Question

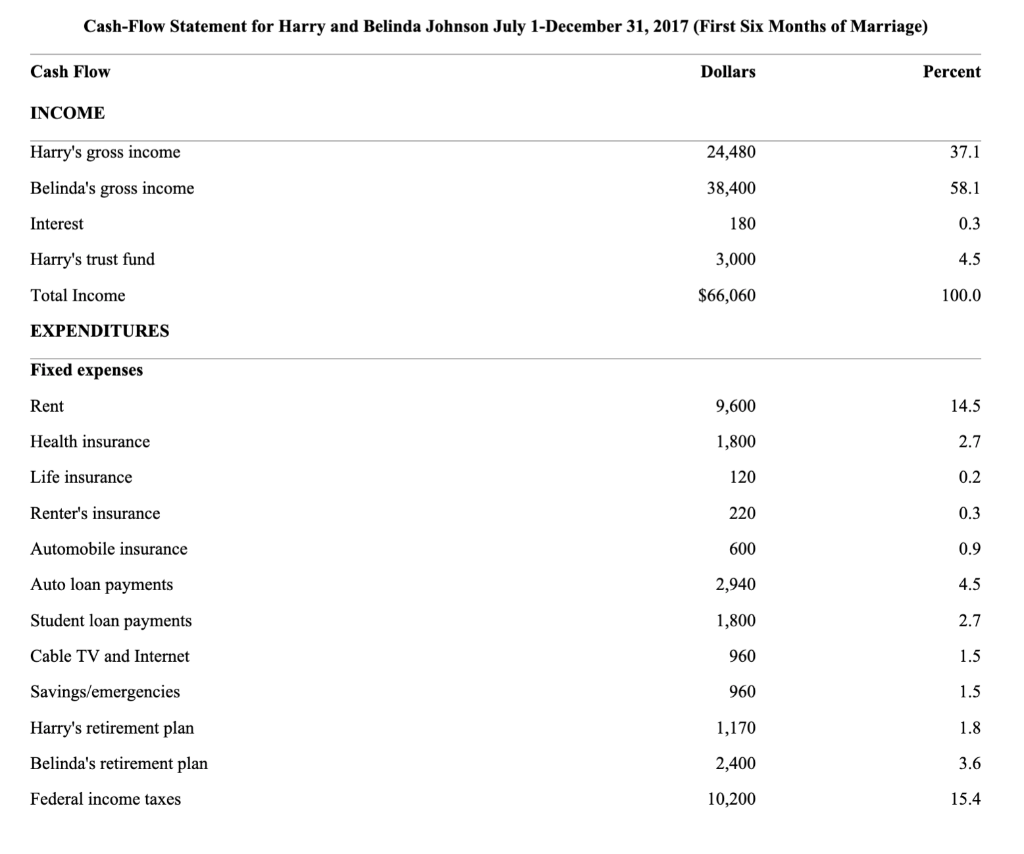

Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in

Harry has worked at a medium-size interior design firm for five years and earns a salary of $4,080 per month. He also receives $3,000 in interest income once a year from a trust fund set up by his deceased father's estate. Belinda earns a salary of $6,400 per month, and she has many job-related benefits including a flexible benefits program, life insurance, health insurance, a 401(k) retirement program, workplace financial education, and a credit union. The Johnsons live in an old apartment located approximately halfway between their places of employment. However, their rent will increase by $100 a month in July. Harry drives about ten minutes to his job, and Belinda travels about 15 minutes via public transportation to reach her downtown job.

