Question

Harry, the owner of Harry Pte Ltd, was finalising his company accounts for the year ending 31 December. His accountant has just met with an

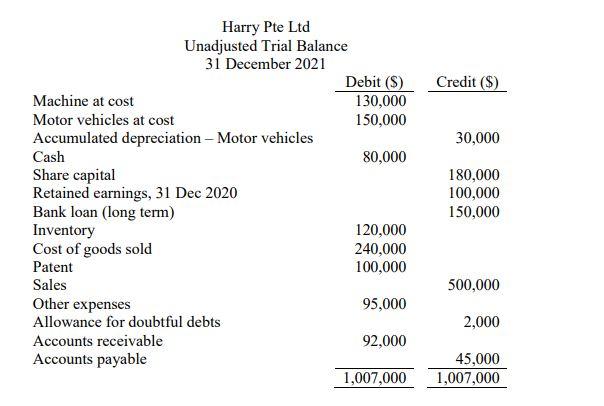

Harry, the owner of Harry Pte Ltd, was finalising his company accounts for the year ending 31 December. His accountant has just met with an accident, and he approached you for help. Harry presented you the unadjusted trial balance. Assumes the company uses the perpetual inventory system.

After discussing with Harry, you are further furnished with the additional information.

(i) The company made sales of $30,000 during December 2021. This included $20,000 sales on credit. The gross margin for these sales was 60%.

(ii) The company estimated that 4% of accounts receivable will be uncollectible.

(iii) The company bought a machine on 1 January 2021 that costs $130,000. The company depreciates the machine using the straight-line method. The machine is expected to have a residual value of $10,000 at the end of its useful life of 5 years.

(iv) On 1 July 2021, the company purchased a patent for $100,000 in cash. The patent will expire in 20 years but the company anticipates the patent will be obsolete and worthless at the end of 10 years.

(v) The company depreciates motor vehicles using the double-declining method with an assumed useful life of 5 years and residual value at 5% of the cost.

(vi) The bank loan carries an annual interest of 5%, payable every 31 December.

(vii) During December 2021, the company received $10,000 cash for amounts owing and paid $5,000 to creditors.

(viii) Due to a substantial decline in demand, the market value of inventory items has declined by 70% at end of 2021. Harry is not certain what to do.

Analyse the above and present the necessary entries for Harry Pte Ltd for the year 2021.

Credit ($) 30,000 Harry Pte Ltd Unadjusted Trial Balance 31 December 2021 Debit (S) Machine at cost 130,000 Motor vehicles at cost 150,000 Accumulated depreciation - Motor vehicles Cash 80,000 Share capital Retained earnings, 31 Dec 2020 Bank loan (long term) Inventory 120,000 Cost of goods sold 240,000 Patent 100,000 Sales Other expenses 95,000 Allowance for doubtful debts Accounts receivable 92,000 Accounts payable 1,007,000 180,000 100,000 150,000 500,000 2,000 45,000 1,007,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started