.94 23.38 21.61 50.90 37.16 30.43 26.49 23.95 22.21 86.07 44.32 30.42 23.4919.33 86.53 44.7730.88 23.95 19.80 86.99 45.23 31.34 24.4120.28 10 88.38 46.61 12 13 89.79 48.01 34.18 27.33 23.27 20.61 15 17 18 19 20 minimum payment w 92.63 The box on credit card statements must show how long it nould take to pay off the ard's balance by making only the minimum payments, and how much you'd need to pay each month to clear the balance in 36 months To illustrate, assume an automdbille loan of $14,000 at 8 percent for five years. To repay $1,000, the monthly payment s $20.28, therefore, multiply $20.288% ow and 60-month column) by 14 to give a monthly payment of $283.92. For ar unts a her than exact 1 00 O increments smply use deo na F? e ample, for a loan of 14,500, the mult lier would be 14.5 For fractonal interest rates of 5.5,6.5, 7.5, and so on, simply take a monthly payment halfway between the whole- number APR payments. For example, the payment for 48 months at 9.5 pecent is $25.12 ($25.36 $2488-$0.48, 0.482 $024, $0.24+$24.88-$25.12)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started