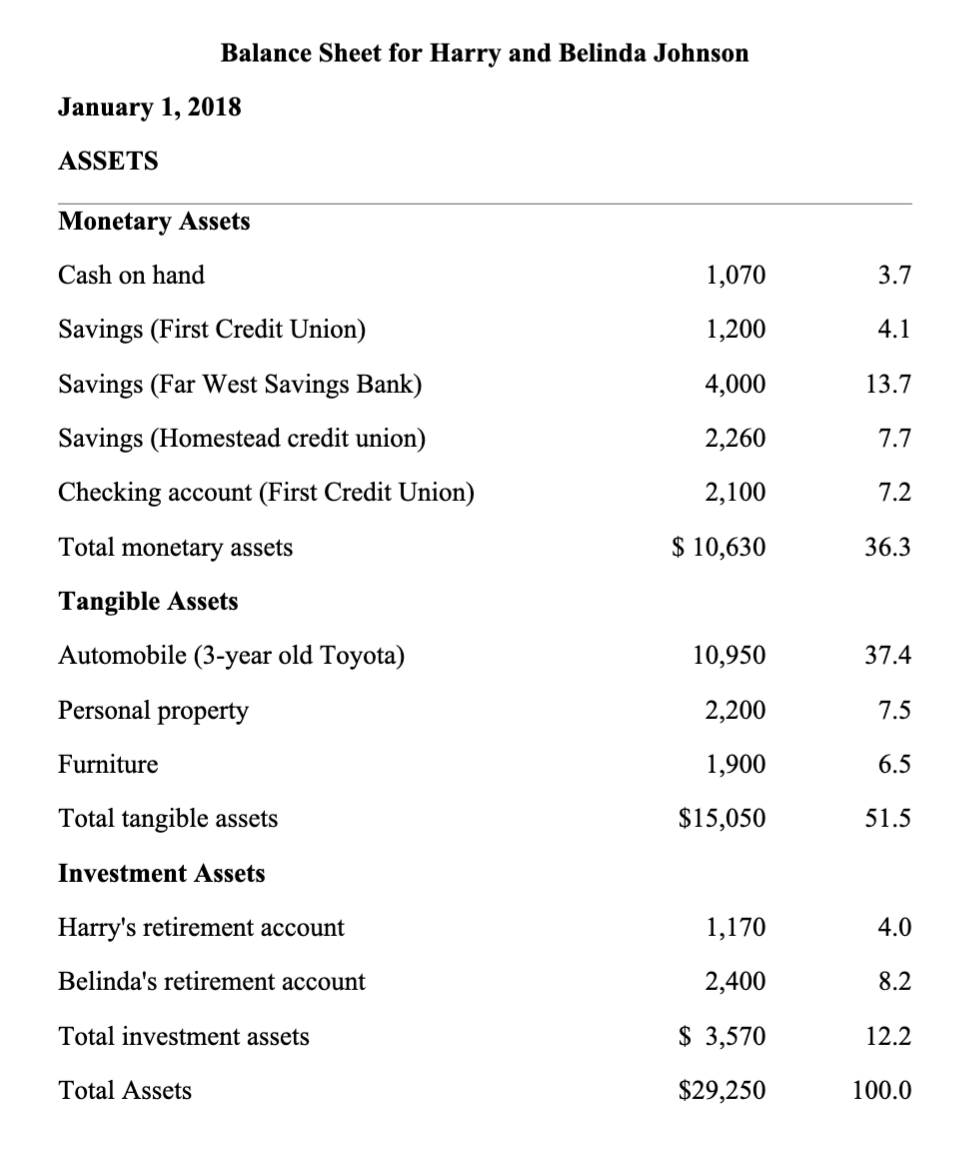

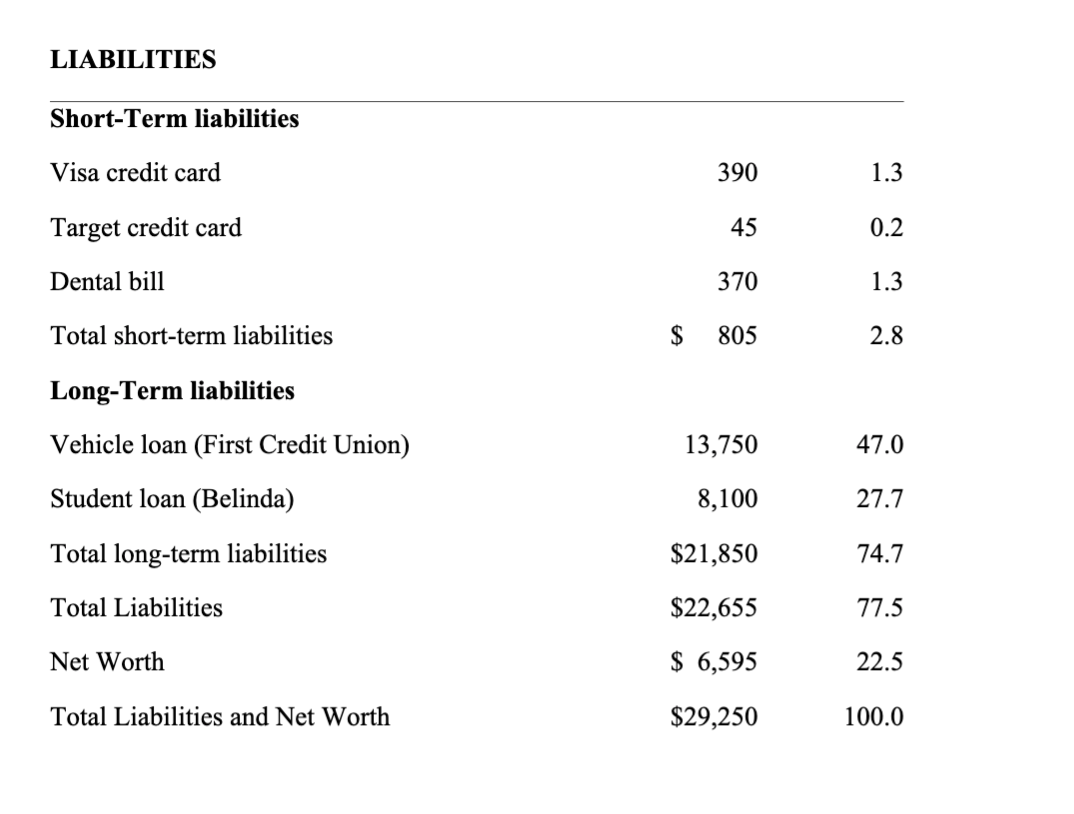

Harry and Belinda's apartment is very nice, but small, and it is furnished primarily with furniture given to them by some of his friends. Soon after getting married, Harry and Belinda decided to begin their financial planning. Fortunately, each had taken a college course in personal finance. After an initial discussion, they worked together for three evenings to develop the financial statements presented below. Note that the cash flow statement covered the first six months of their marriage.

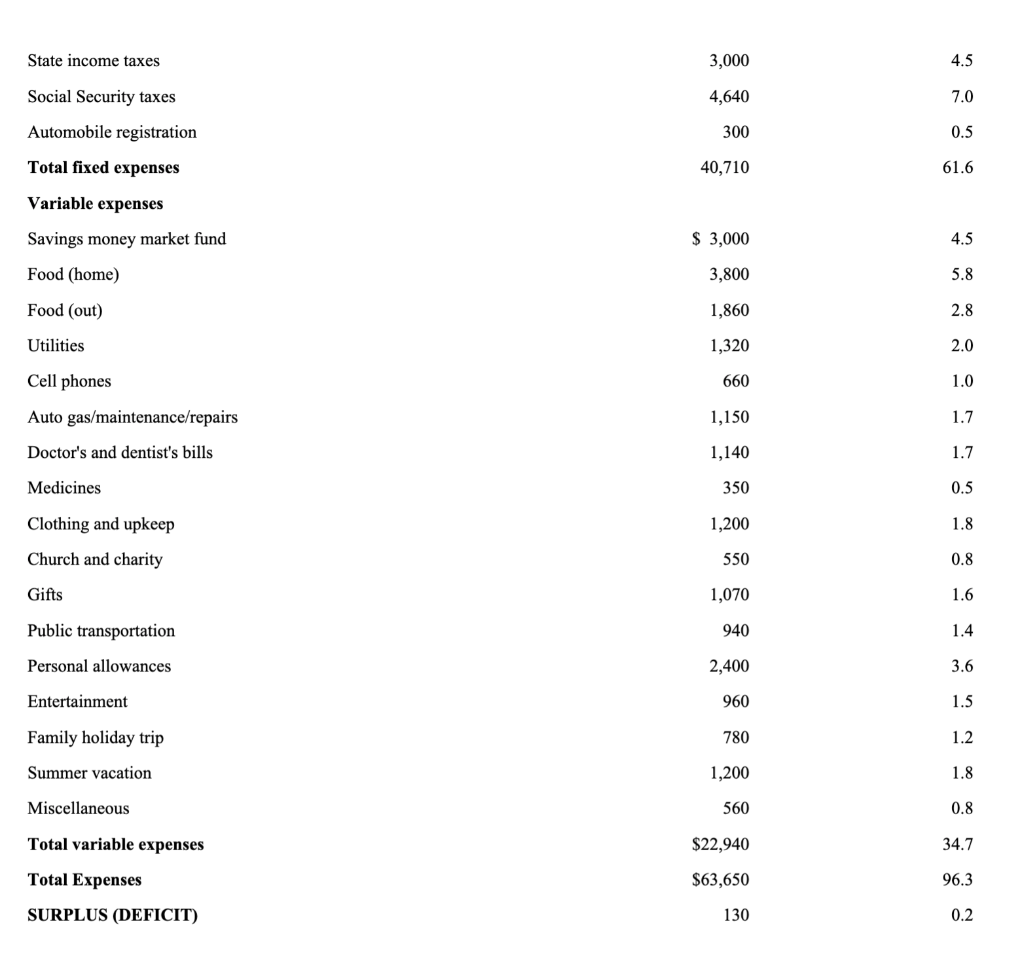

Using the data from the statements developed by Harry and Belinda, calculate the following financial ratios.

1.Liquidity ratio

2. asset to debt ratio

3. Debt to income ratio

4.Debt payments to disposable income ratio

5.Investment assets to total assets ratio

What do these ratios tell you about the Johnson's financial situation? Should Harry and Belinda incur more debt, such as credit cards or a new vehicle loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started